Bitcoin Inflows Surge at Binance: Rally Imminent?

A significant surge in Bitcoin (BTC) inflows to Binance has fueled speculation about a potential price rally. Over 22,000 BTC flowed into the exchange in under two weeks, boosting Binance's BTC reserves from 568,768 BTC on March 28th to 590,874 BTC by April 9th.

Whale Inflows and Macroeconomic Uncertainty

This sharp increase in reserves reflects heightened investor activity, potentially driven by macroeconomic uncertainty and anticipation of the upcoming U.S. Consumer Price Index (CPI) announcement. While some view this as potential sell pressure, others see it as strategic accumulation ahead of market volatility. The shift in investor focus from Bitcoin's scarcity, as evidenced by other metrics, supports this interpretation.

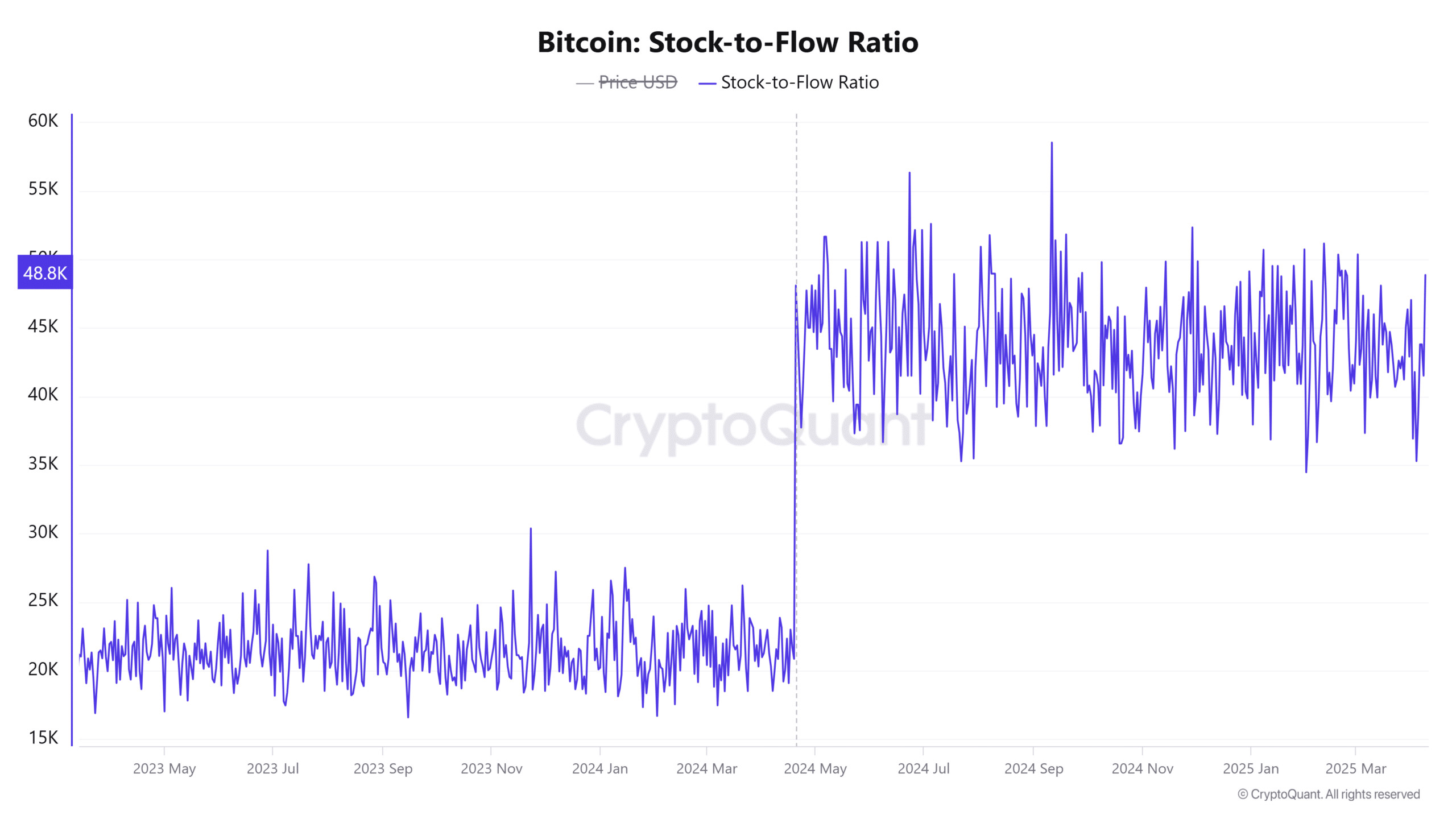

Stock-to-Flow Ratio Decline

The Stock-to-Flow (S2F) ratio, a metric tracking Bitcoin's scarcity, experienced a 16.66% drop in 24 hours, falling to approximately 1.0586 million. This suggests a reduced market emphasis on Bitcoin's scarcity model, with inflation and interest rate factors taking center stage.

Source: CryptoQuant

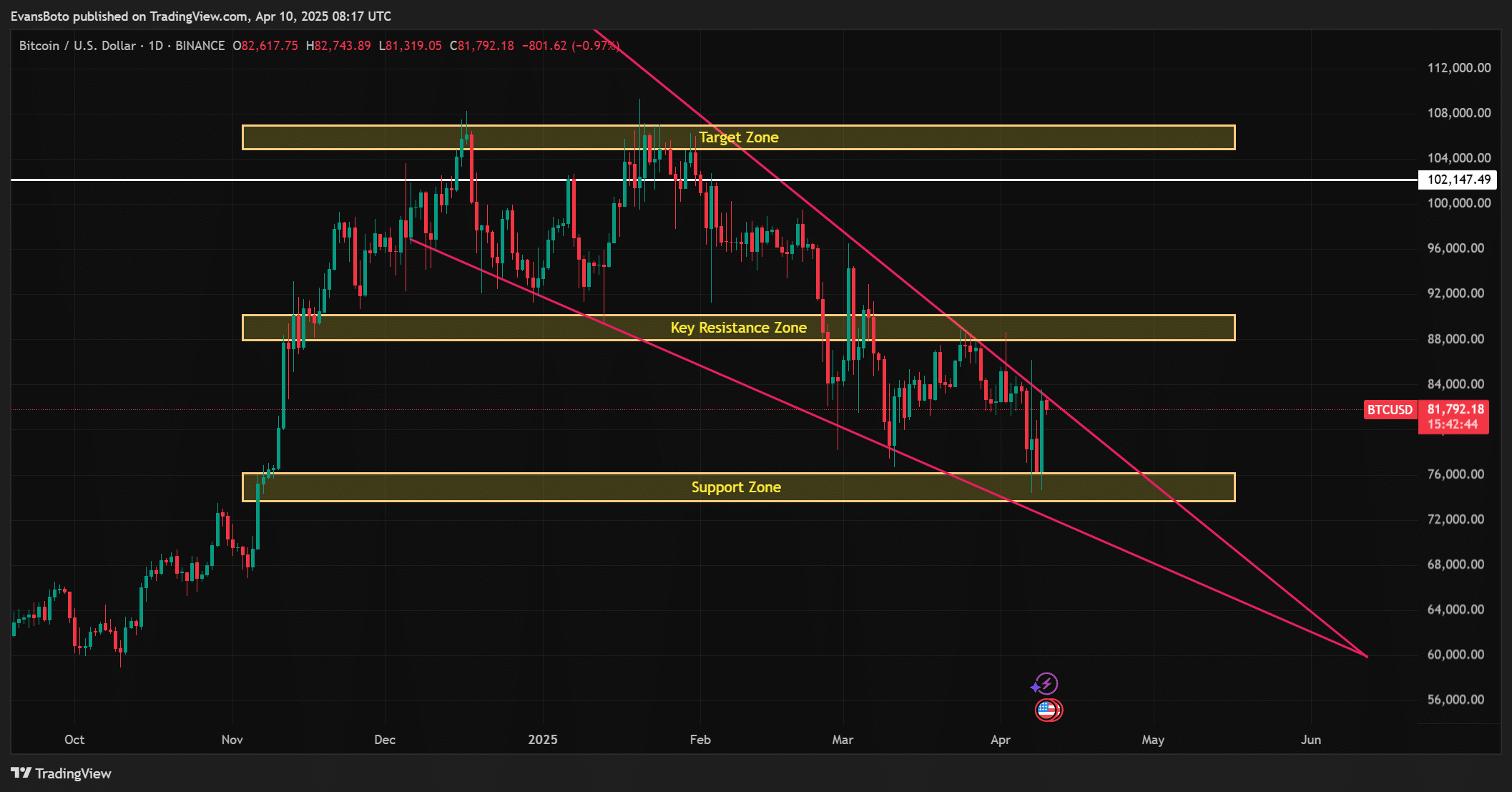

Bitcoin Price Analysis

At the time of writing, Bitcoin traded at $81,715.99, up 5.57% in 24 hours. However, the price remains within a descending wedge pattern, testing resistance near $84,000. Support holds around $76,000, suggesting a potential breakout is imminent. A successful break above resistance could target $102,000, while a failure to maintain support could lead to a drop towards $60,000.

Source: TradingView

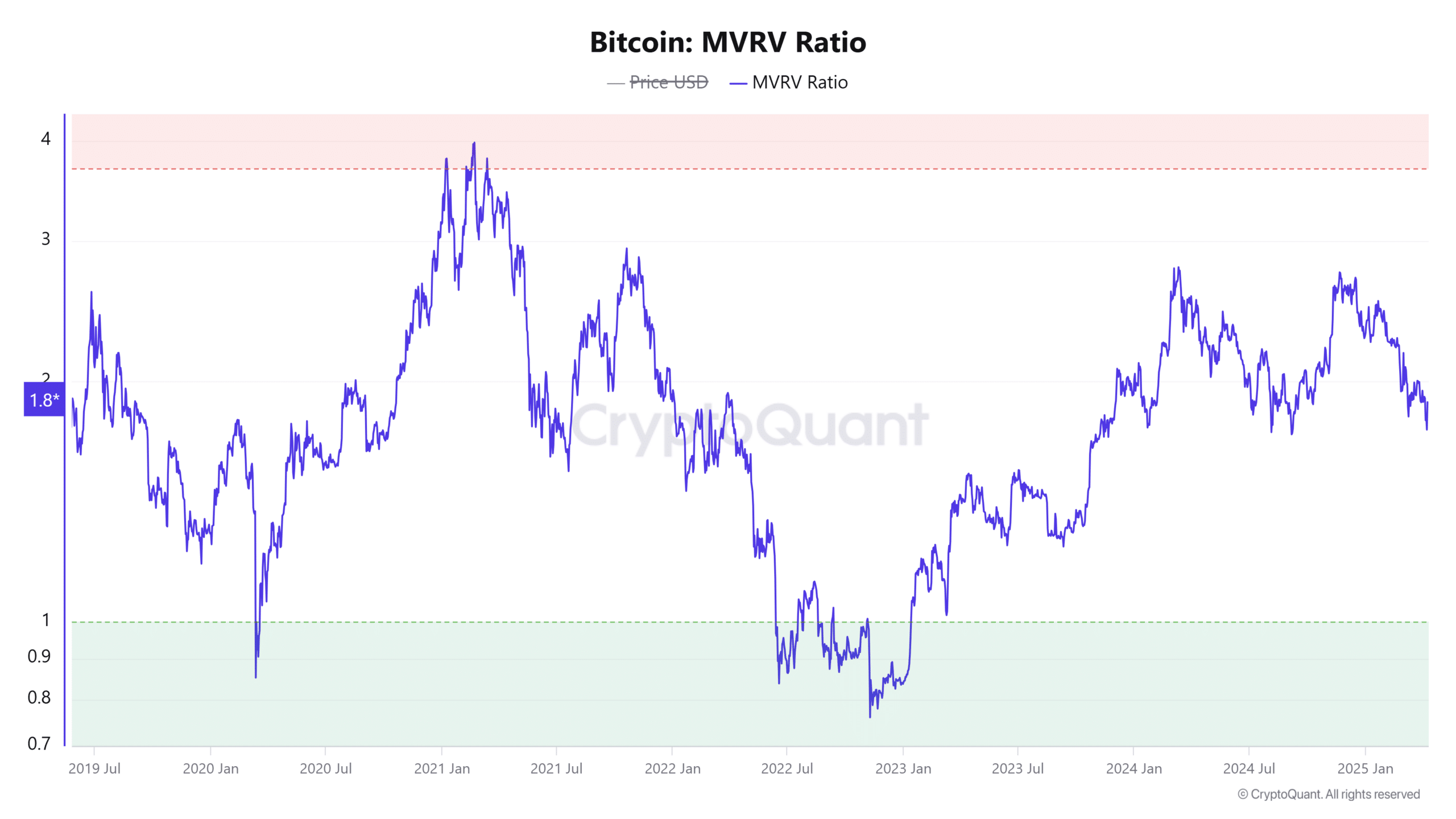

MVRV Ratio and Investor Sentiment

The Market Value to Realized Value (MVRV) ratio, indicating whether BTC is over- or undervalued, sits at 1.86, a 4.84% increase in 24 hours. A ratio above 1 suggests holder confidence. However, high MVRV ratios can also increase the temptation to take profits, highlighting the need for continuous sentiment monitoring.

Source: CryptoQuant

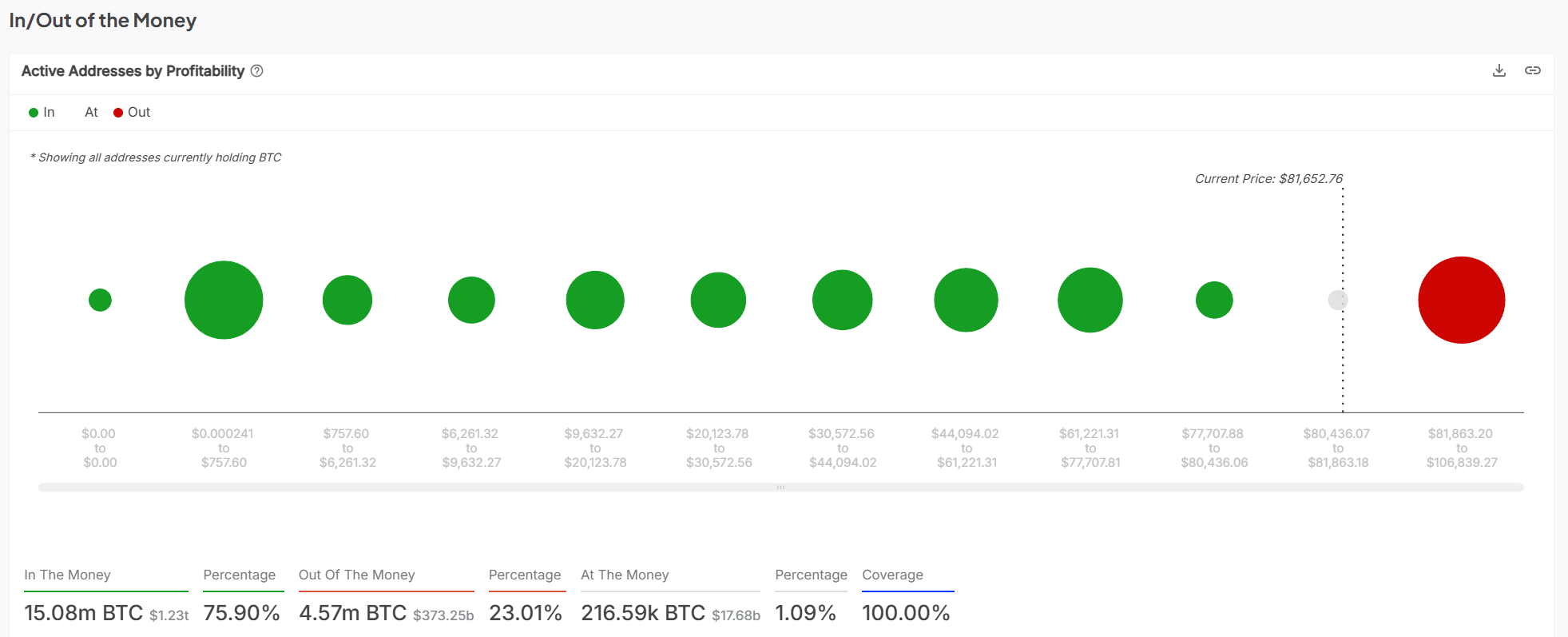

On-Chain Metrics: In/Out of the Money

75.90% of Bitcoin addresses are currently in profit, while 23.01% are underwater. This suggests a strong majority of holders are well-positioned, providing psychological support during potential pullbacks. However, a substantial price drop could trigger panic selling among those near breakeven.

Source: IntoTheBlock

Conclusion: Strategic Positioning

Overall, on-chain data suggests strategic positioning rather than panic selling. The majority of holders remain profitable, and key support levels are holding. Whale accumulation hints at a calculated approach, preparing for the next market move. Codeum provides blockchain security and development services, including smart contract audits, KYC verification, and custom smart contract development to help navigate the complexities of the crypto market.