Bitcoin Dips on China's 34% Tariff

On April 4, 2025, China announced a 34% tariff on all US imports, escalating the ongoing trade war. This action immediately impacted global markets, including the cryptocurrency sector.

Bitcoin's Response to the Trade War

Within hours of the announcement, Bitcoin's price fell 3%, briefly dipping below $82,000. This decline reflects investor concern about the potential economic fallout from the escalating trade tensions. Xinhua News Agency reported that China views the US’s “Reciprocal Tariff” as a violation of WTO rules.

A spokesperson for the Ministry of Commerce stated, "This is a typical act of unilateral hegemony that harms the stability of the global economic and trade order. China firmly opposes this."

This latest development follows President Trump's earlier imposition of a 34% tariff on Chinese goods, resulting in a cumulative 54% tariff on certain products.

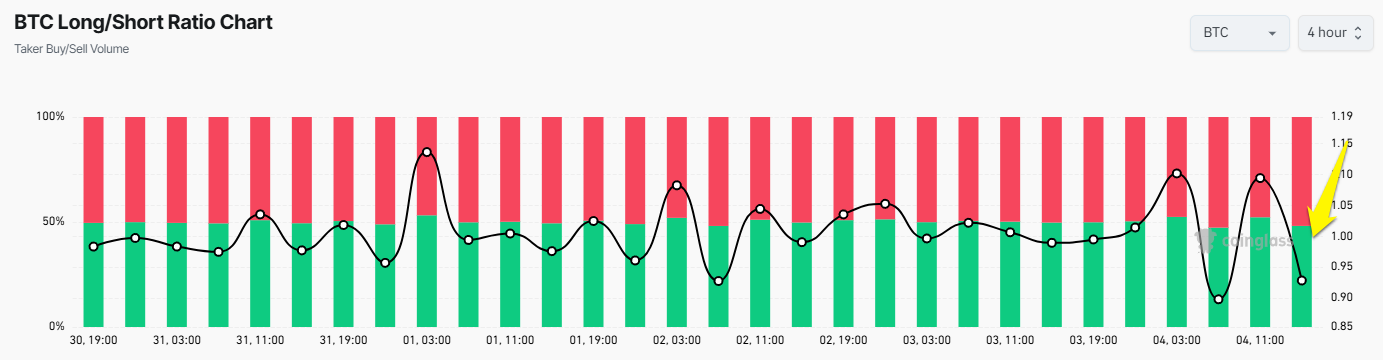

The impact was evident in the Bitcoin market. The Long/Short ratio fell below 1, signaling a shift towards short-selling. Traditional markets also experienced declines, with the S&P 500 and Dow Jones Industrial Average both showing notable drops.

The Kobeissi Letter commented, "The ‘Third World War’ of the trade war has begun."

Bitcoin's Future Amidst Trade Uncertainty

Bitcoin, often considered a hedge against economic instability, displayed its risk-on nature during this period of uncertainty. This aligns with its behavior during the 2018-2019 US-China trade war.

The increased tariffs also impact the Bitcoin mining industry. A significant portion of the global cryptocurrency mining hardware supply chain originates in China. The new tariffs will raise the cost of importing these machines, potentially impacting US miners already facing high energy costs and competition.

However, some analysts believe the long term outlook could be positive. Prolonged trade friction may increase the appeal of Bitcoin as a decentralized asset, unaffected by geopolitical tensions. If inflation or currency devaluation results from the trade war, investors may seek refuge in cryptocurrencies.

Nexo Dispatch Editor Stella Zlatarev noted that Bitcoin is behaving as a risk-dynamic asset; it doesn’t react like traditional safe havens.

Codeum’s services such as smart contract audits, tokenomics consultation, and DApp development can help blockchain projects navigate market volatility and enhance their security posture.

Disclaimer: BeInCrypto adheres to the Trust Project guidelines for unbiased, transparent reporting. Readers should independently verify facts and consult a professional before making any decisions based on this content. See our Terms and Conditions, Privacy Policy, and Disclaimers for more information.