Altcoin Rally: A Hidden Setup?

Bitcoin [BTC], recently flirting with the $105,000 mark after hitting its all-time high, is creating uncertainty in the market. Previous attempts to break this resistance level resulted in a drop to $100,000, leaving traders anxious about the lack of a confirmed bottom.

A Potential Altcoin Rotation?

Historically, Bitcoin's price indecision often triggers altcoin rotations as investors seek short-term gains elsewhere. However, many altcoins remain in the red, showing double-digit weekly losses. While an altseason isn't confirmed, the current market structure might present opportunities for shrewd investors.

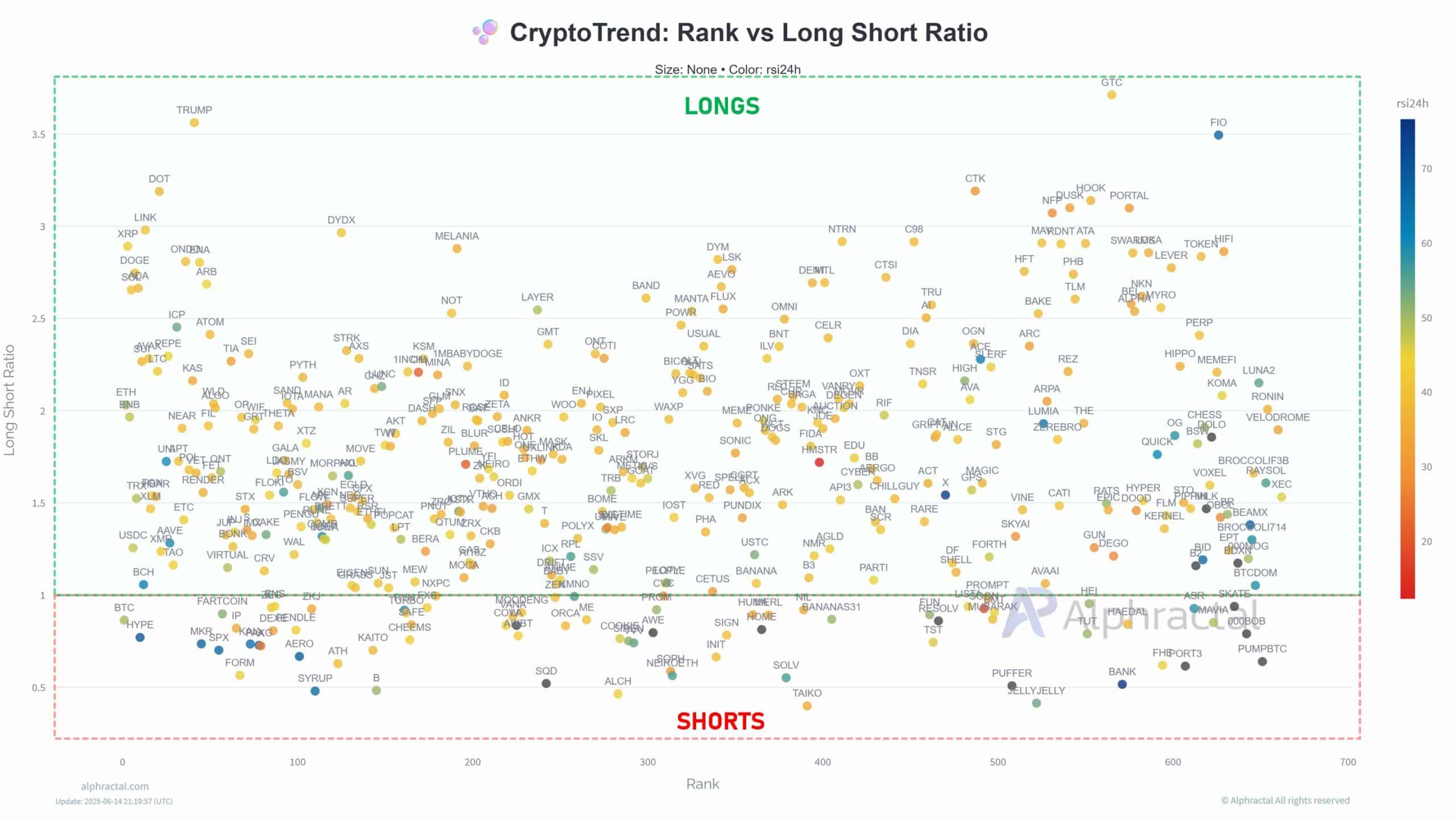

Crowded Long Positions Signal Market Rebalancing

Despite subdued spot prices, the derivatives market shows significant activity. Over 70% of altcoins exhibit a strong long bias, particularly on Binance, where high-cap assets show 60%+ of traders holding long positions. This isn't blind optimism; it suggests strategic risk-taking after last week's significant liquidations. Traders appear to anticipate a near-term market rebalancing and a potential short squeeze.

This is a bold strategy given recent volatility. A Bitcoin drop towards $100,000 would likely benefit short-sellers. However, a market stabilization could trigger a short squeeze, benefiting those with long positions.

Source: Alphractal

Strategic Altcoin Rally Positioning

With Bitcoin dominance above 65%, altcoins remain highly correlated with BTC. A Bitcoin drop to $100,000 would likely pull altcoins down. The previous drawdown showed this; while BTC dropped 9.6% from its ATH, Ethereum [ETH] fell 10.25% due to high long exposure amplifying the downward pressure.

Source: TradingView (ETH/USDT)

However, a key structural shift, as recently noted, makes a full Bitcoin retracement to $100,000 less probable. If Bitcoin stabilizes, altcoins might not only experience a relief rally but potentially lead the rebound, particularly if a short squeeze gains momentum.

This current dip might be a strategic entry point for investors aiming to capitalize on the next market move. Codeum provides essential services to help navigate the complexities of the crypto market, including smart contract audits, KYC verification, and custom smart contract and DApp development. We also offer tokenomics and security consultation, and partnerships with launchpads and crypto agencies.