$46M Hyperliquid Trader Sparks Debate

$46 Million Hyperliquid Trading Profit in Two Months

A crypto trader, James Wynn, has generated significant buzz after reportedly earning over $46 million in profit within two months on the decentralized exchange (DEX) Hyperliquid. His success stems from high-leverage trades on Bitcoin and various meme coins, including PEPE, TRUMP, and Fartcoin, beginning around mid-March.

Aggressive Trading Strategy and CEX Criticism

On-chain analytics firm Lookonchain reveals Wynn employed aggressive long positions with leverage ranging from 5x to 40x. Several positions remain open, holding substantial unrealized gains. His most lucrative trade was a 10x long on PEPE, generating approximately $23.8 million in unrealized profits. Other notable trades include:

- 40x long on Bitcoin: ~$5.4 million unrealized profit

- 10x long on TRUMP token: $5.57 million profit

- 5x long on Fartcoin: $5.15 million profit

- 5x long on HYPE: ~$31,000 profit

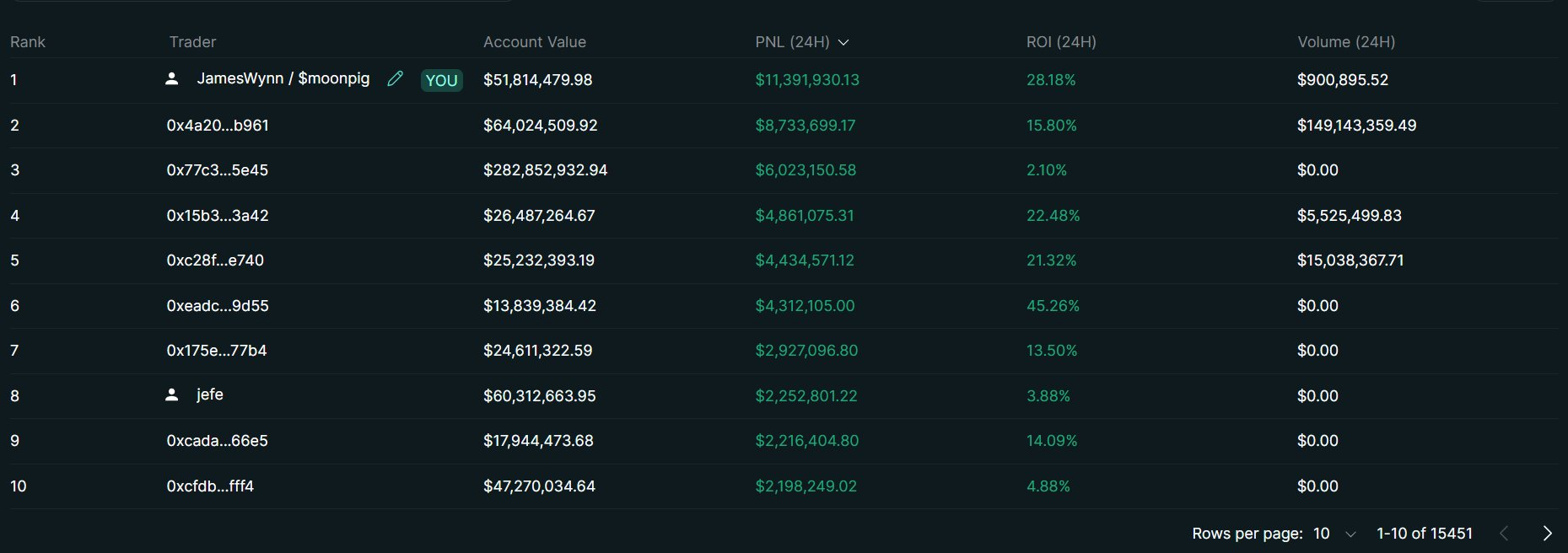

This performance propelled Wynn to the top of Hyperliquid's trader leaderboard, with a reported $11.4 million earned in the past 24 hours alone.

Hyperliquid Top Traders List. Source: X/James Wynn

Hyperliquid's Growth Amid Controversy

Beyond his profits, Wynn has become a vocal advocate for Hyperliquid and a harsh critic of centralized exchanges (CEXs). He publicly accuses platforms like Bybit of manipulating token listings for their benefit, claiming they list tokens to later dump them on retail traders. He even rejected a $1 million monthly offer to trade on Bybit, citing ethical concerns.

They want me to trade on ByBit, I won’t stop using HyperLiquid even if they offer me $1m a month. Half the reason I’m shilling my trades publicly is because I want HL to dominate the exchange market share because other exchanges are corrupted. They will list anything to dump…

Wynn contrasts this with Hyperliquid, describing it as a trustworthy platform despite recent controversy surrounding the JELLY meme coin short squeeze. Hyperliquid's decentralized nature, offering perpetual futures trading with rapid on-chain execution and full user fund control, attracts many day traders.

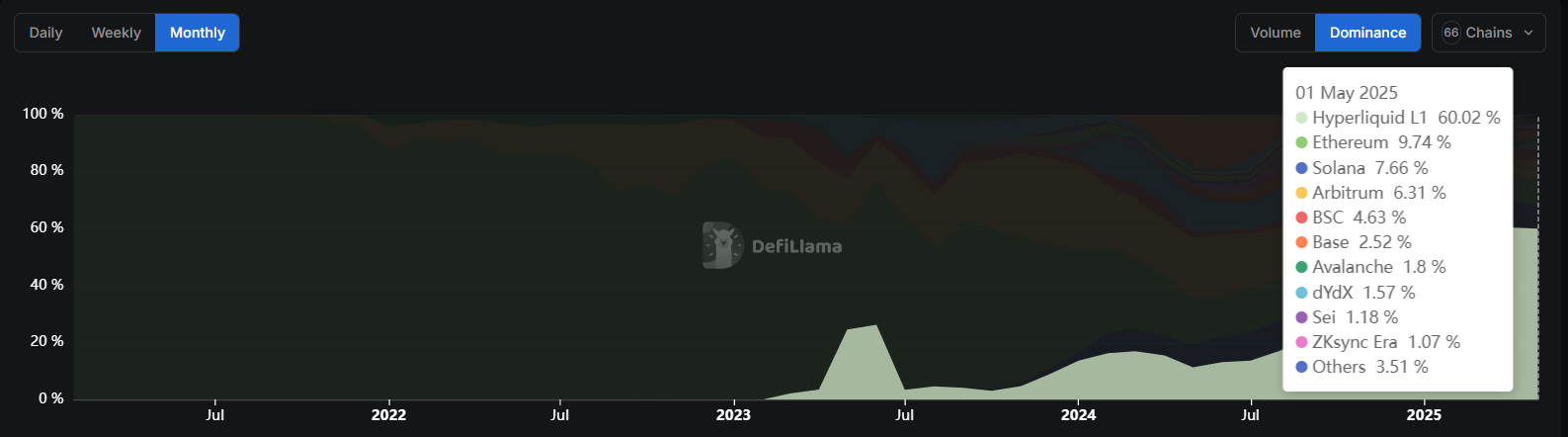

Hyperliquid Market Dominance. Source: DeFiLlama

Hyperliquid's market dominance has grown significantly, holding over 60% of the decentralized perpetual market, up from 44% at the end of 2024 (Source: DeFiLlama).

Disclaimer: BeInCrypto is committed to unbiased, transparent reporting. Readers should independently verify facts and consult a professional before making decisions based on this content. See our Terms and Conditions, Privacy Policy, and Disclaimers for more information.

Codeum provides blockchain security and development services including smart contract audits, KYC verification, custom smart contract and DApp development, tokenomics and security consultation, and partnerships with launchpads and crypto agencies.