Bitcoin Dips: Panic Selling or Short-Term Volatility?

Bitcoin (BTC) recently experienced a 6.4% decline in the last 24 hours, forming a rounding top pattern. An intraday low of $90,000 triggered significant panic selling.

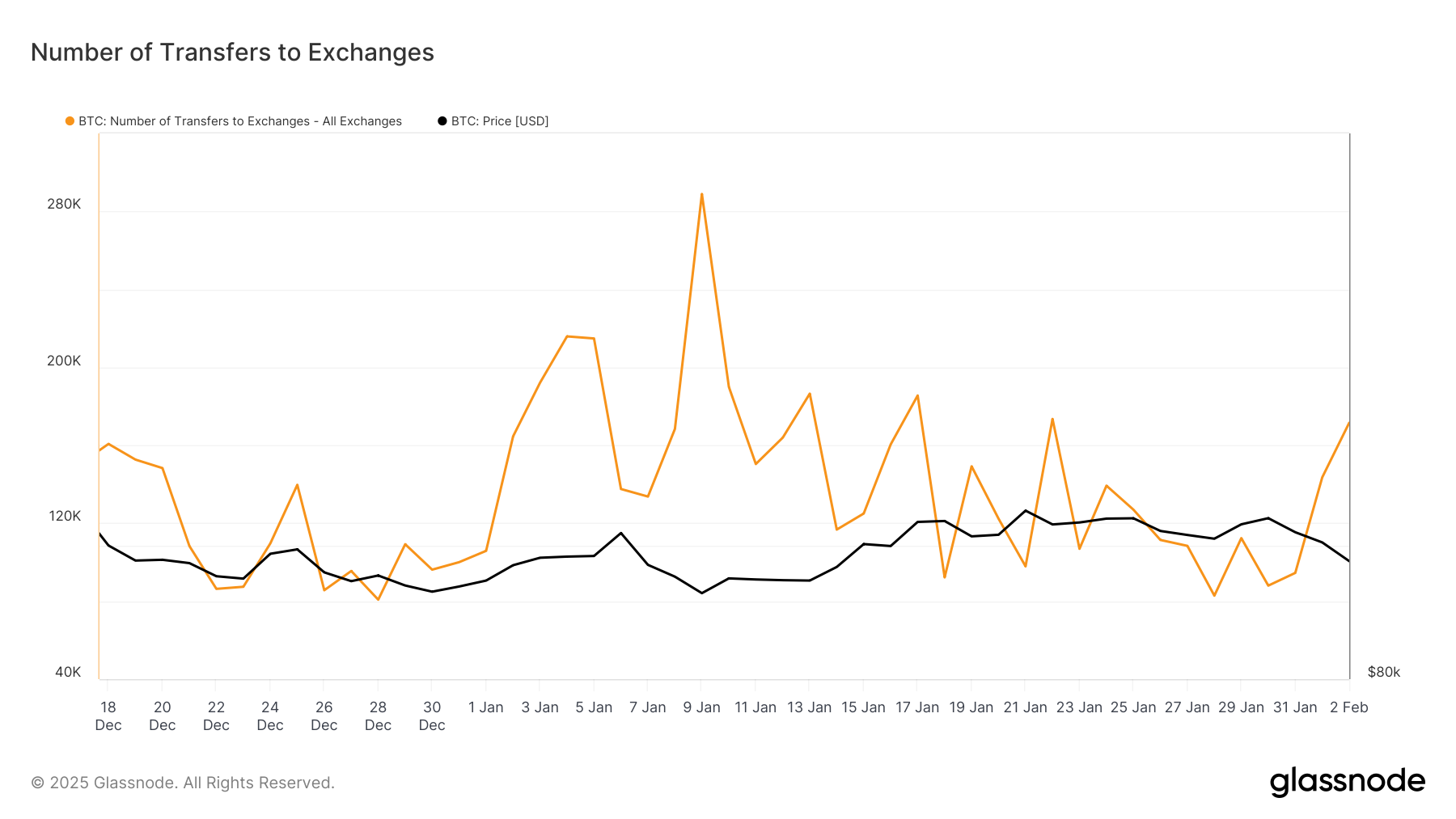

Bitcoin Exchange Inflows

Over 80,000 BTC (approximately $7.5 billion) were moved to exchanges in two days. This increase is often interpreted as a precursor to selling pressure. However, it's crucial to note that this movement may simply reflect investors seeking liquidity during market uncertainty, not necessarily a sustained bearish trend.

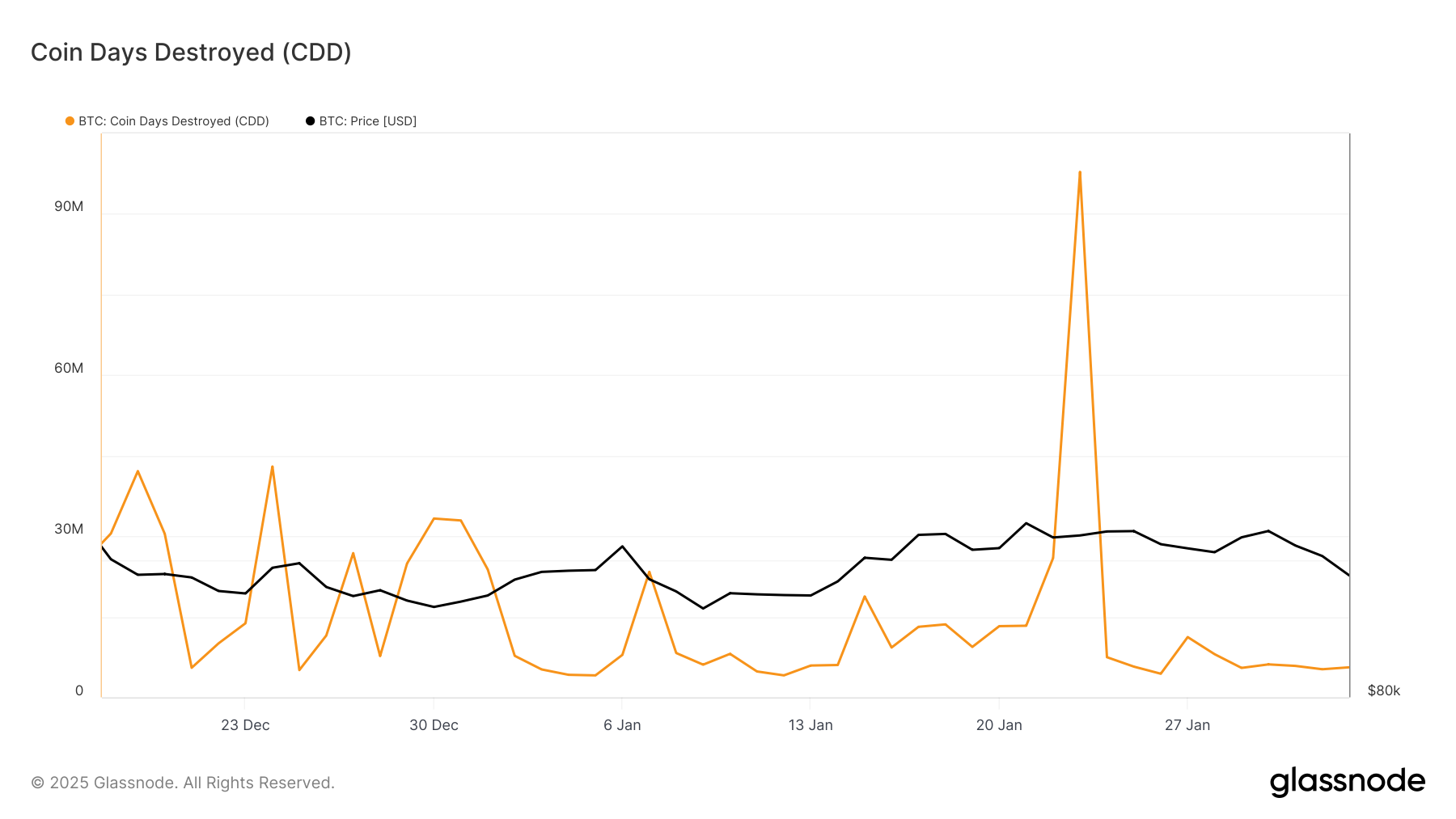

Long-Term Holder Behavior

The Coin Days Destroyed (CDD) metric, tracking long-term holder (LTH) activity, remained relatively low despite the price drop. This suggests that LTHs are not participating in the sell-off, potentially indicating confidence in a market recovery.

BTC Price Prediction

While a rounding top pattern initially suggested a bearish trend, the possibility of an inverse cup and handle pattern exists. Current bearish momentum is not overly intense, suggesting a potential bounce from support around $93,625.

A successful bounce could push BTC towards $100,000 after breaking through $95,668, restoring investor confidence. However, continued bearish pressure might lead to a drop to $92,005.

A break above $100,000 and its establishment as support would invalidate the bearish outlook, potentially leading to a rise towards $105,000.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Market conditions are volatile. Conduct your own research before making any investment decisions.

Codeum: For robust blockchain security and development, consider Codeum's services: smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies.