Here's how THESE factors can push AAVE's price action forward

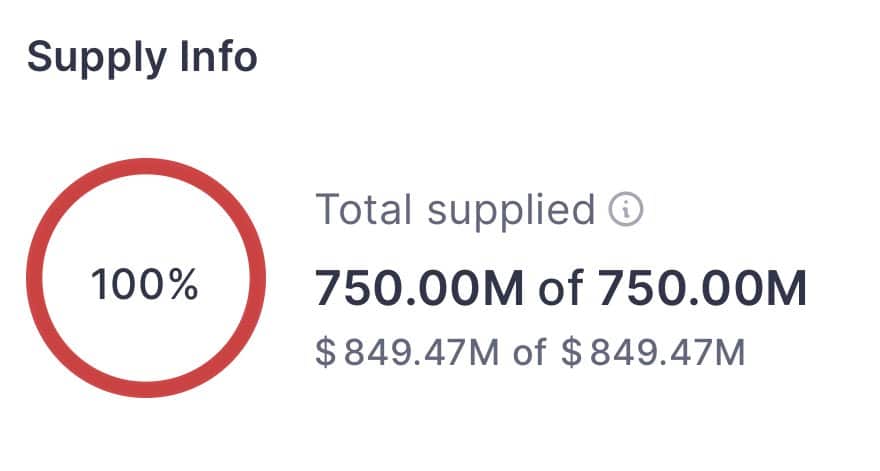

- The supply of sUSDe, a stablecoin unique to the Aave ecosystem, has been fully utilized

- At the same time, the protocol’s Total Value Locked (TVL) has reached its highest level since its inception

Despite positive developments on the Aave protocol, AAVE’s price dipped by 1.01% over the last 24 hours, contrary to expectations of extending its impressive 30.47% weekly gains.

In fact, an analysis by AMBCrypto suggested that the altcoin may see a price hike soon, one driven by rising interest and improving liquidity. These factors could position the asset for a stronger performance in upcoming sessions.

Supply cap reached – What does it mean for AAVE?

According to Macro Mate on X (formerly Twitter), the sUSDe stablecoin native to Aave has hit its market supply cap of $850 million within 24 hours.

Aave’s decision to cap the supply of its stablecoin is a strategic approach to mitigating risks and ensuring the effective utility of the asset. However, with the supply maxed out, this move has triggered a rise in borrowing costs of sUSDe due to high demand and limited availability.

Source: X

Such heightened activity is a sign of higher user engagement on the Aave protocol. This often correlates with greater demand for the token, which could positively influence its price trajectory.

AMBCrypto also noted that these developments have been affecting multiple aspects of Aave’s ecosystem.

TVL hits all-time high

Recent data from DeFiLlama revealed a sharp uptick in AAVE’s TVL, surpassing $21.55 billion – The highest level since the protocol’s inception.

This hike indicated growing investor activity within the ecosystem, including actions such as locking and staking assets.

Source: DeFiLlama

As the coin remains central to these activities, the rise in user engagement on the protocol is expected to influence its token’s price too.

AMBCrypto expects greater accumulation of AAVE by investors in the coming days, which will impact its market performance.

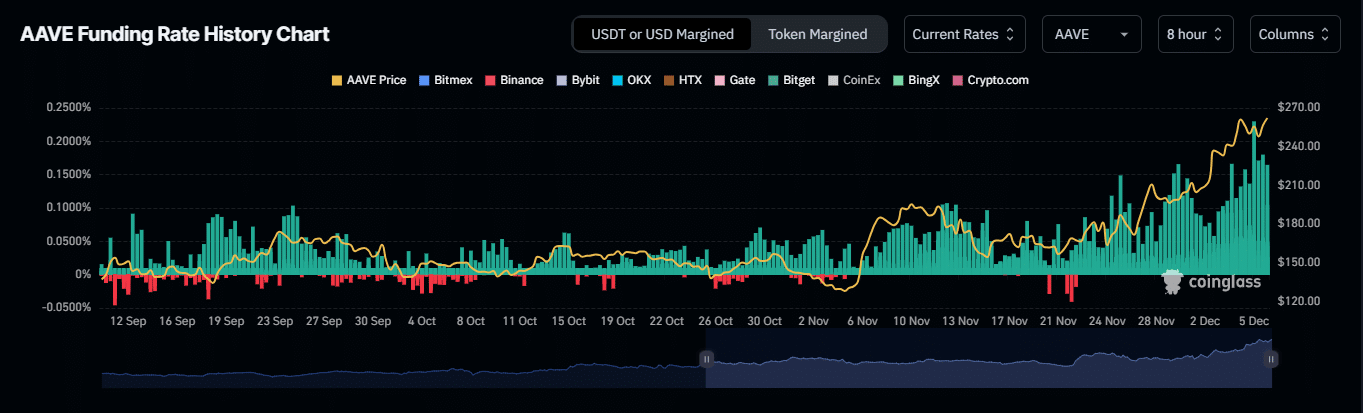

Long traders bet on AAVE as supply tightens

Finally, there has also been a notable increase in activity from derivative traders. According to Coinglass’s funding rate data, long positions are gradually dominating AAVE, with the funding rate hitting 0.0393%.

A positive funding rate means that long traders are paying periodic fees to maintain a price balance between the alt’s Spot and Futures markets. This reflects their belief that the asset’s price will climb on the charts.

Source: Coinglass

Similarly, spot traders have been displaying a bullish trend, with a significant outflow of the coin from exchanges over the last 48 hours.

Read Aave’s [AAVE] Price Prediction 2024-25

A total of $3.372 million worth of AAVE has been moved to private wallets for potential long-term holding. This movement could lead to a supply squeeze, potentially driving up the asset’s price.

If this trend continues and the available supply of AAVE falls, demand will likely increase, further supporting the asset’s price action.

Source link