API3 Soars After Upbit Listing Announcement

API3 (API3) experienced a significant price surge, reaching an 8-month high, after Upbit, South Korea's leading digital asset exchange, announced its listing of the token.

The announcement propelled API3 to become the top daily gainer on CoinGecko and a trending coin within the cryptocurrency market.

Upbit Listing Fuels API3 Price Rally

API3 is a decentralized oracle network connecting decentralized applications (dApps) with real-world data via first-party oracles. This approach distinguishes API3 from traditional oracle solutions that rely on third-party intermediaries. API3 allows API providers to operate their own oracles, improving data authenticity and reducing trust-related concerns.

Before its debut on Upbit, API3 was already available on major exchanges such as Binance, Coinbase, and OKX.

Trading of API3 on Upbit commenced at 17:00 Korean Standard Time (KST) on August 19. The exchange offers trading pairs against the Korean Won (KRW) and Tether (USDT). Upbit cautioned users to verify the network before depositing API3 to avoid unsupported transactions.

"Please ensure you check the network before depositing the digital asset. Deposits and withdrawals made through networks other than the specified network will not be supported,” the notice read.

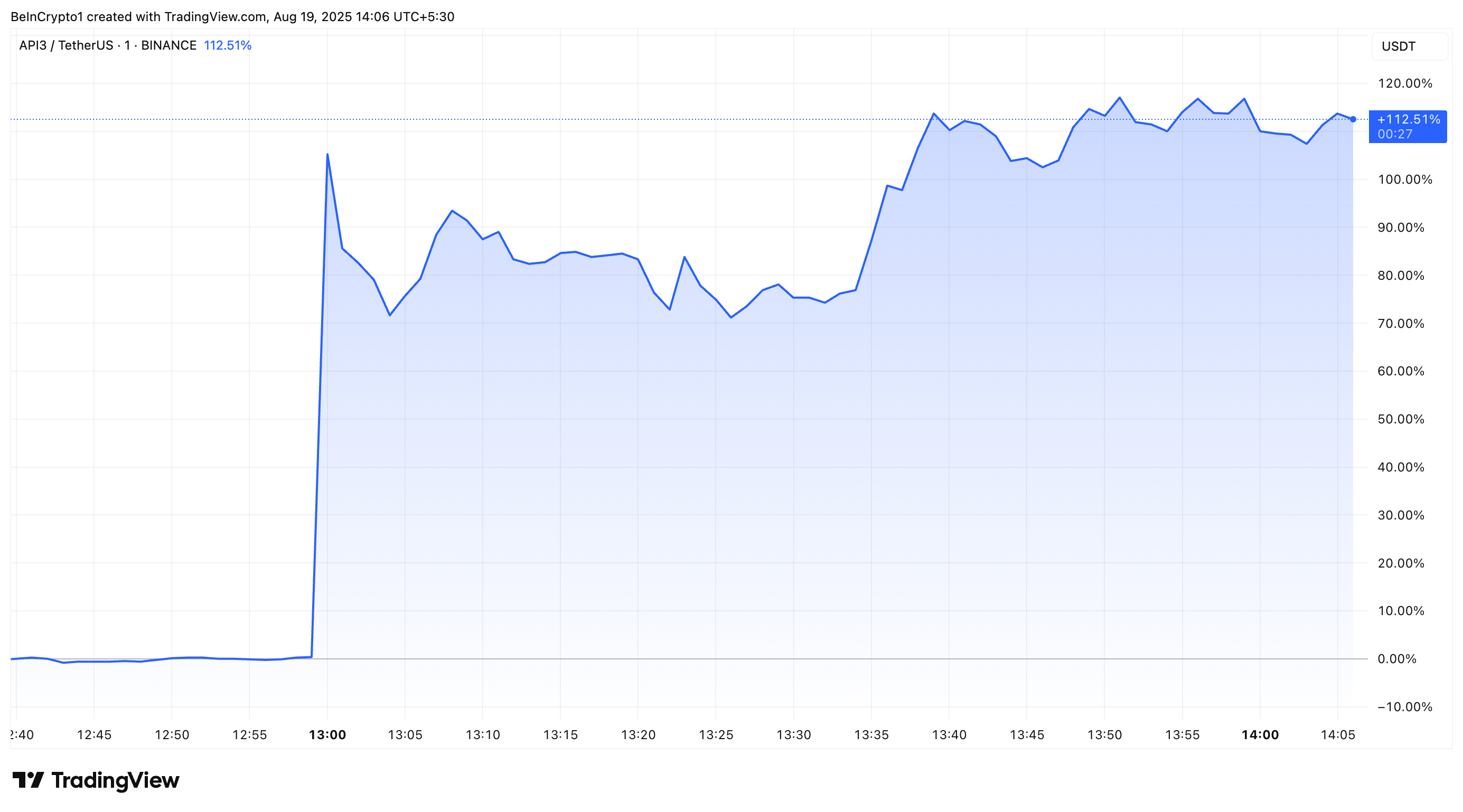

Following the listing announcement, API3's price increased by 121.43%, from $0.84 to $1.86. At the time of writing, the price stabilized at $1.77, reflecting a gain of 112.5%.

The token's market capitalization doubled, climbing from nearly $100 million to over $200 million. This growth positions API3 as the third-largest oracle coin by market capitalization, behind Chainlink (LINK) and Pyth Network (PYTH).

The price surge correlated with a substantial increase in trading volume, which rose by 409.6% to reach $473 million. Data from CoinGecko indicates that Upbit accounted for 24.58% ($118 million) of the total volume within a few hours of listing.

Upbit's influence on market performance through its listings is well-documented. Its high trading volume in South Korea often leads to significant price movements for newly listed tokens. Platforms like Codeum provide critical security audits for tokens prior to listing, as well as KYC services to ensure a high standard for tokens available in the market.