Crypto Wallet vs Exchange: What is The Difference?

In this article, you’ll learn about the major differences between crypto wallets and exchanges. We will discuss each entity in detail and understand the pros and cons of each platform. By the end, you will have the knowledge and resources to make an informed decision about the platform that best fits your current needs.

What Is a Crypto Exchange?

A crypto exchange is a digital marketplace where traders can buy and sell cryptocurrencies using either fiat currencies or other digital assets. Exchanges provide different types of order books, allowing buyers to place orders at specific prices while sellers can place orders to match available buyers. Some exchanges allow users to trade directly with each other, while others use third-party brokers to facilitate trades.

Crypto exchanges are typically open 24/7, providing access to trading opportunities around the world. For traders who want to get started with digital currencies, crypto exchanges offer a straightforward way to purchase cryptocurrencies and become active traders in no time.

Exchanges may provide various payment methods such as bank transfers, credit cards, and digital wallets. Some exchanges may also offer additional features such as margin trading, derivatives trading, futures contracts and more.

How Do Crypto Exchanges Work?

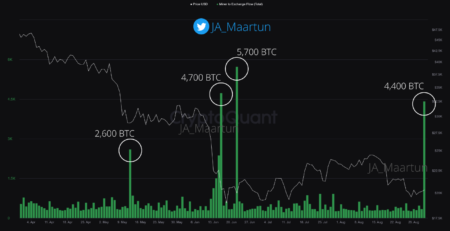

Let’s say you want to purchase Bitcoin (BTC). You can do this by visiting a crypto exchange and sending your fiat currency (e.g. USD) to the exchange in order to buy BTC at the current rate. The exchange will then take your funds and generate a digital wallet for you, where your purchased cryptocurrency will be stored.

Once your digital wallet is created, you can withdraw the funds directly from the exchange to your personal wallet. You can also store your cryptocurrency on the exchange for an extended period of time and use it to trade with other users.

The way exchanges work is similar to that of a traditional stock exchange. Buyers and sellers put their orders in the order book, which is then matched by the exchange based on price and other conditions. The exchange takes a small fee for every trade made through its platform. Once the orders are matched, the exchange fulfills the trades and sends out the respective funds to each user’s digital wallet.

The biggest difference between an exchange and a traditional stock exchange is that a crypto exchange doesn’t require any type of regulation or approval from financial authorities. This allows users to freely trade without having to worry about compliance with laws and regulations.

Exchanges Usage and Risks

Trading on an exchange is generally not recommended for beginners, as the complexity of the process can be confusing. Additionally, there are certain risks involved with using exchanges, including:

Security Risks: Exchanges can be vulnerable to hacks and security breaches, resulting in the loss of funds. It is important to use a reputable exchange that has quality security protocols in place.

Price Manipulation: Some exchanges may be subject to price manipulation from traders or other malicious actors. It is important to monitor prices closely and ensure that the exchange is not being manipulated to benefit any one party.

Counterparty Risk: Crypto exchanges may be subject to counterparty risk, meaning that if a customer defaults on their payments or withdraws funds, the exchange is at risk of losing money. Privacy Risks: Some exchanges may not have robust privacy protocols in place, which can result in users’ personal information being exposed. This is why it is important to only use exchanges that have strong privacy policies and procedures in place.

What Is a Crypto Wallet?

Before we dive into crypto exchange vs. wallet, it is important to understand what a crypto wallet is. A crypto wallet is basically a bank account for digital assets. It is a secure storage system that stores public and private keys, which are used to send and receive cryptocurrencies.

Crypto wallets come in many different forms, including desktop wallets, mobile wallets, hardware wallets, and web wallets. Desktop and mobile wallets are software-based and can be downloaded on a computer or smartphone. Hardware wallets resemble USB flash drives and are designed to store digital assets offline. Web wallets are online accounts hosted by third-party providers that allow users to store their cryptocurrencies.

Hardware wallets are considered the most secure option, as private keys are never exposed to third-party networks. They are typically more expensive than other wallets, but they offer added security against hackers.

How Do Crypto Wallets Work?

To understand exchange vs wallet, you need to know how crypto wallets work. Crypto wallets store private and public keys that are used to receive and send cryptocurrencies, respectively. Private and public keys act like digital signatures—they identify the user’s identity on the blockchain network.

When sending a cryptocurrency, users must enter their recipient’s address and the amount they want. The transaction is then broadcasted to a network of miners who validate the transaction and add it to the blockchain. After the transaction is validated, the cryptocurrency can be sent to its recipient’s wallet address.

The way you interact with crypto wallets will depend on the wallet type you are using. For example, desktop and mobile wallets typically require users to download a software application to access their wallets. Hardware wallets need to be plugged into a computer or smartphone to use them. Web wallets have an online interface that allows users to log in and manage their cryptocurrencies.

Crypto Wallet Usage and Risks

Using a crypto wallet is relatively simple, but there are several risks to be aware of. They include:

- Phishing attacks: Hackers can use malicious websites, emails, and messages to try and access private keys. These attacks are difficult to prevent, so users should always be cautious when navigating online.

- Permanent loss of funds: Cryptocurrencies can be lost if a user’s private key is stolen or forgotten. There is no central authority that can help with the recovery process, so it is important for users to take proactive measures to protect their wallets. This includes setting up two-factor authentication and strong passwords.

- Security breaches: Wallets can be vulnerable to malicious actors if not properly secured. This means users should use only trusted wallets and always keep their software updated with the latest security patches. The best way to protect against these attacks is to use a hardware wallet.

- Flash crashes: Flash crashes occur when the price of a cryptocurrency suddenly drops to nearly zero. This can be caused by market manipulation or inaccurate pricing information. To protect against this, users should always double-check the price before making any trades.

- Hacks: Cryptocurrency exchanges have been the target of several high-profile hacks. These incidents can lead to significant losses, so users should always be vigilant when using exchanges.

- Fraud: Crypto exchanges can sometimes be the target of fraudsters. Users should always verify the authenticity of an exchange before making any transactions.

To mitigate these risks, there are a few tips users should keep in mind when using crypto wallets:

- Choose a reputable wallet: There are many wallets available, so it is important to do your research and choose one that is reputable.

- Avoid storing large amounts of funds in one wallet: To minimize losses, users should spread their funds across multiple wallets. You can have a small number of funds in your main wallet and the rest stored in cold or hardware wallets.

- Keep your private keys secure: Securing your private keys is essential to protect your funds. Consider setting up two-factor authentication and using a password manager to keep your passwords safe.

- Set up two-factor authentication: This will help protect against unauthorized access to your wallet. Also, consider using a hardware wallet for extra security.

Crypto Wallets vs Exchange

Now that we have looked at each type of crypto wallet, it’s time to delve into the differences and similarities between them and cryptocurrency exchanges.

But first, let’s do a recap. Crypto Wallets are simply digital storage spaces for your digital currency, like a virtual safe or bank vault. They provide you with the ability to store, transact, and even trade in cryptocurrencies. In contrast, an exchange is more of a marketplace where people can buy and sell cryptocurrencies from one another.

Crypto Wallet vs Exchange: Similarities

Crypto wallets and exchanges both allow you to store, purchase, and sell cryptocurrencies. How is this possible? Well, most exchanges have built-in wallets which allow you to store your cryptocurrency. This means that it is possible to use an exchange as both a wallet and an exchange.

There are also wallets, such as Tezro, that have integrated exchanges. This allows you to buy and sell cryptocurrencies directly from your wallet without having to switch between wallets and exchanges.

They are both connected to the blockchain network and provide users with access to their funds. The blockchain network is simply a digital ledger that records all of the transactions and data associated with cryptocurrencies. When you make a transaction, the blockchain is what verifies it and records it in its database.

By being connected to the blockchain network, wallets and exchanges are able to securely store your cryptocurrency and allow you to access it whenever you need it.

Both exchanges and wallets help people easily interact with the crypto ecosystem. They provide users with the tools and resources necessary to buy, sell, store, and transact in cryptocurrencies.

Crypto Wallet vs Exchange: Differences

What is the difference between a crypto wallet and an exchange? There are several key differences between crypto wallets and exchanges. They include:

Privacy

Wallets are generally more private than exchanges. Exchanges require users to provide a lot of personal information, such as name, address, and bank account details. Wallets offer different levels of privacy, depending on the type you use. Most of them are pseudonymous, meaning that you do not need to provide any personal information in order to use them.

Level Of Control

With wallets, you have complete control over your funds. The best wallets are non-custodial, meaning that no one else, not even the wallet provider, has access to your funds. With exchanges, this is generally not the case. Most exchanges have the ability to freeze or even confiscate user funds if they believe that the transaction is suspicious.

User Interface

Wallets typically have a much simpler and friendlier user interface than exchanges. Exchanges often require users to navigate complex menus and fill out forms in order to make trades, while wallets usually only require a few clicks of the mouse. This makes wallets a much more user-friendly option for those who are new to the crypto world.

Crypto Wallet vs Exchanges: Advantages

There are many advantages of using both crypto wallets and exchanges, depending on your individual needs. They offer a great deal of flexibility and convenience, allowing users to store and trade their digital currency.

Additionally, they both offer a variety of security measures to protect users’ funds.

By using these services, users can easily conduct transactions with others worldwide and have control over their own funds.

They also provide users with access to a wide variety of digital currencies, as well as the ability to convert funds into fiat currency or other cryptos.

Frequently Asked Questions

Which Type of Crypto Wallet is Considered the Safest?

Hardware wallets provide users with the highest level of security and are considered to be one of the safest types of crypto wallets. This type of wallet is stored on a physical device and is not connected to the internet, making it almost impossible for hackers to gain access. Additionally, hardware wallets often allow users to have multiple layers of security such as passwords or PIN numbers.

Is it Safer to Keep Your Crypto in a Wallet or an Exchange?

Generally speaking, it is safer to keep your crypto in a wallet rather than an exchange. Exchanges are vulnerable to hacks and other malicious activities, while wallets provide users with more control over their funds. Additionally, many wallets offer additional security measures such as two-factor authentication or multi-signature validation, which further protect users’ funds.

What Happens When You Move Crypto From an Exchange to a Wallet?

When you move crypto from an exchange to a wallet, your funds will be transferred from the exchange’s address to your wallet. This process can take anywhere from a few minutes to several hours depending on the type of crypto being moved and the network traffic on the blockchain. Once the funds have been successfully transferred, they will show up in your wallet balance and you will be able to access them.

Leave a Reply