Bitcoin Price Surge: Bullish Signals Emerge

Bitcoin Price Surge: Bullish Signals Emerge

Bitcoin (BTC) is showing promising signs of a bullish trend in May 2025, fueled by several key indicators. Experts point to factors like miner economics, network hashrate, long-term holder accumulation, and increased global fiat liquidity as potential drivers for a price increase.

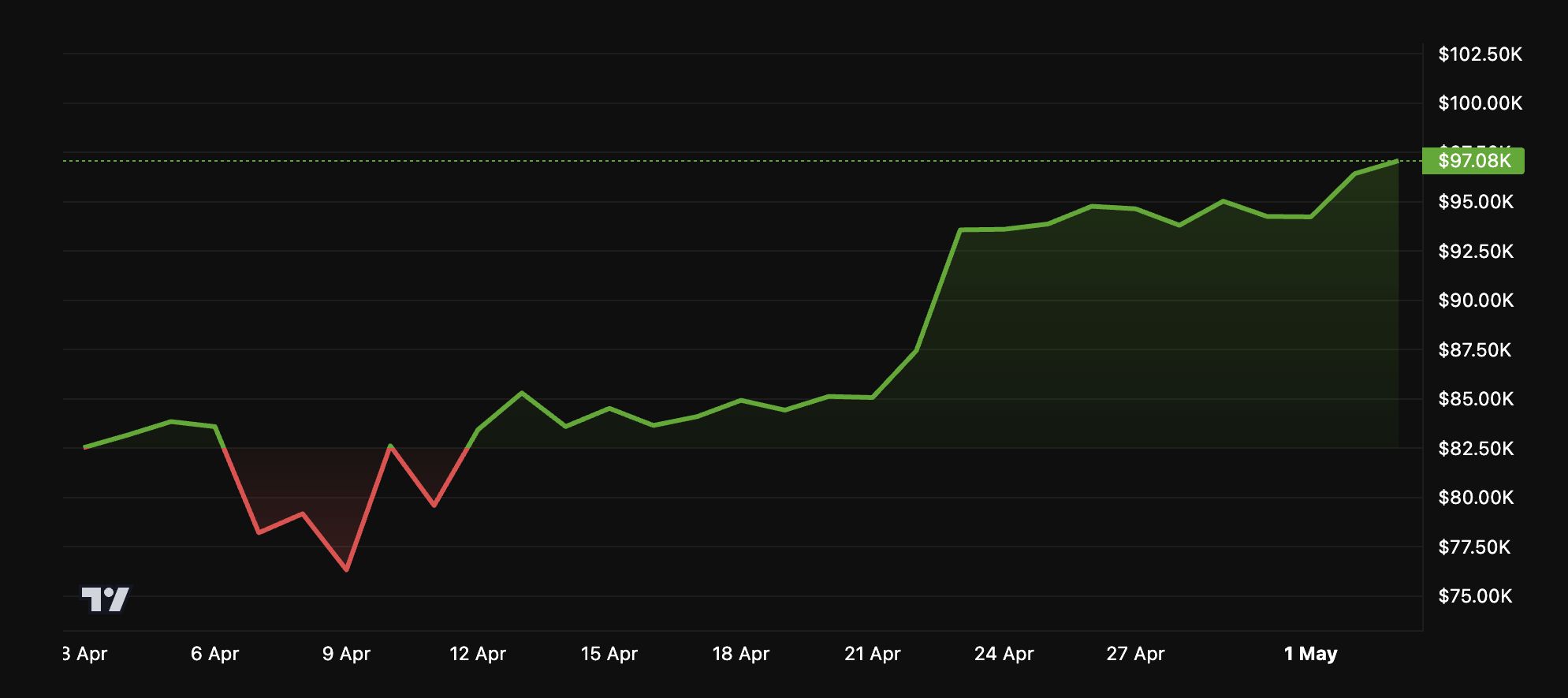

Bitcoin has already seen a 14.6% recovery rally since early April lows.

Is a Bitcoin Bull Run Imminent?

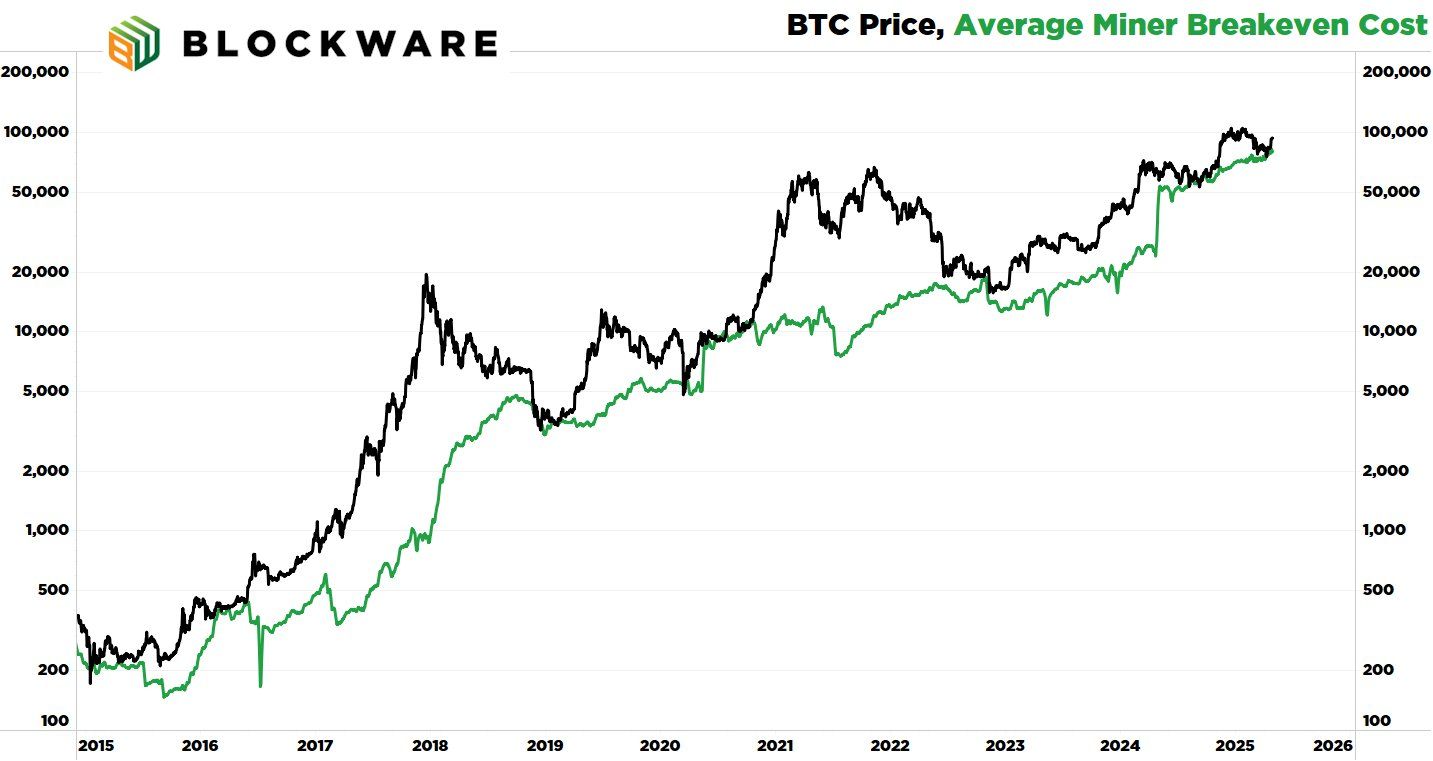

Analyst Robert Breedlove, founder of WiM Media, cited Blockware Team’s average miner breakeven cost data to predict a potential bull market. He noted that Bitcoin's price rarely stays below the average miner production cost for extended periods, as this is the point where miners may become unprofitable and cease operations.

"In a rational economy, assets rarely trade below their cost of production," Breedlove observed.

Breedlove's analysis, using the average miner cost data, correctly identified six market bottoms between 2016 and 2024, suggesting another potential bottom and subsequent price increase.

Source: X/Robert Breedlove

MacroMicro data supports this. The 30-day moving average (MA) of the mining cost-to-BTC price ratio is 1.05, indicating miners operated at a loss recently. This could lead to a price increase as miners reduce operations, thus tightening supply.

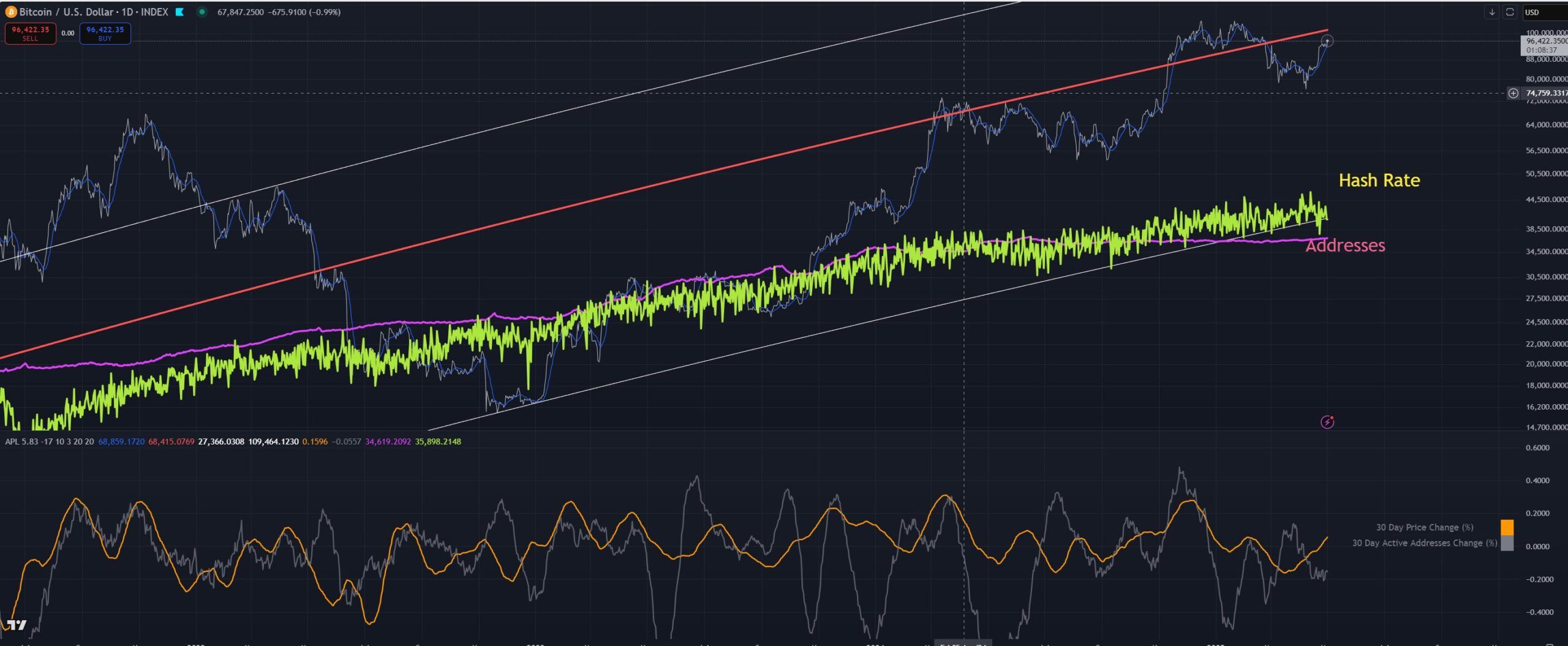

Further supporting the bullish outlook is the Bitcoin hash rate price model, which analyzes the historical relationship between Bitcoin's price and hash rate. Analyst Giovanni noted on X that this model is currently at a support level, suggesting a potential local bottom.

"The fact the hash rate based BTC valuation is at the support level means that probably we reached some kind of local bottom," Giovanni stated.

Source: X/Giovanni

Additional positive signs include long-term holder accumulation of approximately 150,000 BTC over the past 30 days, indicating reduced selling pressure in the $80,000 to $100,000 range. This reduced selling pressure, combined with strong demand, could push prices higher.

"At its core, the Bitcoin price is simply a function of supply and demand. After prolonged periods of sideways or negative price action, long-term holders begin accumulating more coins, setting the stage for a supply-shock and upward price pressure," Breedlove added.

Increased global fiat liquidity, bolstered by ETFs, Bitcoin treasury companies, and convertible bonds, is also a contributing factor. This increased liquidity makes it easier for new capital to flow into the Bitcoin market.

"And it’s not just USD liquidity that’s increasing – liquidity of all fiat currencies is on the rise, and Bitcoin is a global asset," Breedlove stated.

BeInCrypto also previously highlighted positive indicators, including a positive shift in Bitcoin's demand and a rebound in the Market Value to Realized Value (MVRV) ratio from its historically significant mean of 1.74—a sign often associated with early bull market stages.

Source: BeInCrypto

Bitcoin's price currently stands at $97,048, showing a 4.3% increase over the past week and 2.3% daily gains.

Disclaimer: This information is for educational purposes only and is not financial advice. Always conduct your own research and consult with a financial professional before making any investment decisions.