Bitcoin Mining Difficulty Soars to Record High

Bitcoin Mining Difficulty Reaches Record High

Bitcoin (BTC) recently hit new all-time highs (ATH), and this surge is accompanied by a record-high Bitcoin mining difficulty. This reflects the growing computational power dedicated to securing the Bitcoin network.

Data from Blockchain.com shows a 7.96% increase in Bitcoin mining difficulty, reaching 126.27 T, with a seven-day average network hashrate of 908.82 EH/s. This follows BTC's recent price touch of $122,000.

Impact on Miners and Upcoming Adjustment

The increased difficulty could potentially reduce miners' profitability, especially considering the comparatively lower mining yields observed in June. However, a projected 6.69% decrease in Bitcoin mining difficulty is anticipated on July 27, 2025, potentially boosting miner efficiency.

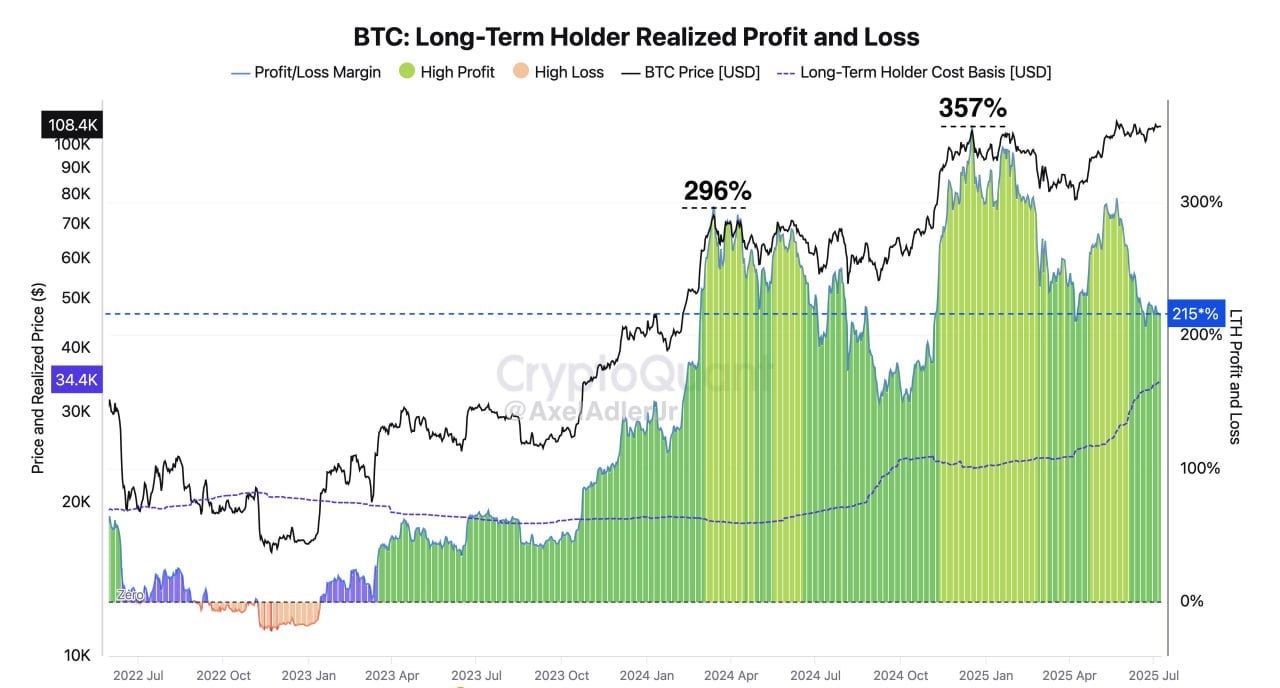

Long-Term Holder (LTH) Behavior

Analysis of long-term holder behavior reveals interesting insights. Glassnode data, shared by NekoZ on X, shows realized profit for LTHs surging to $108,400, with a profit ratio of 357% in July 2025. Their average cost basis remains significantly below the current price.

This suggests strong conviction among LTHs, with little indication of significant selling pressure, even at these ATHs. Historically, periods of high LTH profits have correlated with sustained price rallies.

Market Sentiment and Global Liquidity

Interestingly, Google search interest in Bitcoin remains relatively low compared to previous bull markets. This might reflect a shift towards a more long-term, less FOMO-driven investment strategy.

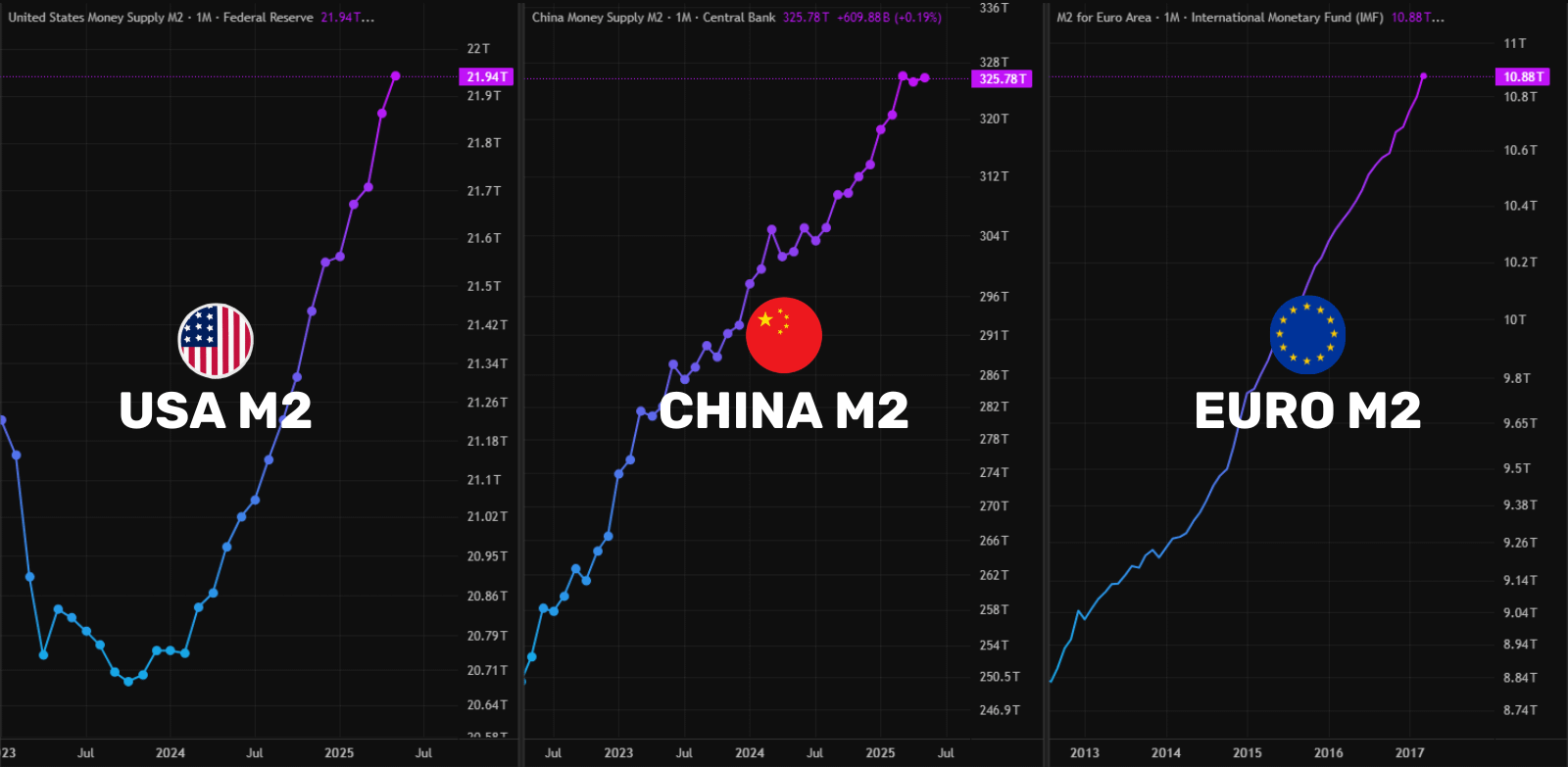

However, with global liquidity (M2 money supply) reaching ATHs in the US, China, and Europe, Bitcoin's short-term potential remains significant.

Conclusion

The confluence of record-high Bitcoin mining difficulty, strong LTH behavior, and increasing global liquidity presents a complex picture. While the outlook is generally positive, investors should remain vigilant and monitor key metrics for potential corrections. Codeum offers services including smart contract audits, KYC verification, and custom smart contract development to help navigate the complexities of the blockchain space.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Always conduct your own thorough research before making any investment decisions.