Bitcoin Miner Confidence Soars After $95K Breakout

Bitcoin Miner Confidence Soars After $95K Breakout

Bitcoin's decisive break above the crucial $95,000 mark has sparked renewed optimism, particularly among miners. On-chain data reveals a significant increase in BTC miner reserves in recent days, indicating a shift in sentiment.

Miners Bet on BTC Upside as Reserves Rise

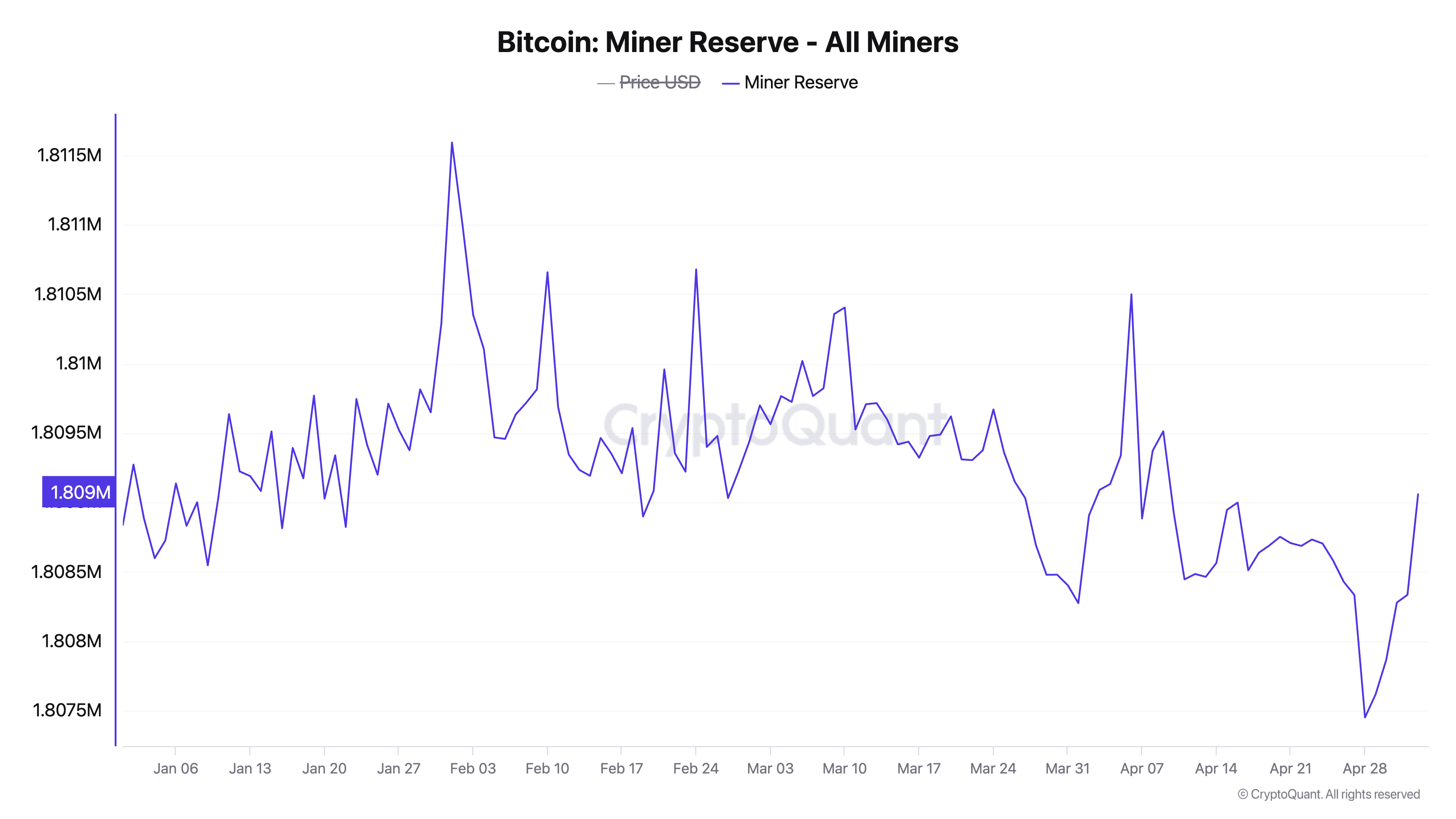

According to CryptoQuant, Bitcoin's miner reserve, previously on a downtrend, started climbing on April 29th, shortly after BTC surpassed $95,000. The reserve had hit a yearly low of 1.80 million BTC the day before, highlighting the recent shift. This reserve tracks the number of BTC held by miners before being sold. A rising reserve suggests growing confidence in future price appreciation.

Source: CryptoQuant

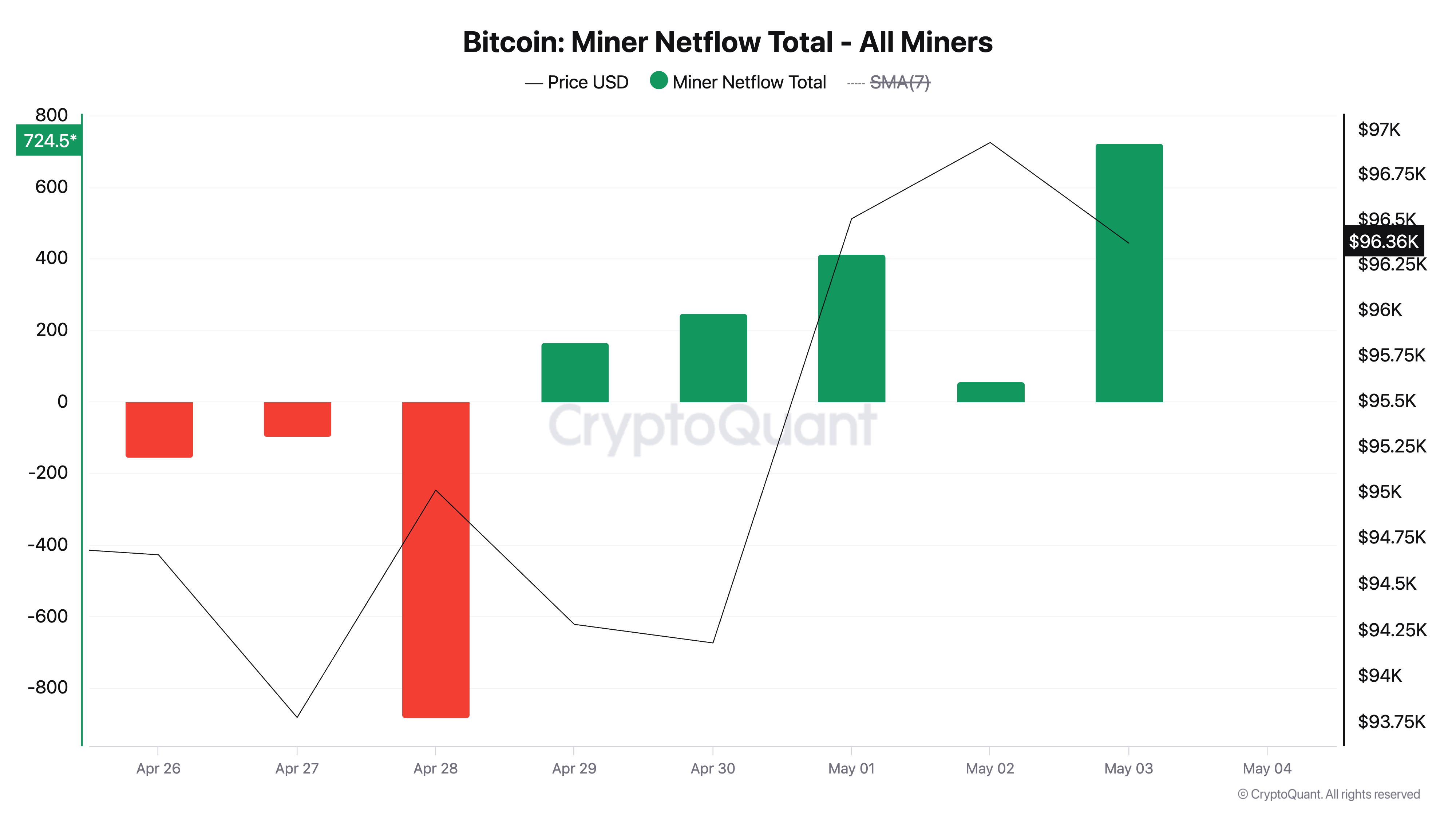

Further bolstering this bullish sentiment is the positive miner netflow since April 29th. This shows more BTC entering miner wallets than leaving for exchanges.

Source: CryptoQuant

A Cautious Outlook: Diverging Signals

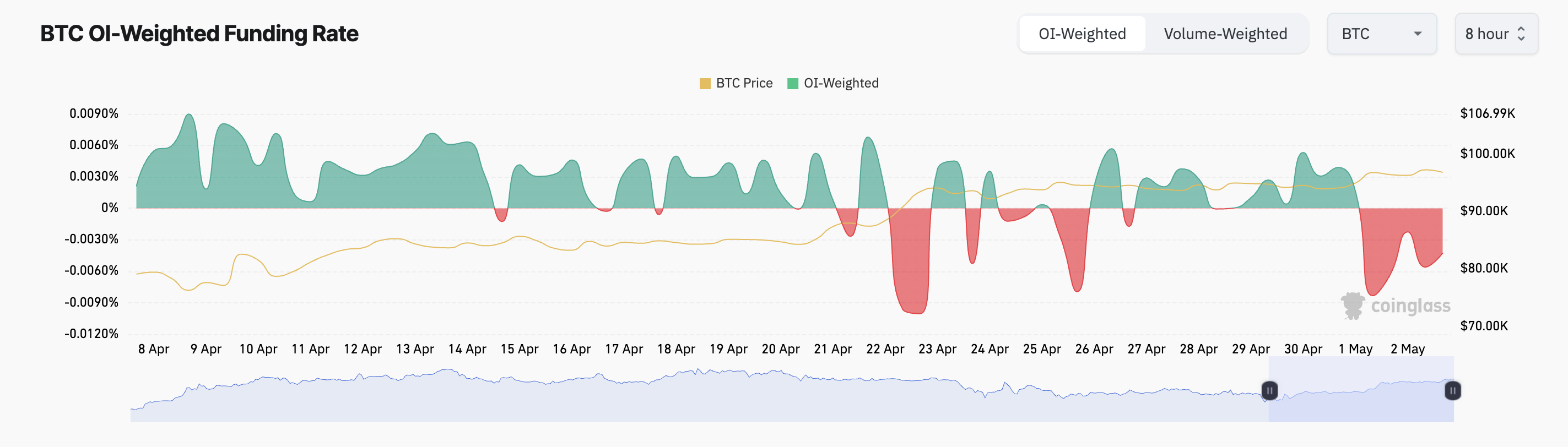

However, the overall market sentiment isn't entirely bullish. While miners are accumulating, derivatives data paints a contrasting picture. Bitcoin's funding rate has been negative since early May, suggesting many traders anticipate a near-term price correction. At press time, the funding rate stands at -0.0056%.

Source: Coinglass

A negative funding rate indicates more short than long positions, pointing to bearish pressure. This divergence between miner behavior and trader sentiment creates uncertainty.

Breakout or Breakdown? The Future of BTC

The contrasting signals create uncertainty. Stronger accumulation could push BTC beyond $98,515 resistance and towards $102,080. Conversely, if bearish bets prevail, the price could dip below $95,000, potentially reaching $92,910.

Source: TradingView

Disclaimer: This analysis is for informational purposes only and not financial advice. Market conditions change rapidly. Conduct thorough research before making investment decisions.