Bitcoin Price Dip: Death Cross Looms

Bitcoin (BTC) has experienced a significant price decline over the past three days, falling below the key psychological level of $95,000. This downturn has fueled bearish sentiment, raising concerns about a potential drop to $90,000.

Bearish Signals for Bitcoin

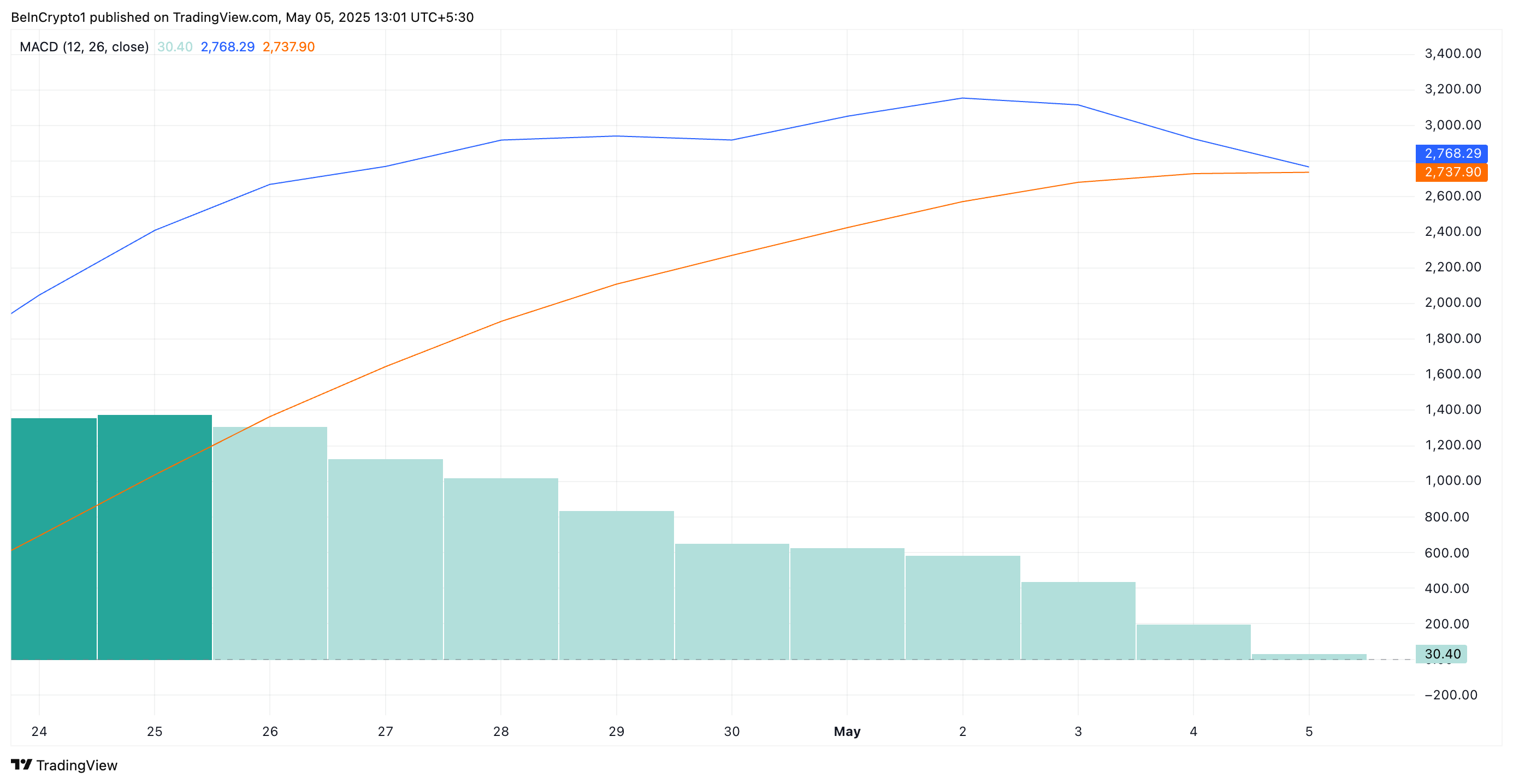

Several technical indicators point to a bearish outlook for Bitcoin. The Moving Average Convergence Divergence (MACD) indicator is nearing a 'death cross,' a pattern often associated with extended price declines. This occurs when the MACD line crosses below the signal line, suggesting a shift in momentum.

Source: TradingView

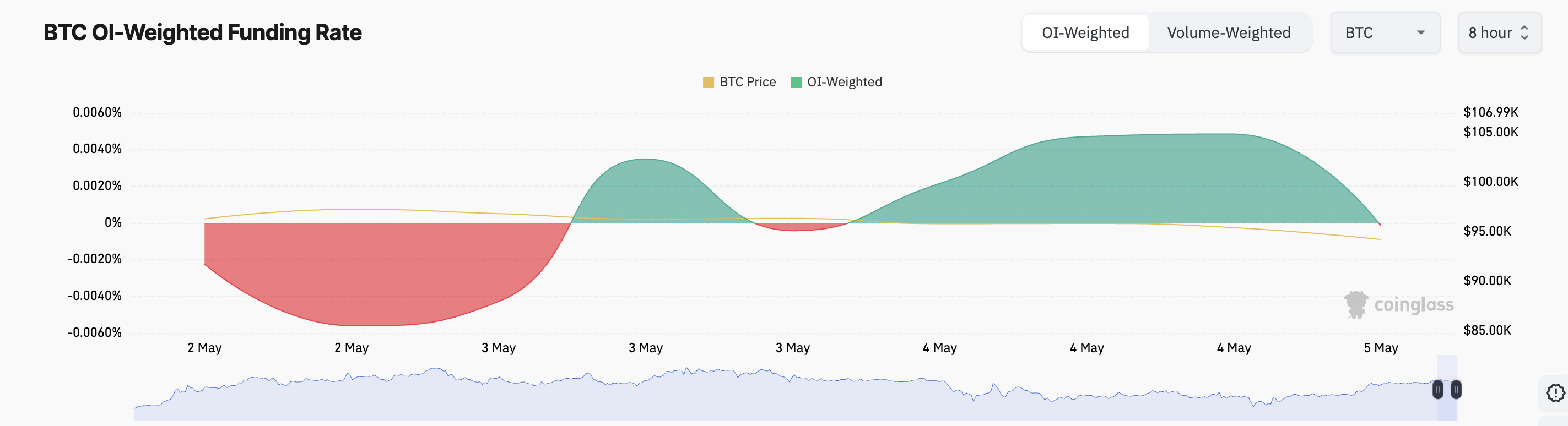

Adding to the bearish pressure is Bitcoin's persistently negative funding rate. Data from Coinglass reveals more red days than green since May 1, indicating a preference for short positions among futures traders. A negative funding rate suggests a bearish sentiment among traders.

Source: Coinglass

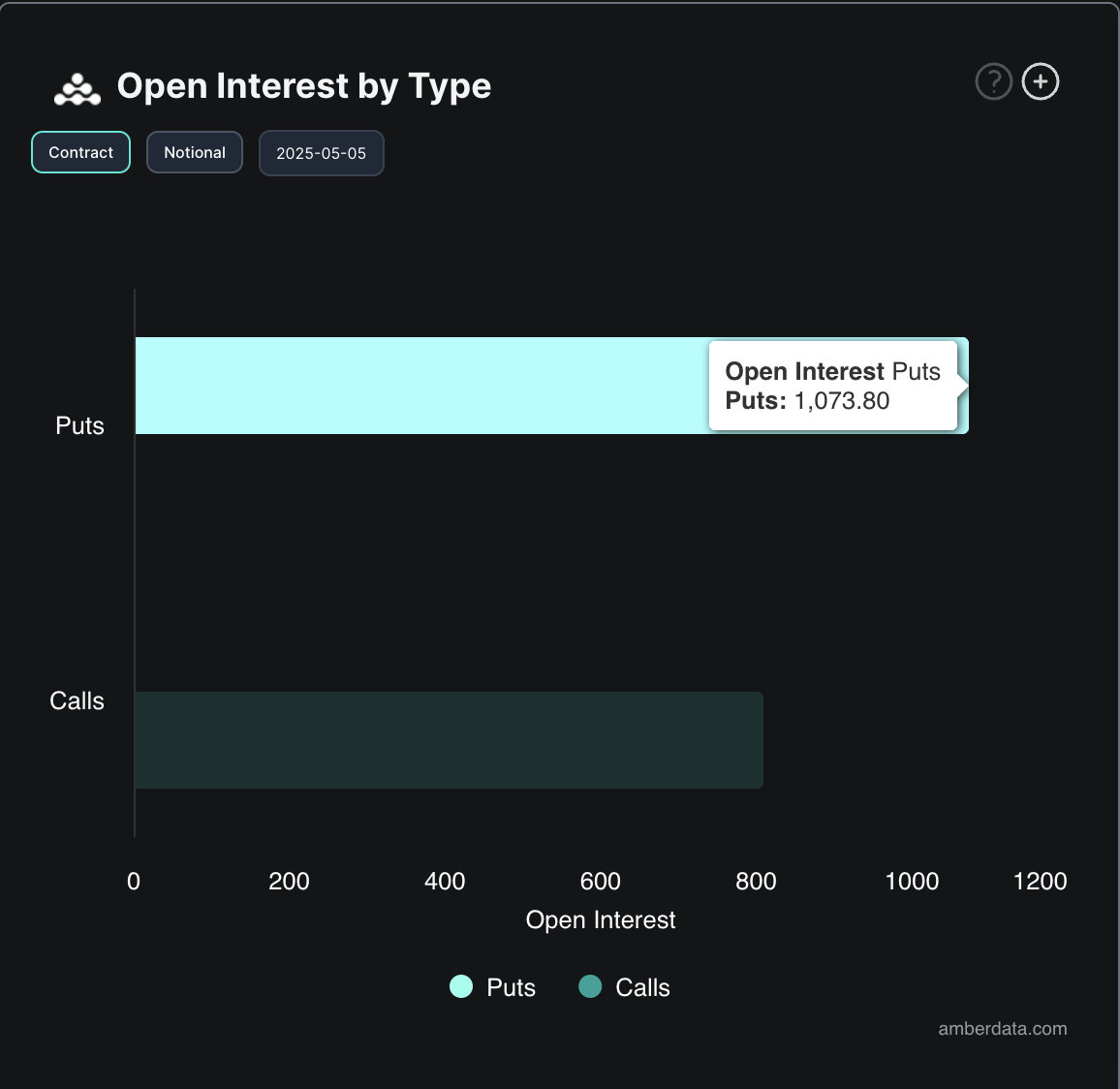

The options market also reflects bearish sentiment. The put-to-call ratio is at 1.33, indicating significantly more open put contracts (bets on price drops) than call contracts (bets on price increases). This suggests traders are hedging against further downside or actively positioning for a price drop.

Source: Deribit

Bitcoin's Next Move: Potential Crash or Rebound?

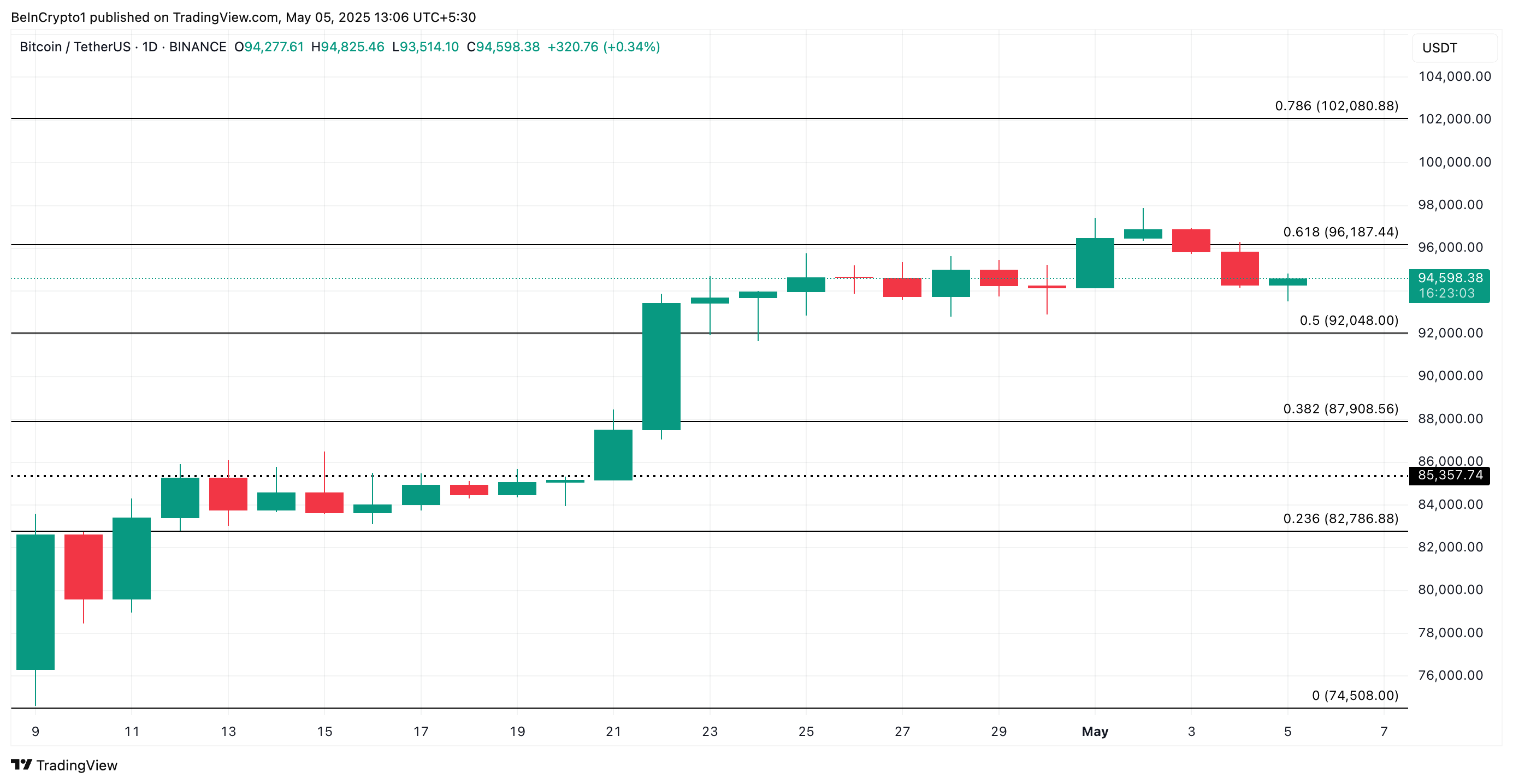

Bitcoin is currently trading around $94,598. If the bearish pressure continues, the price could drop to $92,048, and potentially even lower to $87,908. However, a rebound is possible. If bulls regain control, Bitcoin could break above $95,000 and potentially rally to $96,187.

Source: TradingView

Disclaimer: This analysis is for informational purposes only and should not be considered financial or investment advice. Market conditions change rapidly.

Codeum provides smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies to ensure the security and success of blockchain projects.