Bitcoin Price Analysis: Will it Hit $100K?

Bitcoin (BTC) has traded below the $100,000 mark since early February, recently sitting at $96,920, representing a 7% weekly decline. However, significant macroeconomic indicators suggest a potential price reversal.

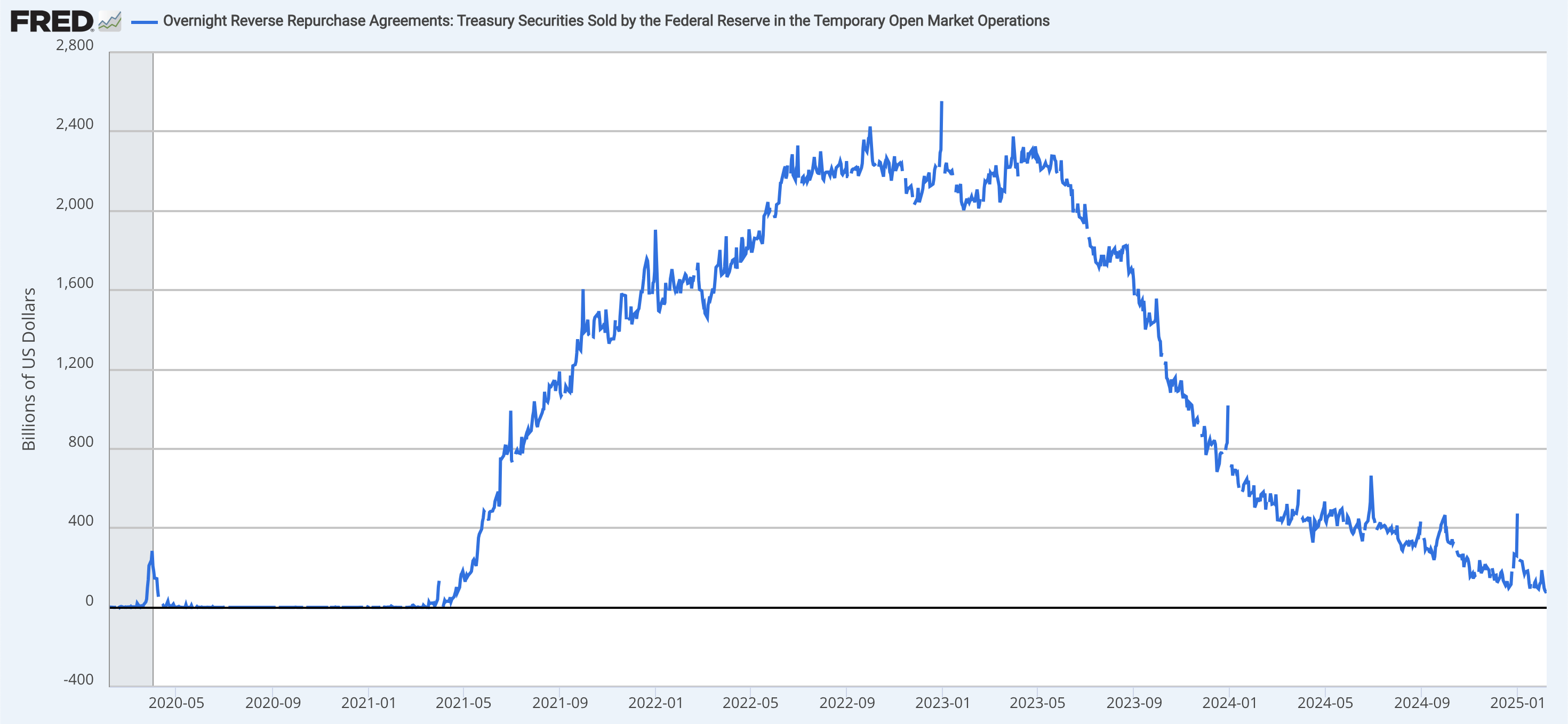

Fed's RRP Drop: A Bitcoin Catalyst?

The Federal Reserve's Reverse Repurchase Agreement (RRP) facility has reached its lowest level in 1,387 days. This signals a potential shift in liquidity. The RRP allows financial institutions to deposit excess cash overnight with the Fed in exchange for Treasury securities, controlling short-term interest rates and managing system liquidity. A drop suggests these institutions are moving funds elsewhere, potentially into riskier assets like cryptocurrencies.

Increased liquidity could fuel demand for crypto assets, boosting Bitcoin's price as institutional investors seek alternative stores of value.

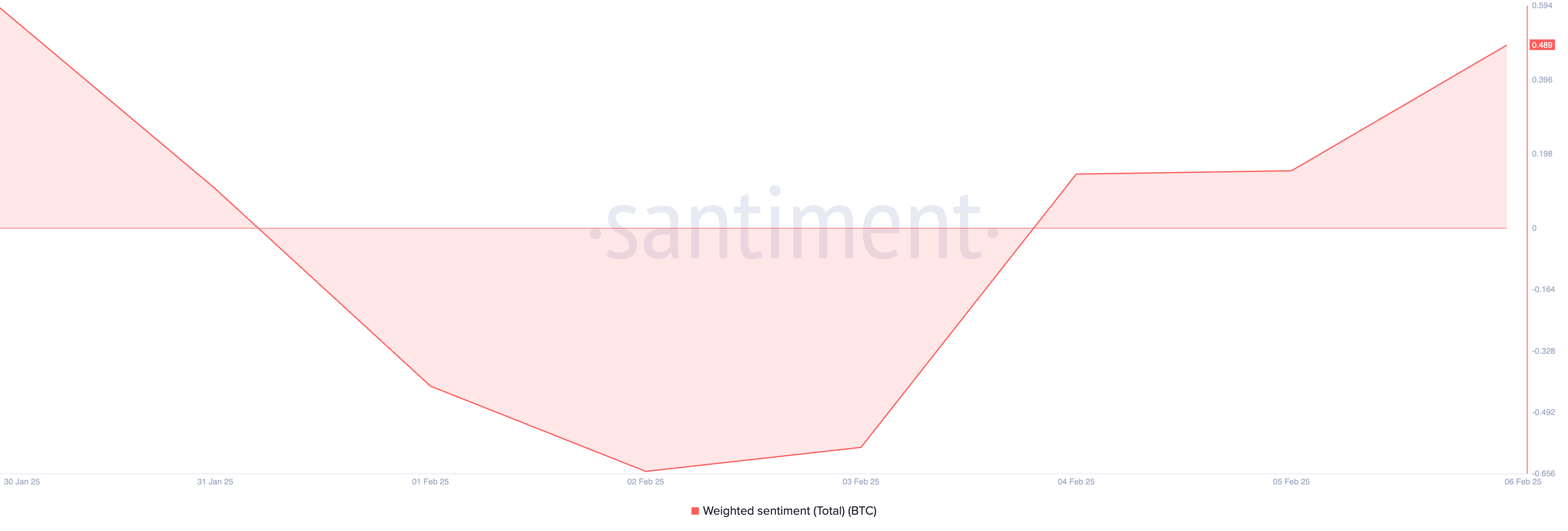

Resilient Bitcoin Trader Sentiment

Despite recent headwinds, Bitcoin traders maintain a bullish outlook. Positive weighted sentiment indicates market optimism for a near-term price rebound. This metric considers social media volume and sentiment.

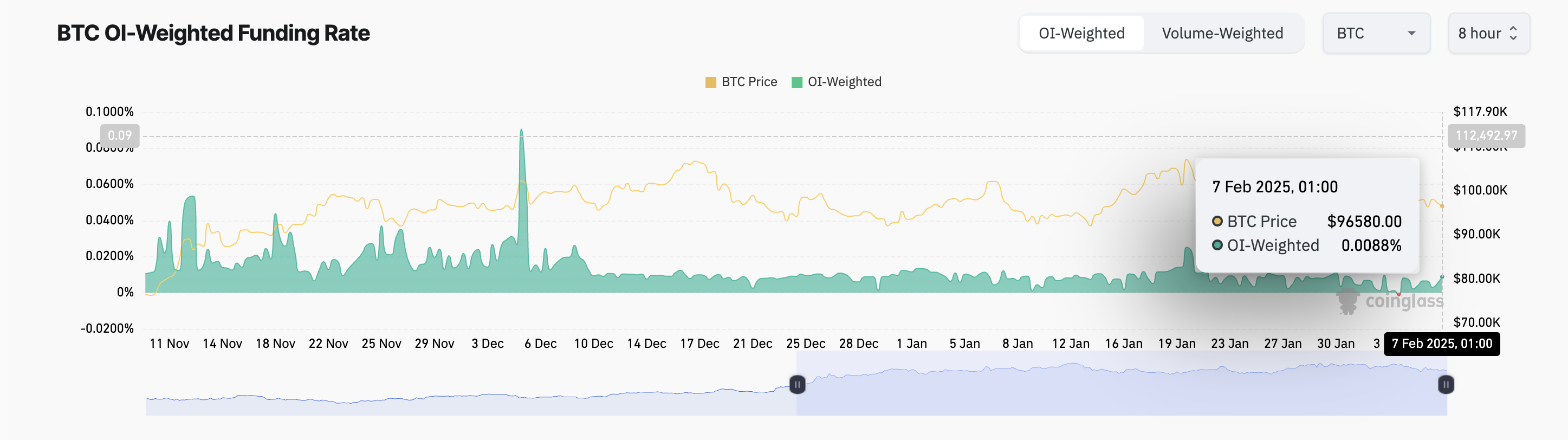

Further supporting this, Bitcoin's funding rate across derivatives markets is positive (0.0088%). A positive funding rate means long position holders pay short position holders, signifying high demand for long positions.

Bitcoin Price Prediction: A $100K Breakout?

Increased liquidity could drive Bitcoin above the $100,000 resistance level, potentially pushing it towards its all-time high of $109,356. However, decreased buying pressure could lead to a decline to $92,325.

Disclaimer: This analysis is for informational purposes only and not financial advice. Market conditions are volatile. Conduct thorough research and consult professionals before making investment decisions.