Bitcoin Price Surge: New ATH in Sight?

Bitcoin Eyes New All-Time High

Bitcoin (BTC) is making a strong push towards a new all-time high (ATH), currently attempting to break the $106,000 resistance level. Despite recent price volatility, the overall trend remains bullish, suggesting a continuation of patterns seen in previous market cycles.

Bitcoin's Stability and Bullish Momentum

The Mayer Multiple indicator shows Bitcoin is currently in a neutral zone, neither overbought nor oversold. This suggests the ongoing upward trend could persist without immediate correction. This balanced market sentiment is a positive signal for Bitcoin investors. The combination of neutral market sentiment and a bullish trend indicates strong potential for Bitcoin to break through key resistance levels and reach a new ATH.

Source: Glassnode

4-Year Pattern in Bitcoin Dominance

Bitcoin's market dominance is following a familiar four-year pattern. After reaching a low of 54% in December 2024, it has rebounded to over 57% in January 2025. This mirrors the 2020 cycle, where dominance rose from 60% to 69% between November 2020 and January 2021. This resurgence suggests Bitcoin's strengthening market leadership and potentially points to a continued price rally.

Source: TradingView

Bitcoin Price Analysis: Crucial Resistance Level

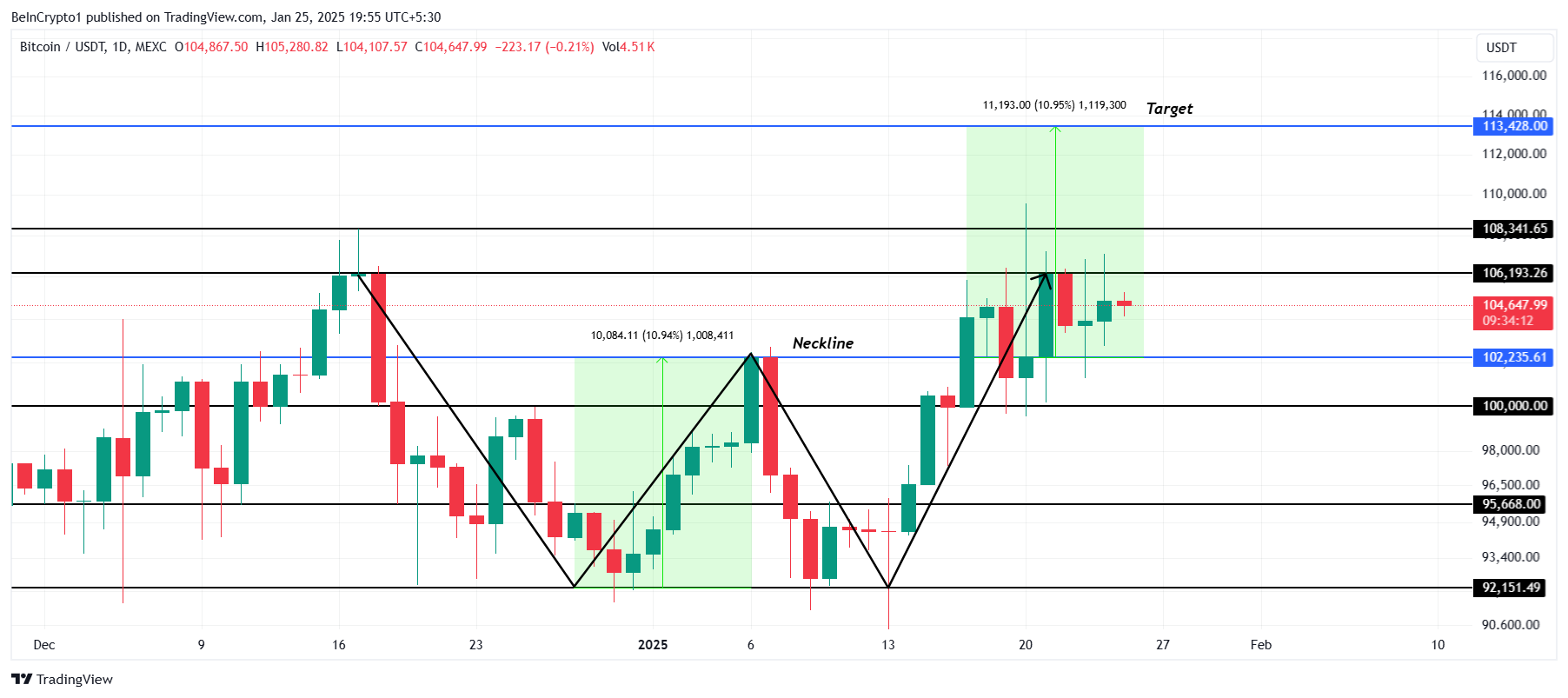

At $104,647 (as of [Date]), Bitcoin needs to decisively break the $106,193 resistance level to confirm its upward trajectory. A successful breakout could propel the price beyond $108,400 to a new ATH. A double-bottom pattern suggests a potential 11% rally following this breakout, potentially reaching $113,428.

Source: TradingView

Failure to breach $106,193 could lead to consolidation above $102,235. A break below this support could trigger a decline towards $100,000, potentially even reaching $95,668. Maintaining these key support levels is crucial for maintaining a bullish outlook.

Disclaimer

This analysis is for informational purposes only and does not constitute financial or investment advice. Market conditions are volatile. Conduct your own research before making any investment decisions.