Crypto ETF Boom: $5B Firm Targets Memecoins

$5 Billion Asset Manager Files for Crypto ETFs Including Memecoins

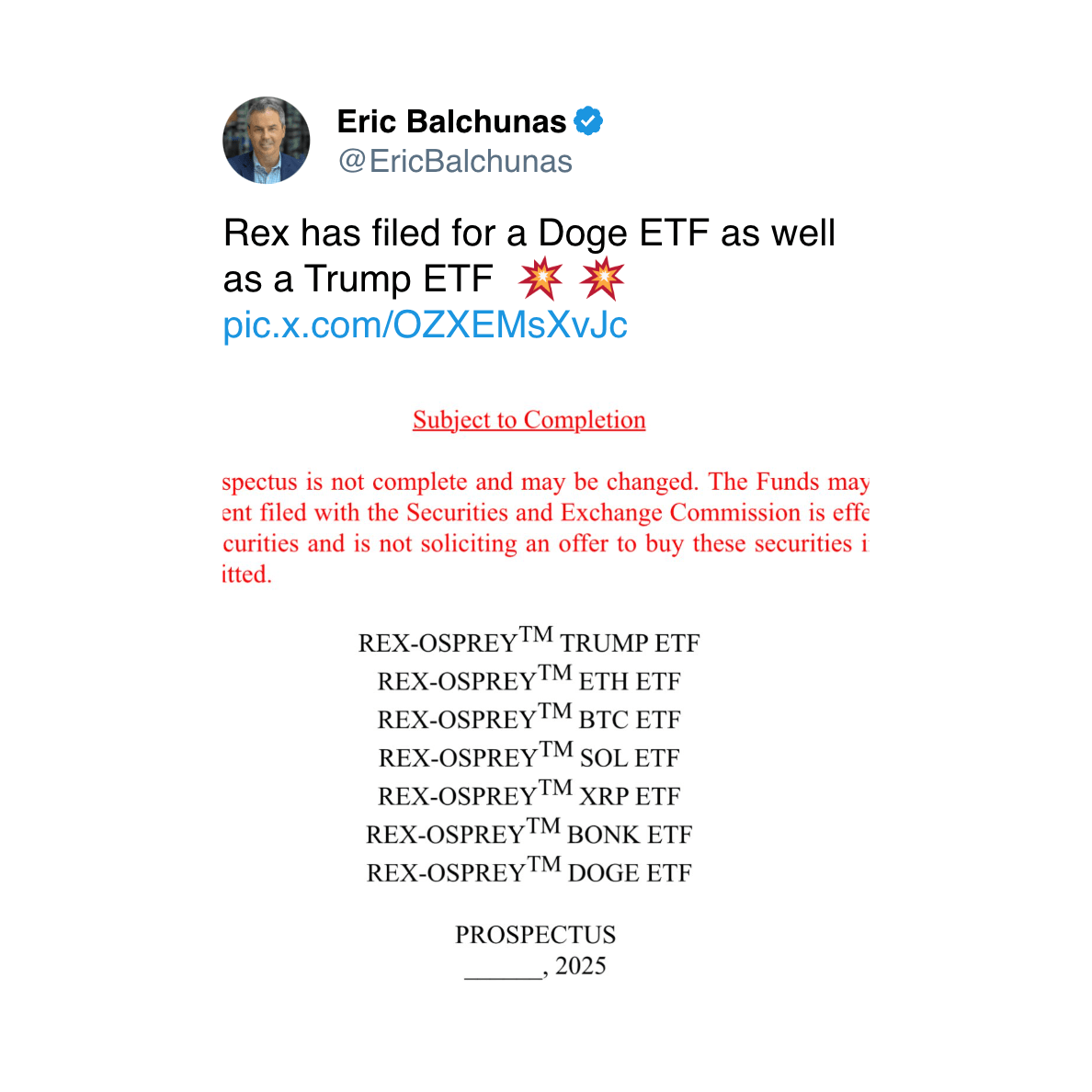

REX Shares, a Miami-based investment firm managing $5 billion in assets, has filed to list a series of cryptocurrency exchange-traded funds (ETFs). This move is significant, as it includes exposure to several prominent memecoins alongside established cryptocurrencies.

According to filings first reported by Bloomberg, the proposed ETFs would offer exposure to DOGE, BONK, and even TRUMP, Donald Trump's recently launched memecoin. The firm also seeks approval for ETFs tracking Bitcoin, Ether, Solana, and XRP.

Regulatory Shift and Implications

This filing comes amidst a notable change at the U.S. Securities and Exchange Commission (SEC). With the departure of Chair Gary Gensler and the appointment of Mark Uyeda as interim Chair—who has publicly criticized the SEC's previous approach to crypto enforcement—the regulatory landscape appears to be shifting. Uyeda and Commissioner Hester Peirce previously stated that the current regulatory environment for crypto assets is "untenable."

REX Shares has existing experience in the crypto space through its association with Osprey Funds, which managed leveraged funds for BTC, ETH, and MicroStrategy.

Codeum: Ensuring Security in the Crypto Ecosystem

As the crypto market evolves, robust security measures are crucial. Codeum provides comprehensive blockchain security solutions, including:

- Smart contract audits

- KYC verification

- Custom smart contract and DApp development

- Tokenomics and security consultation

- Partnerships with launchpads and crypto agencies

Codeum's mission is to build a safer and more secure future for the blockchain industry.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.