Over $2B in Bitcoin, Ethereum Options Expire Today

Over $2 Billion in Crypto Options Expire Today

Today marks a significant day for the crypto market as over $2.09 billion in Bitcoin (BTC) and Ethereum (ETH) options expire. This follows the Federal Open Market Committee (FOMC) minutes and the recent digital asset summit, adding layers of market uncertainty. Investors are closely watching for potential price shifts.

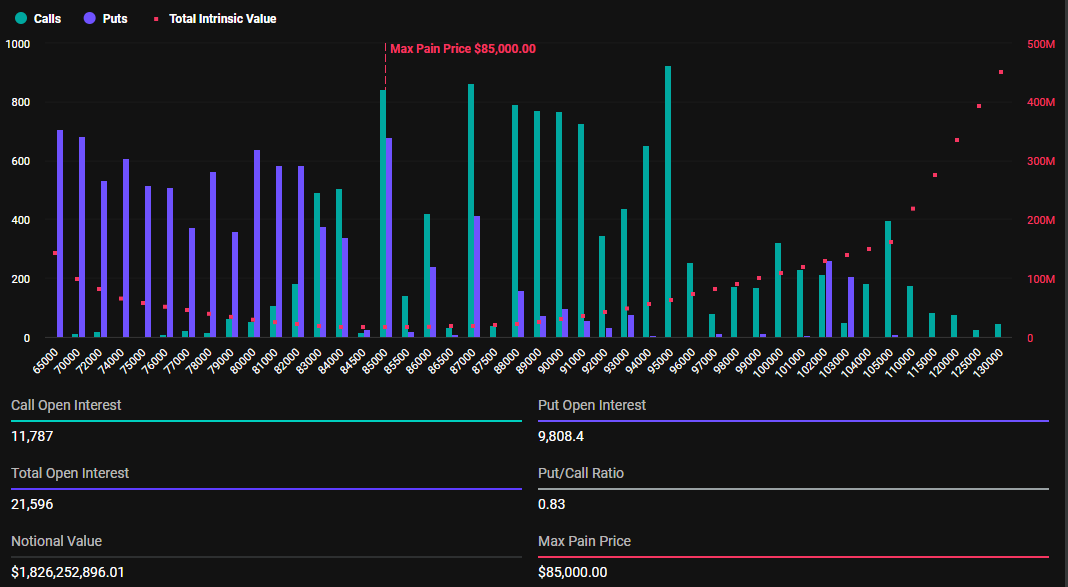

Bitcoin Options Expiry

According to Deribit, $1.826 billion in Bitcoin options are expiring, with a maximum pain point of $85,000. While the number of contracts (21,596) is slightly lower than last week, the put-to-call ratio of 0.83 suggests a generally bullish sentiment despite recent volatility.

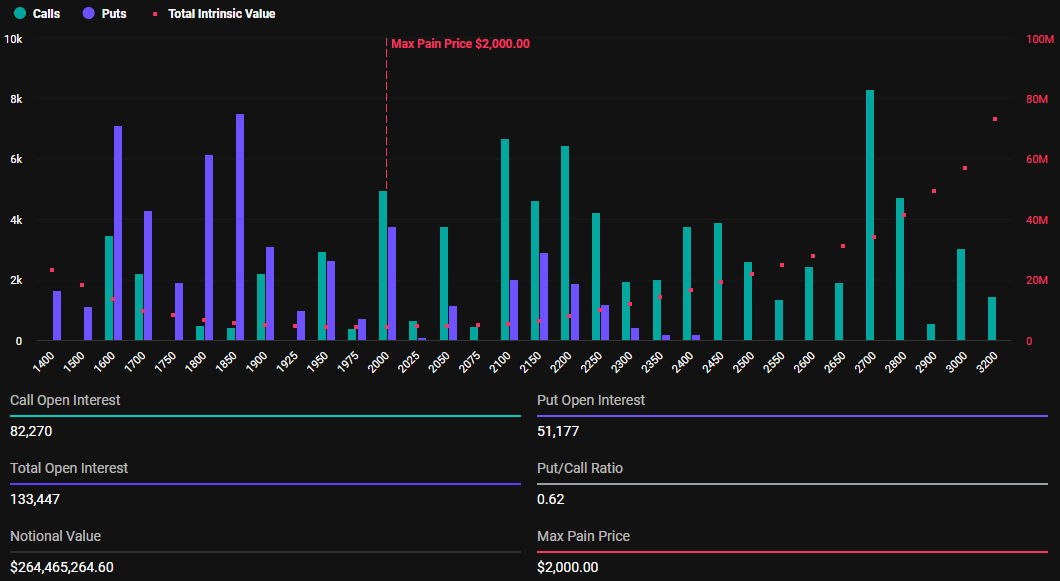

Ethereum Options Expiry

$264.46 million in Ethereum options are also expiring today, totaling 133,447 contracts (down from 223,395 last week). The maximum pain point for ETH is $2,000, and the put-to-call ratio stands at 0.62.

Market Sentiment and Price Predictions

As the options contracts near expiration, Bitcoin traded at approximately $84,414 and Ethereum at $1,977, suggesting potential movements toward their respective maximum pain points. This is in line with common options trading strategies where prices often push toward the "max pain" level.

Analyst opinions are divided. Some anticipate a price drop following the FOMC meeting's rejection of further interest rate cuts. Others predict a temporary rise before choppy conditions, with a focus on the $83,000 to $85,000 range for Bitcoin. The potential impact of President Trump's statements and MicroStrategy’s actions will also influence the market.

Bitget CEO Gracy Chen, however, remains optimistic, predicting BTC will stay above the $73,000 to $78,000 range and potentially rally to $200,000 due to the potential impact of the US strategic Bitcoin reserve.

Navigating Market Volatility

While options expirations often cause temporary price swings, the market typically stabilizes afterward. Traders and investors should remain vigilant, carefully analyzing technical indicators and market sentiment to manage potential risks. Codeum, a blockchain security and development platform, offers smart contract audits, KYC verification, and custom smart contract and DApp development to help navigate this complex landscape.

Disclaimer: This information is for educational purposes only. Always conduct your own thorough research before making any investment decisions. Consult with a financial professional if needed.