Bitcoin & Economic Indicators: Key Data to Watch

Bitcoin's Price: A Week of Crucial Economic Indicators

The cryptocurrency market is poised for a significant week, with three major US economic indicators set to influence investor sentiment and potentially Bitcoin's price. Recent inflation data has already sparked speculation about a Federal Reserve policy shift, making this week's releases particularly important.

Key Economic Indicators and Their Potential Impact on Bitcoin

- Retail Sales: Consumer spending accounts for roughly 70% of the US economy. A decline in retail sales could signal weakening consumer confidence and potentially lead to expectations of monetary easing by the Federal Reserve, potentially boosting Bitcoin's appeal as a store of value.

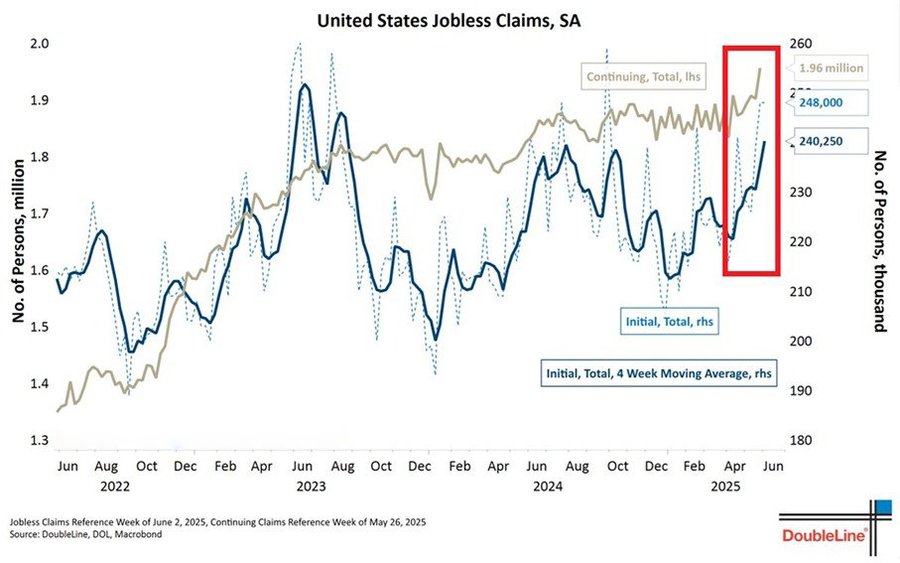

- Jobless Claims: Rising jobless claims indicate a weakening labor market. This could prompt the Federal Reserve to adopt a more accommodative monetary policy, potentially benefiting Bitcoin.

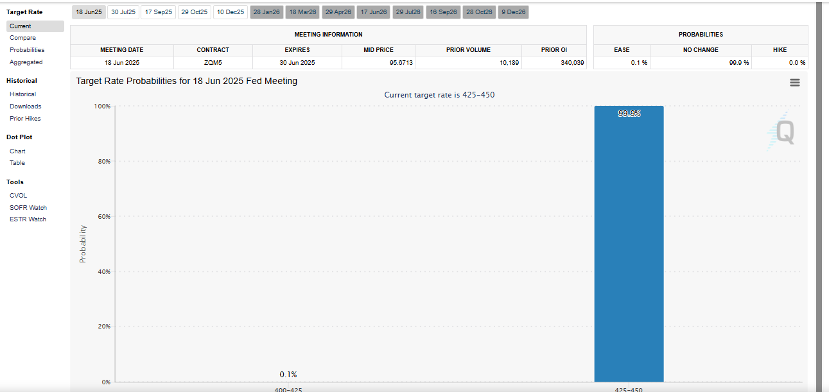

- FOMC Interest Rate Decision: The Federal Open Market Committee (FOMC) interest rate decision is the week's most significant event. While a rate hold is widely anticipated, even a small rate cut could negatively impact Bitcoin's price by reducing the opportunity cost of holding non-yielding assets.

Retail Sales: A Barometer of Consumer Spending

The US Census Bureau's monthly retail sales report provides crucial insights into consumer confidence and overall economic health. While April saw a modest 0.1% increase, economists are forecasting a 0.6% drop in May. A steeper-than-expected decline could be bullish for Bitcoin, suggesting increased potential for monetary easing.

Jobless Claims: Gauging Labor Market Strength

Weekly jobless claims data offers a real-time snapshot of the US labor market's health. Last week's figure of 248,000 exceeded expectations, and a further increase to 250,000 this week could signal a weakening labor market, increasing the likelihood of the Federal Reserve easing monetary policy.

Source: X (Twitter)

FOMC Interest Rate Decision: The Fed's Influence

The FOMC's interest rate decision on Wednesday is highly anticipated, especially after May's surprise CPI uptick. Markets currently expect the Fed to maintain the benchmark rate at 4.25–4.5%, but a rate cut, however unlikely, could negatively impact Bitcoin's price due to the reduced opportunity cost of holding other, higher-yielding assets.

Source: CME

Codeum provides comprehensive blockchain security and development services including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies. Contact us to secure your blockchain project.