Bitcoin Price: Could $100K Return Soon?

Bitcoin Price: A Look at Current Market Trends

Bitcoin (BTC) has been trading below $100,000 since February 5th, facing persistent resistance despite recovery attempts. Recent indicators suggest a shift in market dominance, with sellers appearing to have gained the upper hand. However, potential for a price reversal remains.

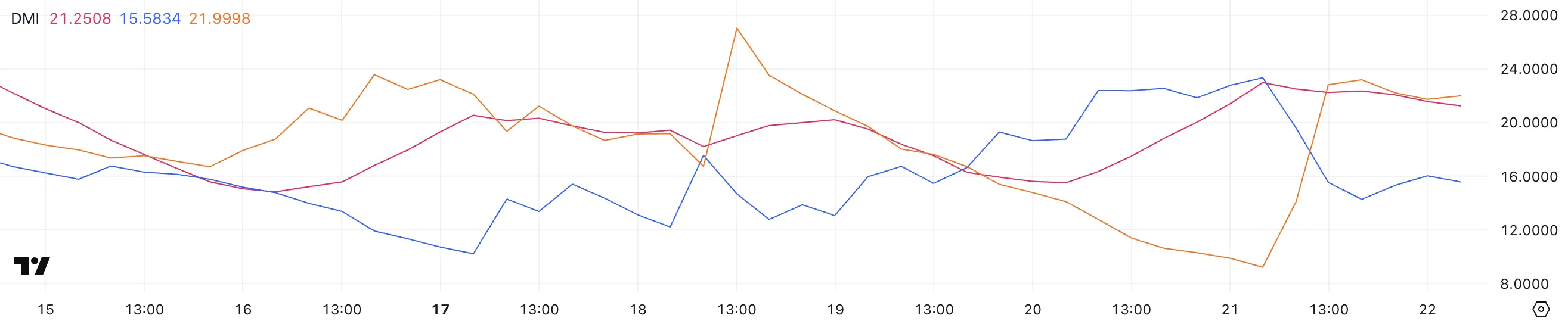

Analyzing Bitcoin's Directional Movement Index (DMI)

Bitcoin's DMI reveals a weakening trend. The Average Directional Index (ADX) is currently at 21.2, indicating a relatively weak trend, potentially signaling a transition period. A value above 25 typically denotes a strong trend, while below 20 suggests a weak or ranging market. The +DI (positive directional indicator) is declining, showing decreasing bullish momentum, while the -DI (negative directional indicator) is rising, reflecting increasing bearish pressure. This -DI crossing above +DI suggests sellers are gaining control.

Key DMI Metrics:

- ADX: 21.2 (weak trend)

- +DI: 15.5 (decreasing bullish momentum)

- -DI: 21.9 (increasing bearish pressure)

Source: TradingView

Decoding the Bitcoin Ichimoku Cloud

The Ichimoku Cloud chart presents a more nuanced picture. While the Tenkan-sen (blue line) is above the Kijun-sen (red line), suggesting potential buying pressure and a possible upward move, the price remains below the Kumo cloud, indicating an overall bearish trend. A break above the cloud would signal a potential trend reversal.

Source: TradingView

Bitcoin's Potential Path: $100,000 and Beyond?

While the current market conditions indicate bearish pressure, a potential recovery remains a possibility. If Bitcoin breaks above key resistance levels, a return to $100,000, and potentially even higher to $102,668, is within the realm of possibility. However, failure to break above resistance could lead to further price declines.

Potential Price Targets:

- Resistance: $97,756, $100,000, $102,668

- Support: $94,818, $93,415, $91,300

Source: TradingView

Codeum: Securing the Future of Blockchain

Codeum provides comprehensive blockchain security and development services, including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to learn more about how we can help protect your blockchain project.

Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. Market conditions are dynamic and can change rapidly.