Algo surges as whale activity surges

Algorand has surged by 12. 52% over the past day after a weekly decline. Algo’s bullish crossover confirms a potential trend reversal.

- ALGO has surged by 12.52% over the past 24 hours.

- Algorand’s bullish crossover amidst surging while activity signals a potential sustained uptrend.

Over the past month, Algorand [ALGO] has surged on its price charts, gaining 186%.

However, on weekly charts, the altcoin experienced a market correction, hitting a low of $0.35. Consequently, the altcoin has declined by 4.26% on weekly charts after this pullback.

Moreover, the last 24 hours have seen a significant recovery, signaling a trend reversal. As of this writing, Algorand was trading at $0.46, marking a 12.52% increase over the past day.

The recent market conditions raise questions about whether Algorand is on the verge of a trend reversal.

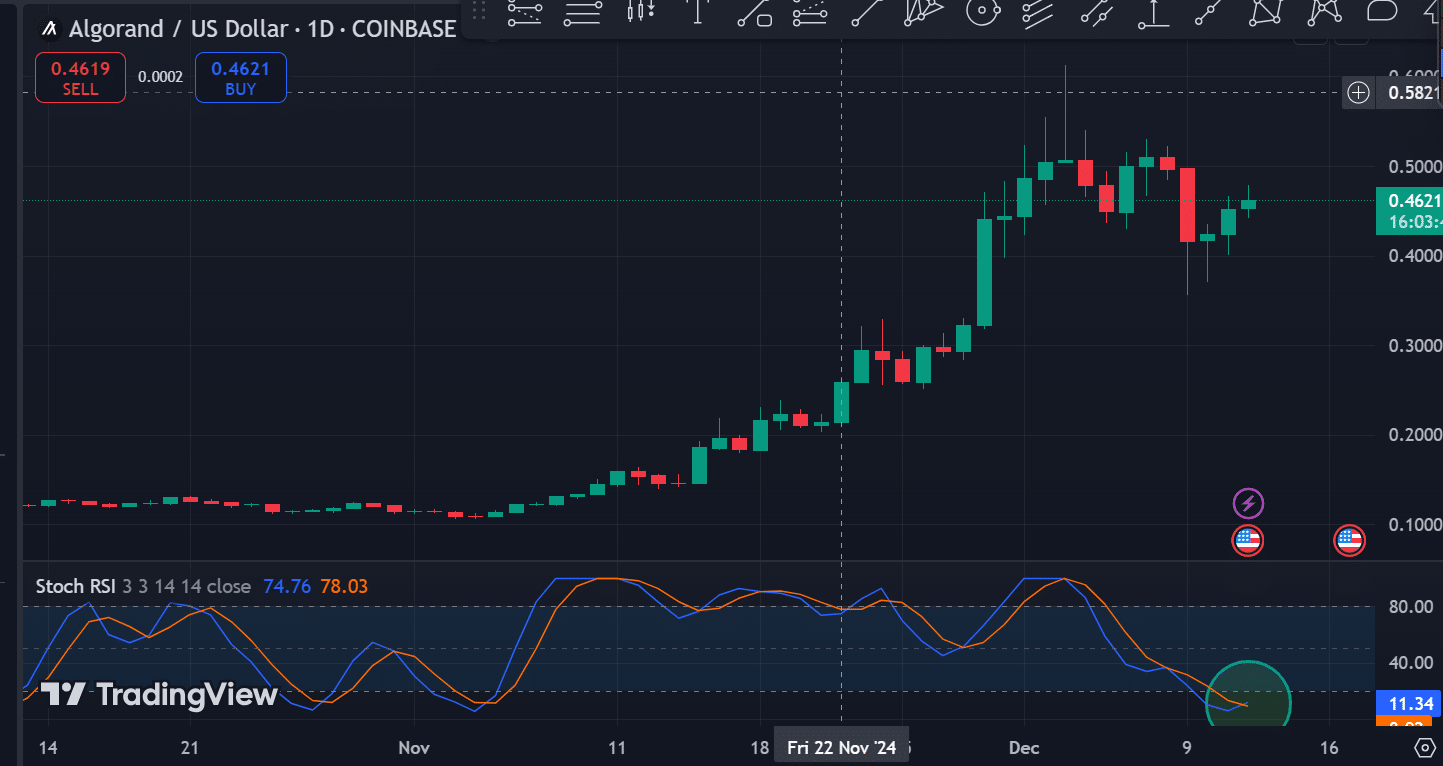

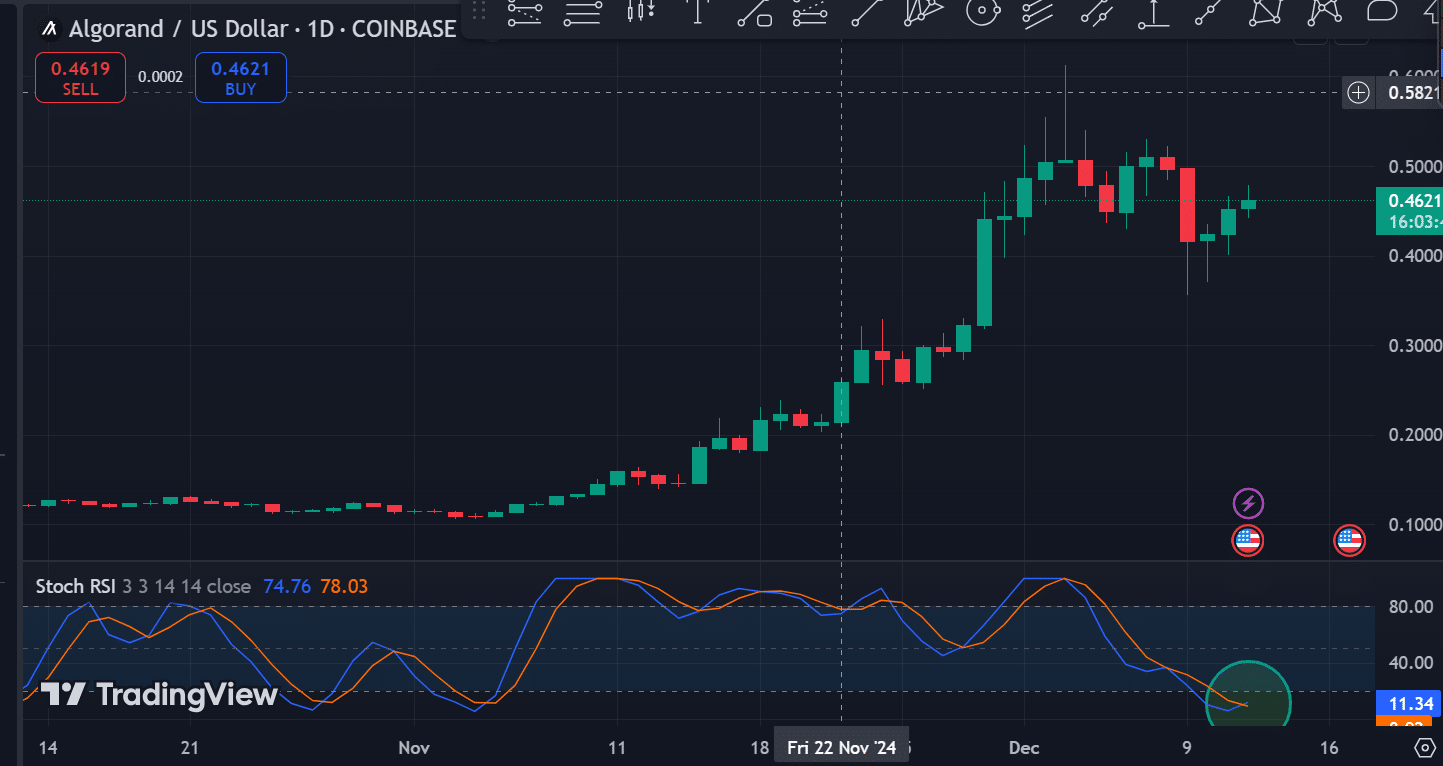

Source: TradingView

This upward momentum and bullishness are now confirmed by a bullish crossover. As such, ALGO has made a crossover on Stoch RSI after declining over the past ten days.

This crossover signals that buyers are entering the market with sellers losing momentum. Therefore, the downward momentum is dwindling.

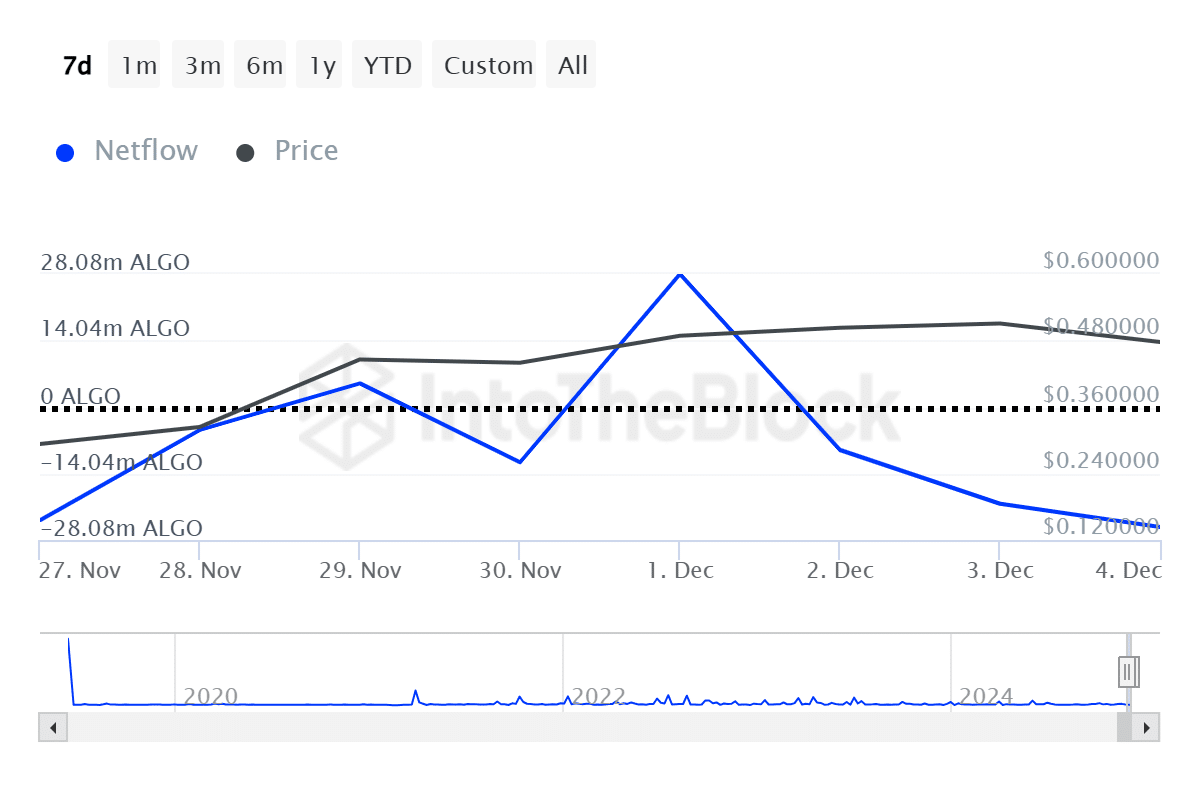

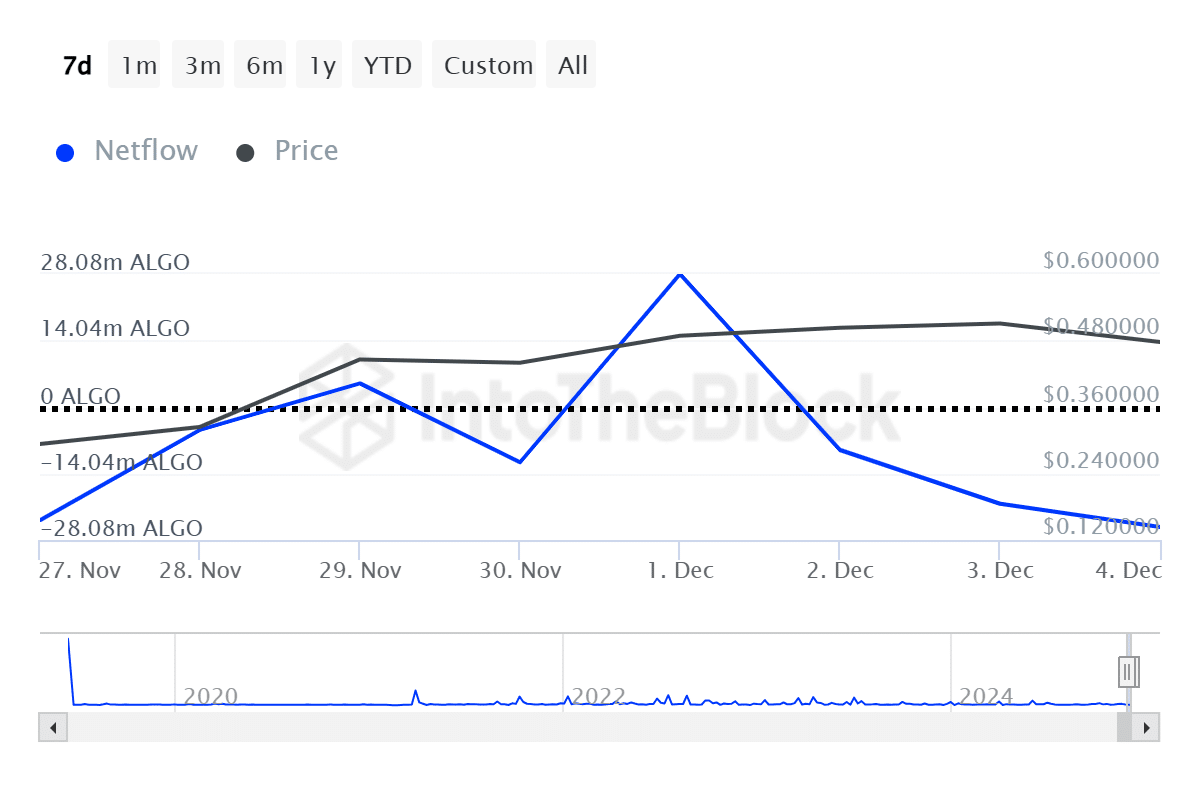

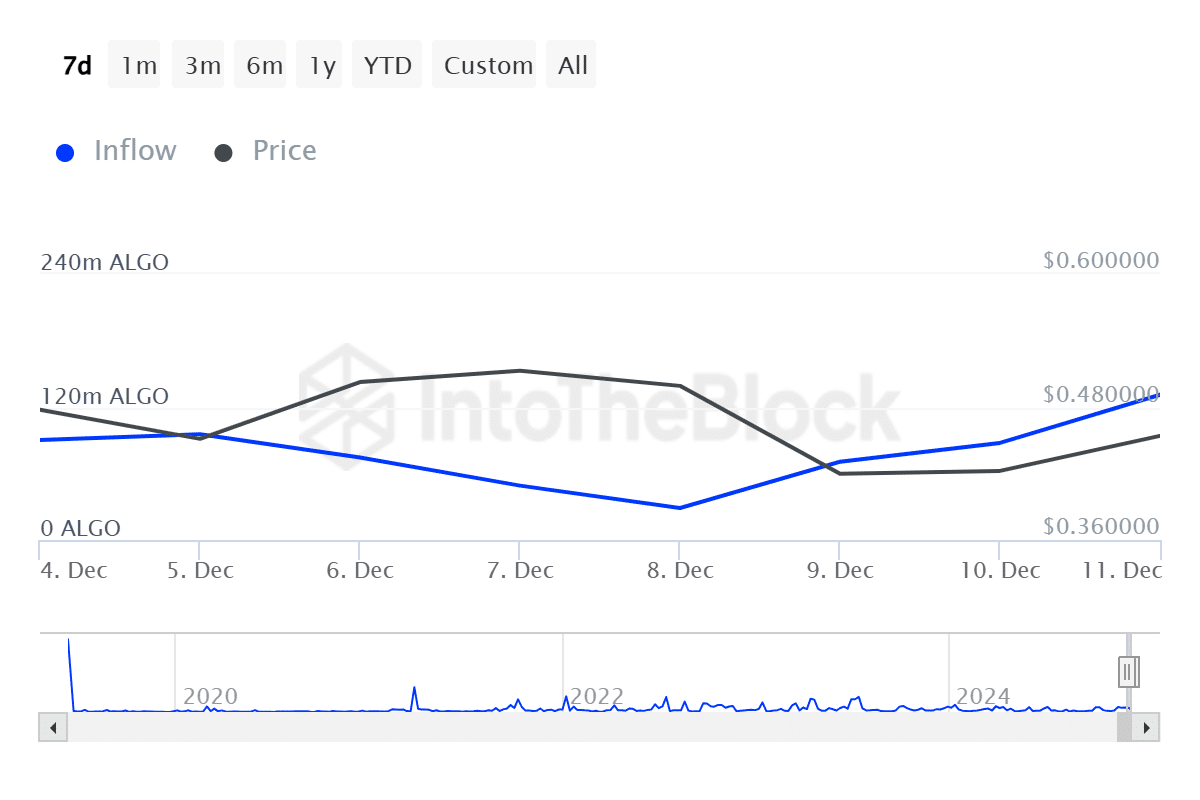

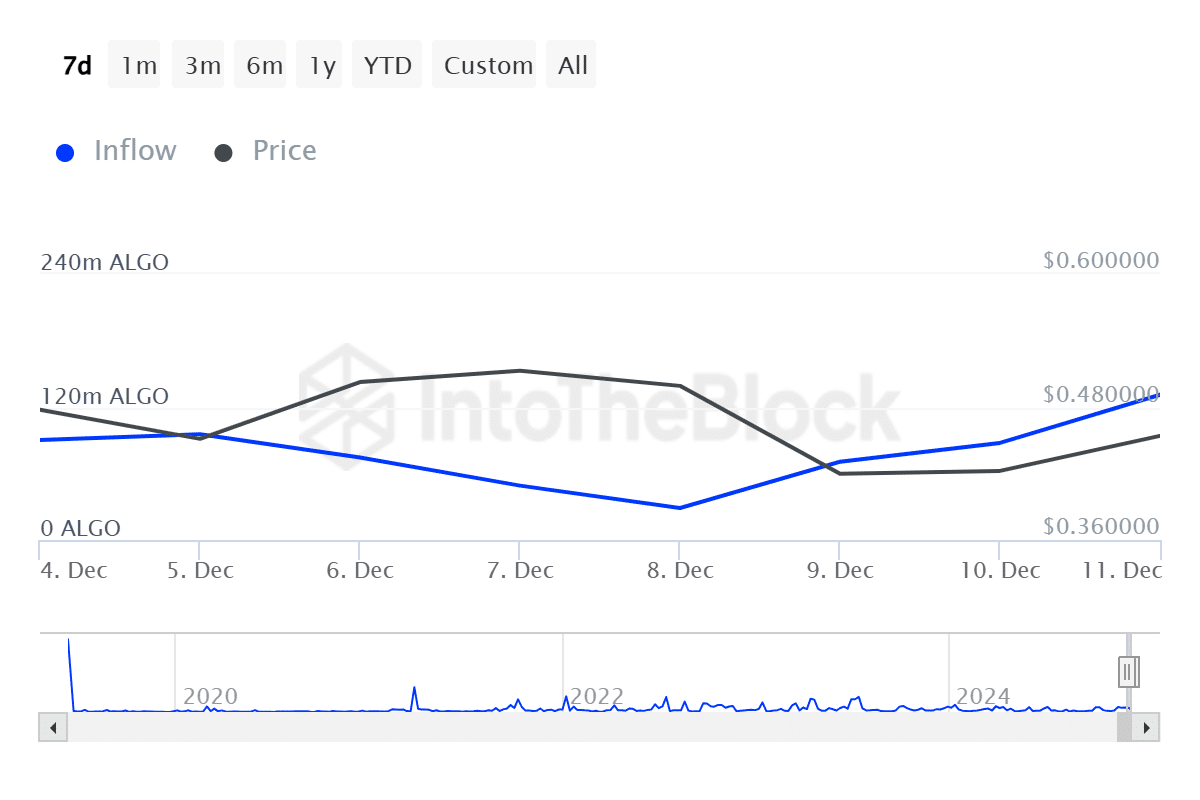

Source: IntoTheBlock

Additionally, Algorand has seen massive whale activity over the past day. As such, large transactions have spiked by 62.22% from 180 to 292.

An increase in whale activity implies that large holders are actively engaged with the network. Accompanied by rising buying pressure, these whale activities suggest a rise in large holders accumulating the altcoin.

Source: IntoTheBlock

We can further see this increased buying pressure among whales has large holders inflow has spiked by 49.67% to $131.06 million over the past day. This implies that ALGO whales are increasingly pumping funds into the altcoin.

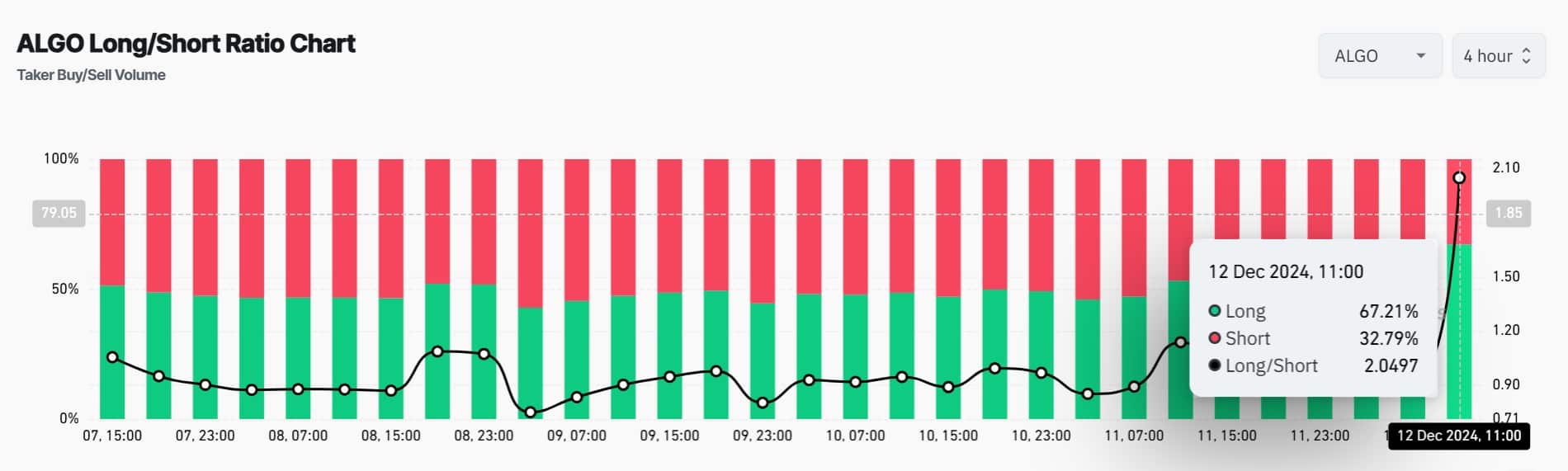

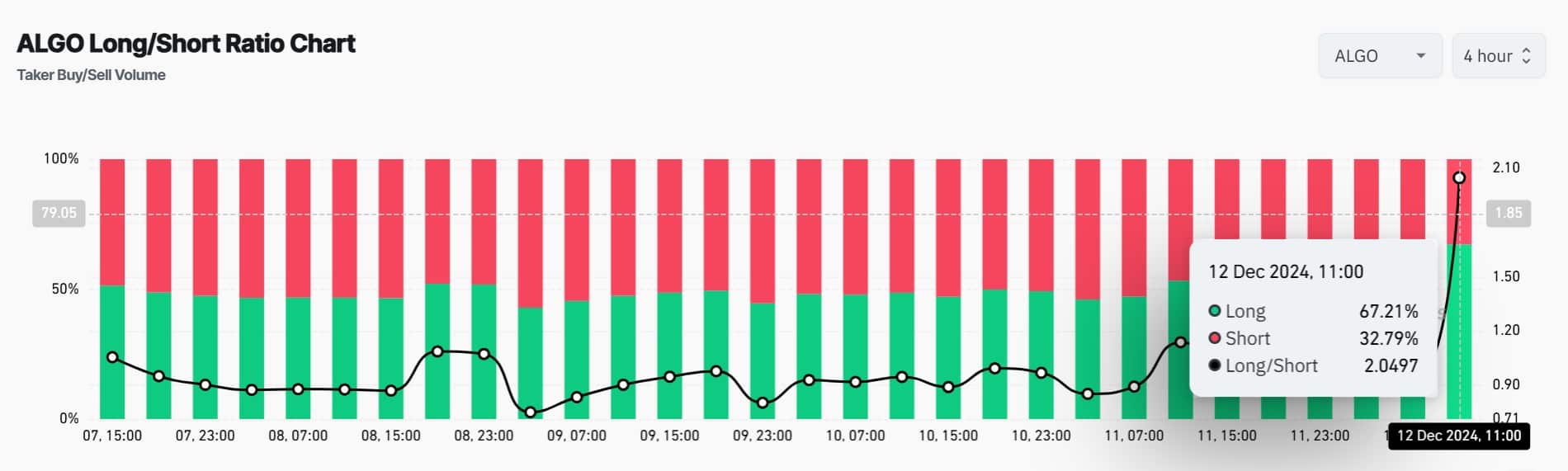

Source: Coinglass

Equally, these investors are taking long positions, especially on 4-hour timeframes. Accordingly, the Long/Short Ratio shows longs are dominating with 67.21% of the total.

When longs are dominating the market, it implies that most investors are bullish and point towards overall market demand for long positions.

Source: Santiment

This demand for long positions is further evidenced by a positive DyDx funding rate. When this is positive, it implies that even when markets are seeing a downturn, investors are willing to pay a premium and hold their positions.

Such market behavior reflects bullish sentiment among long-term holders.

What’s next?

Simply put, Algorand seems to be recovering from its recent decline. This trend reversal is confirmed by a bullish crossover witnessed over the past day.

Is your portfolio green? Check out the ALGO Profit Calculator

Therefore, if the current market sentiment holds, ALGO will attempt a $0.52 resistance level. A breakout from this level will see Algo hit $0.6.

Subsequently, if the bears retake the market, ALGO will decline to $0.40.

Source link