Bitcoin's $111K Barrier: Whale Activity Holds the Key

Bitcoin's $111K Barrier: Whale Activity Holds the Key

Bitcoin recently traded around $105,900 following a temporary ceasefire between Israel and Iran. However, significant price volatility persists, driven largely by the actions of newer Bitcoin whales.

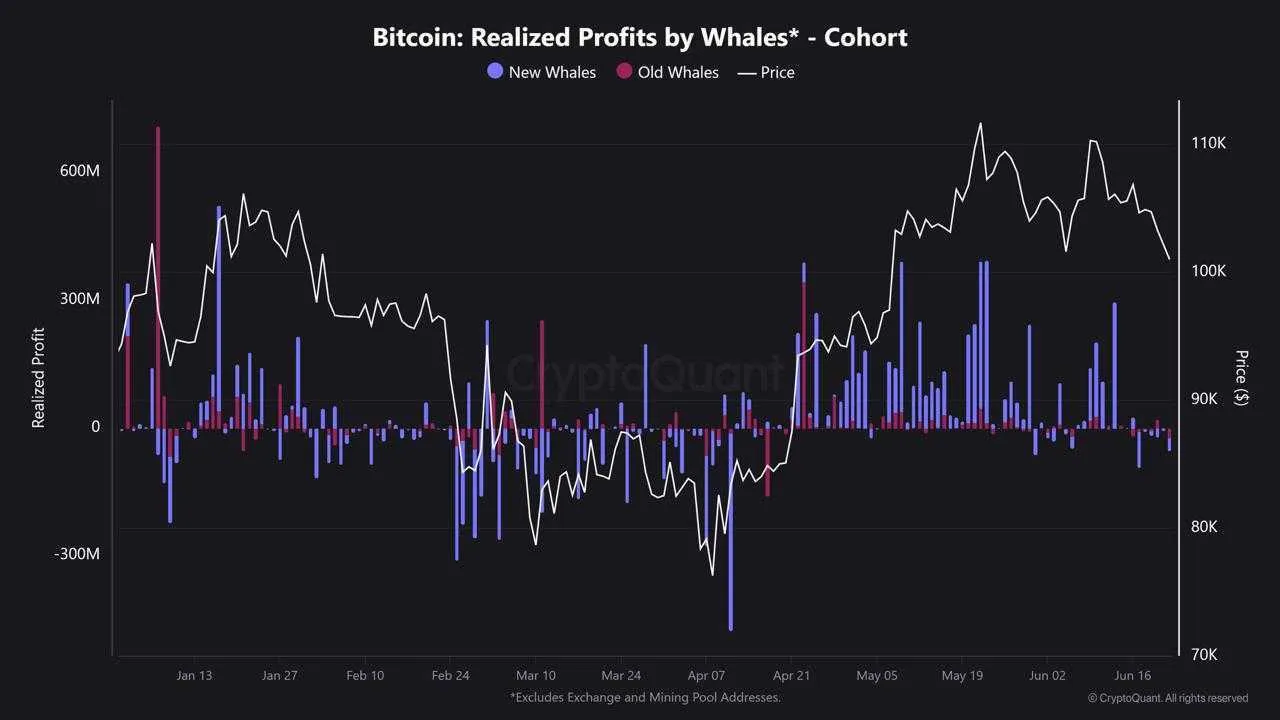

Analysis by CryptoQuant reveals that these newer whales have incurred substantial realized losses, leading to aggressive selling and amplified market downturns. This contrasts with the behavior of established, long-term whale investors.

New Whales Fuel Bitcoin Price Swings

Since mid-June, Bitcoin has experienced considerable price fluctuation, ranging from approximately $107,000 to below $100,000. Between June 14th and 22nd, CryptoQuant analyst JA Maartunn reported approximately $228 million in realized Bitcoin losses among whales. A particularly significant spike occurred on June 17th, with $95 million in losses in a single day.

Remarkably, nearly $85 million of these losses stemmed from newer whales, compared to only $8.2 million from more established investors. While a subsequent spike on June 22nd ($51 million) saw a more even distribution between newer and older whales, the trend remains clear.

Bitcoin Whales Realized Profits. Source: CryptoQuant

This suggests that newer whales, having entered the market at higher price points, are more susceptible to panic selling during periods of geopolitical uncertainty. Their actions intensify price swings and create strong resistance, particularly around the $111,000 level.

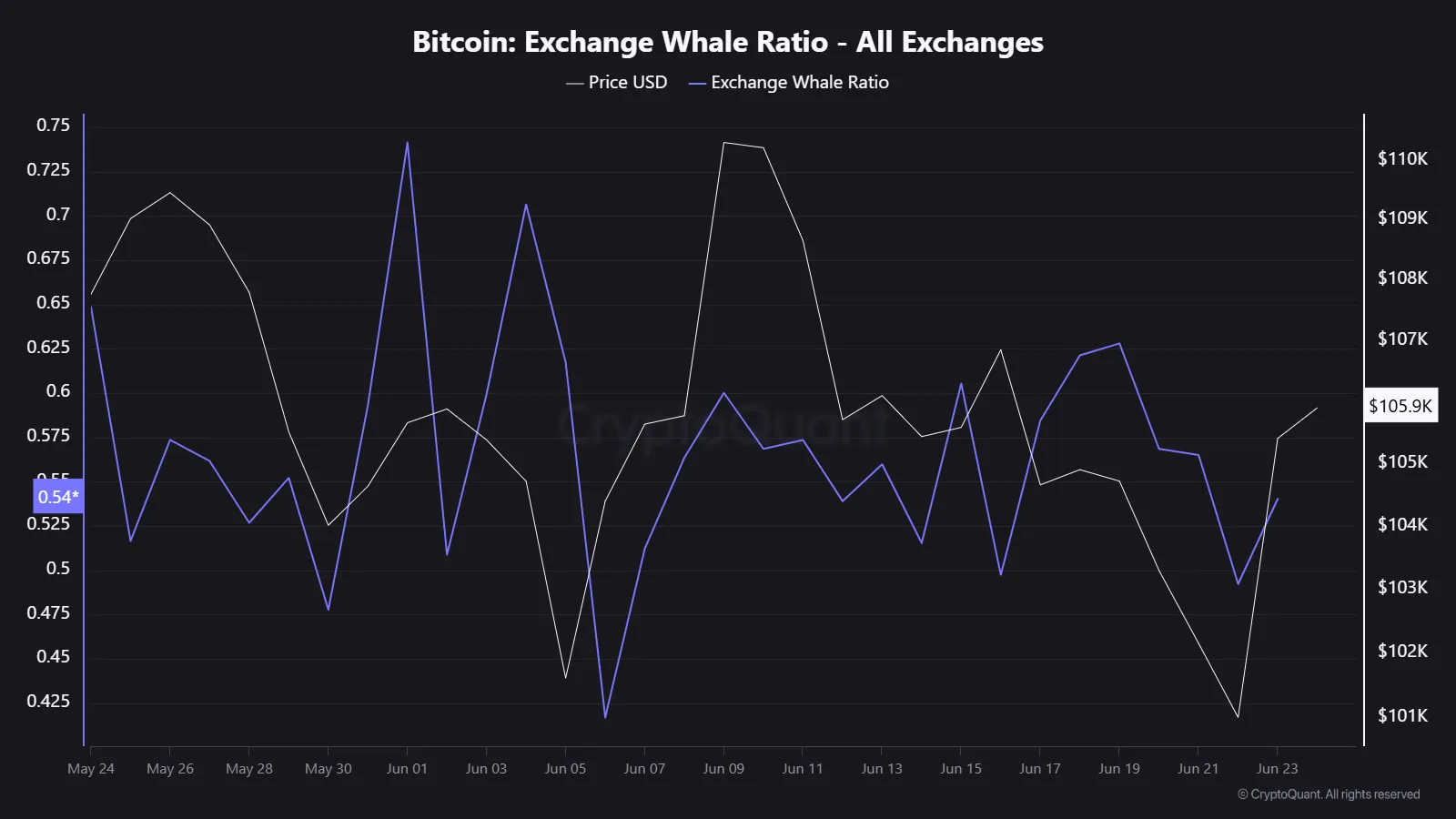

Exchange Whale Ratio Reveals Selling Pressure

CryptoQuant's Exchange Whale Ratio provides further evidence. This metric, which measures whale activity on exchanges, indicates a high ratio when whales deposit Bitcoin, typically preceding selling. Data shows this ratio rose significantly as Bitcoin attempted to break above $110,000, suggesting whales were preparing to sell, limiting upward momentum. The ratio briefly decreased as Bitcoin dipped below $102,000 before rising again as prices recovered.

Bitcoin Exchange Whale Ratio. Source: CryptoQuant

This continuous risk management by whales contributes to market uncertainty and selling pressure.

Geopolitical Uncertainty Exacerbates Whale Anxiety

The recent geopolitical tensions, such as the Israel-Iran conflict and subsequent ceasefire, have heightened market volatility. Newer whale investors appear particularly sensitive to negative news, triggering rapid selling and further price fluctuations. This also impacts leveraged traders, who face margin calls, further amplifying price drops.

For a sustained Bitcoin breakout above $111,000, a decrease in whale selling is crucial. Lower realized losses and reduced exchange inflows would signify improved market confidence. Codeum, a leader in blockchain security and development, provides services including smart contract audits, KYC verification, and custom smart contract and DApp development to help navigate the complexities of the crypto market.