4 Crypto to Watch After the Fed Meeting

The crypto market is closely watching Federal Reserve Chair Jerome Powell's decisions on interest rates. Continued price declines across many tokens suggest potential for further downward pressure if rate cuts aren't hinted at. This article analyzes four cryptocurrencies—BNB, PI, LEO, and SHIB—that may be particularly vulnerable.

Cryptocurrencies to Watch After Powell's Announcement

Following the Federal Reserve's March 19th policy meeting, the market awaits signals regarding future rate cuts. If Chair Powell doesn't indicate upcoming reductions, investors may want to reassess their holdings in certain crypto assets. Let's examine four such assets:

PI Network (PI)

PI Network has experienced a significant price drop, falling over 5% in the past day, trading near $1.14. This volatility is exacerbated by an upcoming token unlock event releasing approximately 129 million PI tokens (estimated value $175 million) and uncertainty around a potential Binance listing.

Binance Coin (BNB)

BNB recently dipped below its crucial support level of $650, experiencing a 3% decrease. While other major cryptocurrencies showed slight growth, BNB faces downward pressure, potentially falling to $600 if the bearish trend persists. Powell's statements on interest rates will play a key role in BNB's future price movement.

UNUS SED LEO (LEO)

LEO reached an all-time high in early March 2025 but has since declined slightly. Falling below the $9.50 support level could trigger a further drop to $9.20, potentially even below $9 in a highly bearish scenario.

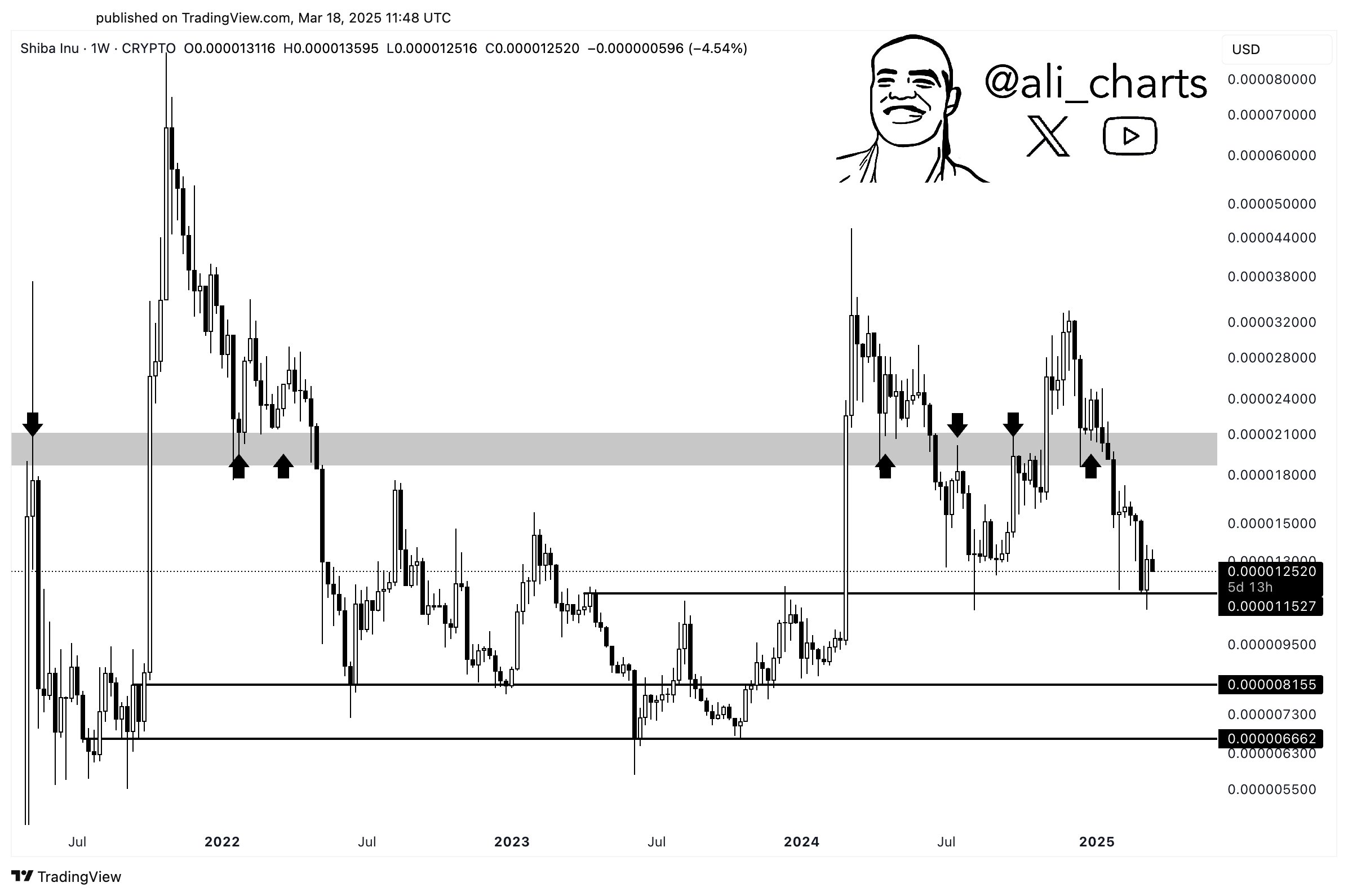

Shiba Inu (SHIB)

SHIB remains above its support level of $0.000012, but recovery is facing strong resistance. The token's recent decline and decreased burn rate (41% drop in the last 24 hours, with only 9,681,341 SHIB burned) signal a negative trend. Analysts have highlighted key support levels at $0.0000115 and $0.00000815.

Conclusion

Powell's communication regarding interest rate cuts will significantly impact market sentiment and cryptocurrency valuations. Investors should carefully consider their risk tolerance and potentially adjust their portfolios based on the Fed's announcement. Conduct thorough research before making any investment decisions.

Frequently Asked Questions (FAQs)

- How will Powell's stance on interest rates affect crypto? Powell's statements directly influence market confidence and crypto valuations.

- Which cryptos are most vulnerable? BNB, PI, LEO, and SHIB are considered relatively vulnerable in the current market.

- When will we know about potential rate cuts? The Fed may signal potential rate cuts through its economic projections.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Market conditions are dynamic, and independent research is crucial before any investment decisions. Codeum is not responsible for any financial losses.