Bitcoin Holders Accumulate Despite Volatility

Bitcoin's price has struggled to maintain stability above $100,000 since early February. Market volatility, partly attributed to global economic factors, has kept traders cautious.

Bitcoin Long-Term Holders Show Resilience

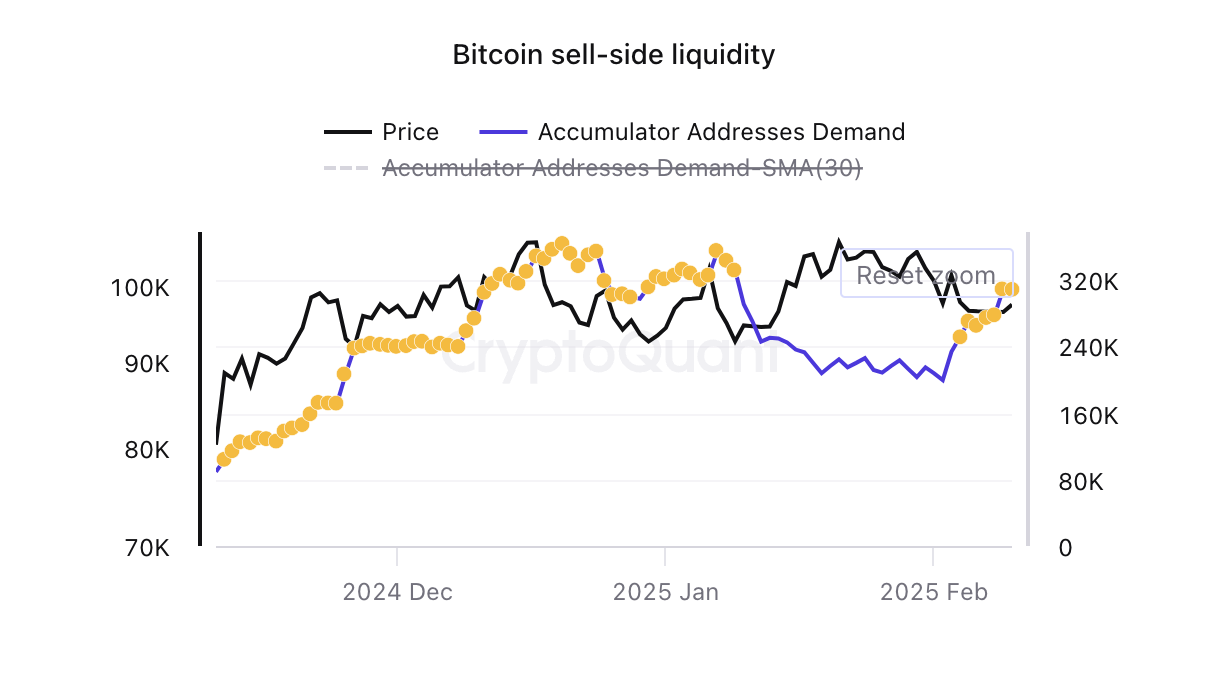

However, a significant group of Bitcoin holders—those with no history of selling—are actively accumulating more Bitcoin. This demonstrates considerable confidence in Bitcoin's long-term potential. Data from CryptoQuant reveals a surge in Bitcoin's Permanent Holder Demand. These are holders who primarily accumulate and rarely, if ever, sell their Bitcoin.

Analysis of Bitcoin's accumulator addresses shows a significant increase in demand since the year-to-date low on February 2nd. This confirms the rise in accumulation by long-term investors. Even with Bitcoin's early February correction, demand rebounded, suggesting unwavering confidence from these long-term holders.

Further evidence of this bullish sentiment is Bitcoin's attempt to surpass its 20-day exponential moving average (EMA). At the time of writing, BTC trades slightly below this key resistance level of $98,995, at approximately $98,022.

The 20-day EMA provides an average price over the past 20 trading days, weighting recent data more heavily. A break above this EMA often indicates increasing bullish momentum, potentially signaling an uptrend.

BTC Price Prediction: Will Strong Holder Demand Push BTC Higher?

Sustained demand from permanent Bitcoin holders could propel the price above the 20-day EMA resistance. A successful break above this level could lead to Bitcoin reclaiming its all-time high of $109,356.

Conversely, if accumulation slows, Bitcoin could see a price reversal, potentially dropping to $92,325.

Disclaimer: This analysis is for informational purposes only and shouldn't be considered financial advice. Market conditions are volatile. Always conduct thorough research and consult with a professional before making any investment decisions.