Bitcoin Holds Steady Above $95,000

Bitcoin Holds Steady Above $95,000

Bitcoin continues to defy market swings, holding firm above the $95,000 mark. While attempts to break the $100,000 barrier have faced challenges this month, showcasing its inherent volatility, the cryptocurrency remains a top performer this year.

Bitcoin Investors Remain Secure

Despite recent market volatility, Bitcoin has largely maintained its position. Unlike some altcoins, particularly those based on the ERC20 standard, which experienced significant selling pressure, Bitcoin has shown remarkable resilience. This stability suggests underlying strength amidst broader market weakness.

The relative underperformance of altcoins points to challenges within the broader cryptocurrency market, highlighting lagging adoption and market positioning. Bitcoin's continued consolidation reinforces its dominance and sets the stage for potential future growth.

Bitcoin YTD Performance. Source: Glassnode

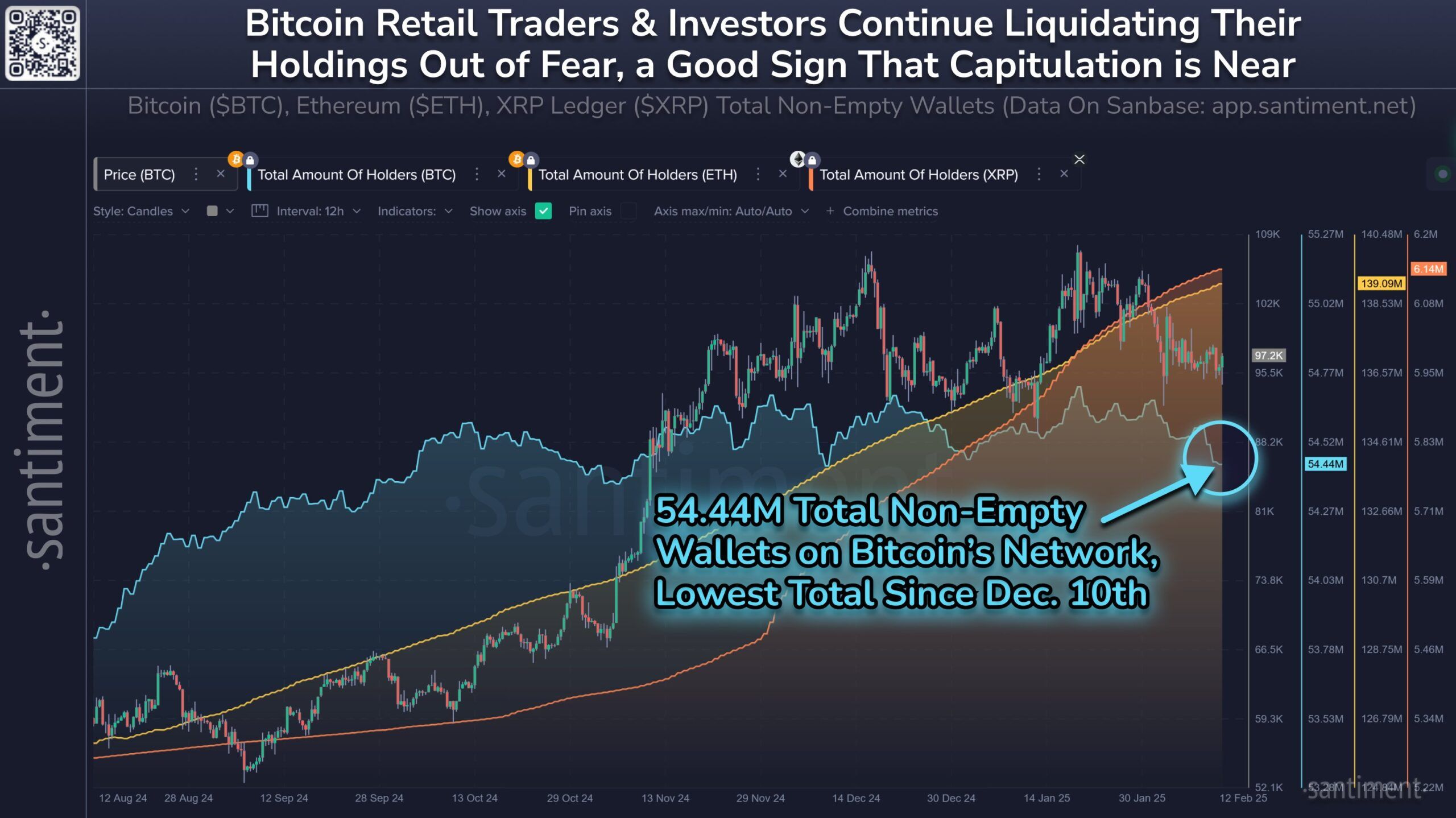

Macro indicators suggest further growth. The number of non-empty Bitcoin wallets, currently at a two-month low, reflects a retreat of smaller investors, potentially driven by concerns about a broader crypto downturn. Historically, this type of retail pullback has been a positive sign for long-term Bitcoin price appreciation.

This is because a reduced retail presence often leads to accumulation by larger investors (whales and sharks), who frequently use their capital to drive prices higher, particularly during periods of heightened market fear.

Bitcoin Non-Empty Wallet. Source: Santiment

BTC Price Prediction: A Look Ahead

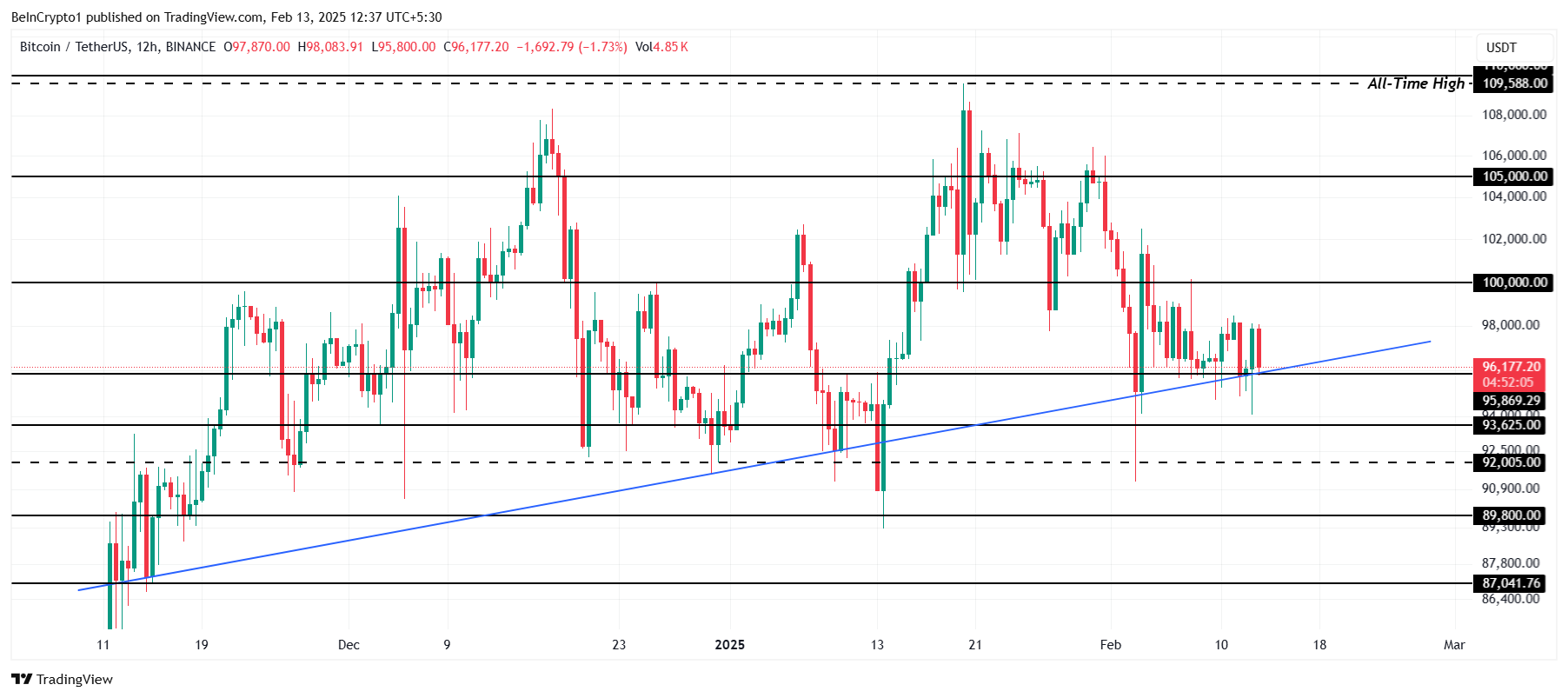

Bitcoin's price has largely stayed above its uptrend line (established two months ago), except for a brief dip last month. Given its historical performance and recent stability, a breakout above $100,000 in the near term is possible.

Currently trading around $96,177, Bitcoin is holding above key support at $95,869. Maintaining this level, supported by investor sentiment, could lead to the significant milestone of exceeding $100,000.

Bitcoin Price Analysis. Source: TradingView

However, a loss of the $95,869 support level could trigger a decline toward $93,625 or lower, invalidating the current bullish outlook and potentially delaying further price gains.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Market conditions are subject to change. Conduct your own research and consult a professional before making financial decisions.