Bitcoin Dips, Gold Soars After Israel-Iran Strikes

Bitcoin Dips, Gold Soars After Israel-Iran Strikes

Following Israeli airstrikes on Tehran, Bitcoin experienced a 5% drop, reaching $102,900 early Friday. Simultaneously, spot gold prices surged to $3,429, as investors sought safer assets amid escalating geopolitical uncertainty. This is according to TradingView data.

Market Reaction and Prior Events

On Thursday, Bitcoin showed a slight recovery to $108,450 from $107,000. However, this followed bearish market signals stemming from reports of Israel's planned operation against Iran, which had been communicated to US officials.

The situation escalated after Israel launched "Operation Rising Lion." Israeli Prime Minister Benjamin Netanyahu declared that the operation would continue "for as many days as it takes to remove this threat."

Prime Minister Netanyahu: "Moments ago, Israel launched Operation Rising Lion, a targeted military operation to roll back the Iranian threat to Israel’s very survival. This operation will continue for as many days as it takes to remove this threat."

US Secretary of State Marco Rubio stated that Israel acted unilaterally, but had justified the strikes as necessary for self-defense, according to AP News.

Heightened Tensions and Global Response

This military action coincides with growing anxieties concerning Iran's nuclear program. The International Atomic Energy Agency censured Iran on Thursday for its lack of cooperation with inspectors. In response, Iran announced plans for a third enrichment site and the deployment of advanced centrifuges.

The US initiated the withdrawal of some diplomats from Iraq's capital and offered voluntary evacuations to US military families in the Middle East. The State Department issued warnings for Americans to leave Iraq, citing heightened regional tensions. Trump's envoy, Steve Witkoff, suggested that nuclear talks with Iran would proceed, despite the potential for increased regional tensions and ramifications for US interests.

Bitcoin's Historical Response to Geopolitical Events

Bitcoin has historically shown short-term price drops during periods of geopolitical instability. This often reflects investors' tendency to shift toward more traditional safe-haven assets like gold. However, Bitcoin has frequently recovered quickly, bolstered by its growing recognition as a digital store of value.

Current Market Overview

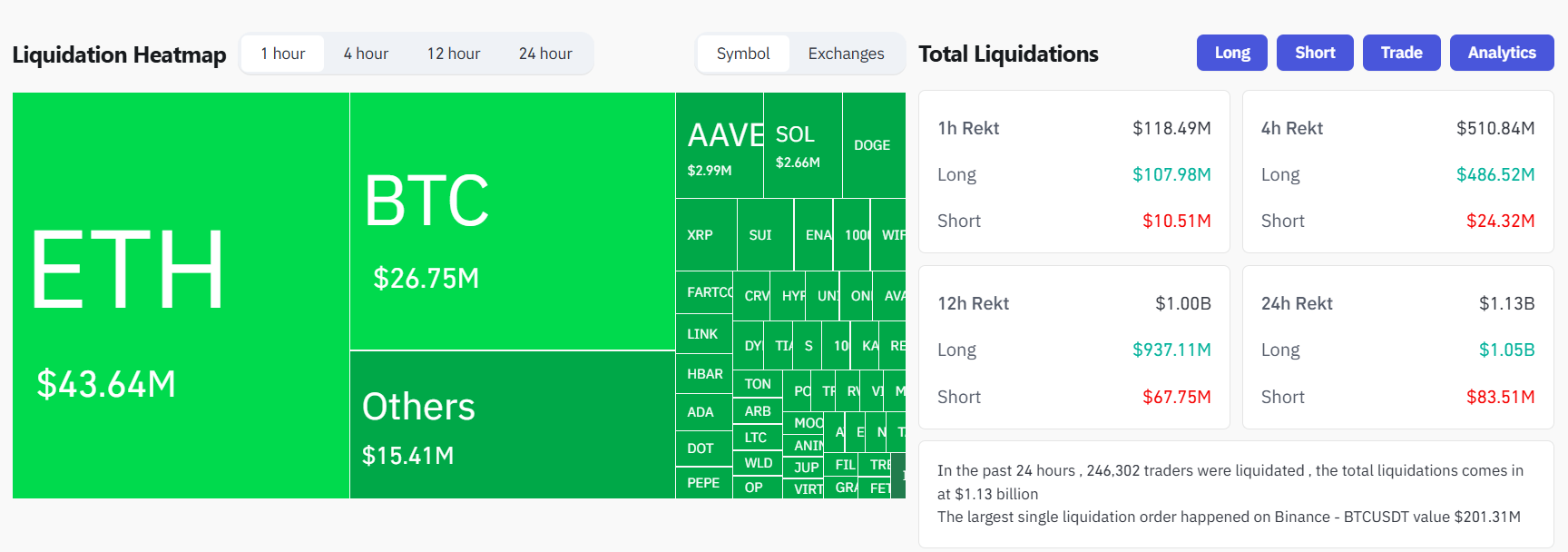

At the time of writing, BTC is trading around $103,100. The broader crypto market is experiencing downward pressure, with Ethereum falling below $2,500 and XRP dropping to $2.1. According to Coinglass data, leveraged liquidations across crypto assets reached $1 billion in the last 12 hours, with long positions accounting for the vast majority of losses.

Codeum provides comprehensive blockchain security and development services, including smart contract audits, KYC verification, and custom smart contract and DApp development. We also offer tokenomics and security consultation, along with partnerships with launchpads and crypto agencies.