Why BNB is in the running for the best-performing cryptos in 2023

- BNB has managed to outperform some of the top cryptocurrencies in terms of its ability to hold value.

- The robust utility of the BSC contributed greatly to sustaining BNB’s demand.

BNB has performed better than Bitcoin (BTC) and Ethereum (ETH) in terms of price performance during the bear market. It was drawn down by 61% from its ATH at its latest price level.

Meanwhile, both BTC and ETH were drawn down by over 77%. BNB will likely retain its position among the top coins in 2023 and here’s why.

Read BNB price prediction for 2023-2024

A recent AMA titled, “The Anatomy of BNB Smart Chain Performance” reveals some interesting bits about the BNB smart chain. The beginning of the AMA highlights the fast-paced growth that the network has achieved. This includes outperforming Ethereum in terms of transactions per second.

BNB Chain x Nodereal: The Anatomy of BNB Smart Chain Performance

— BNB Chain (@BNBCHAIN) November 22, 2022

The Nodereal correspondent revealed that the BNB smart chain is currently capable of 1,000 TPS. However, the blockchain network plans to increase the transaction throughput to 5,000 TPS in the near future.

This move will allow the network to adapt to the BSC’s rapid adoption while boosting its efficiency in terms of transaction capacity. In addition, the robust BSC ecosystem and rapid adoption may boost the demand for BNB in the long term, thus contributing to its value.

The link between BSC’s performance and BNB’s value

As noted earlier, BNB has managed to outperform some of the top cryptocurrencies in terms of its ability to hold value. This can be attributed to the fact that it is BSC’s native cryptocurrency and the network managed to achieve high levels of utility.

This is mainly because of the widescale adoption of the BSC’s wide range of offerings. It includes the Binance exchange which has held the top spot in terms of volume for quite some time.

Furthermore, the robust utility of the BSC contributed greatly to sustaining BNB’s demand. This allowed the BNB to avoid losing too much value as the bearish conditions dampened investors’ sentiment.

Despite this, BNB’s short-term value took a hit in the last two weeks. Nevertheless, its $273 price tag at press time represented a 9% recovery in the last two days.

Source: TradingView

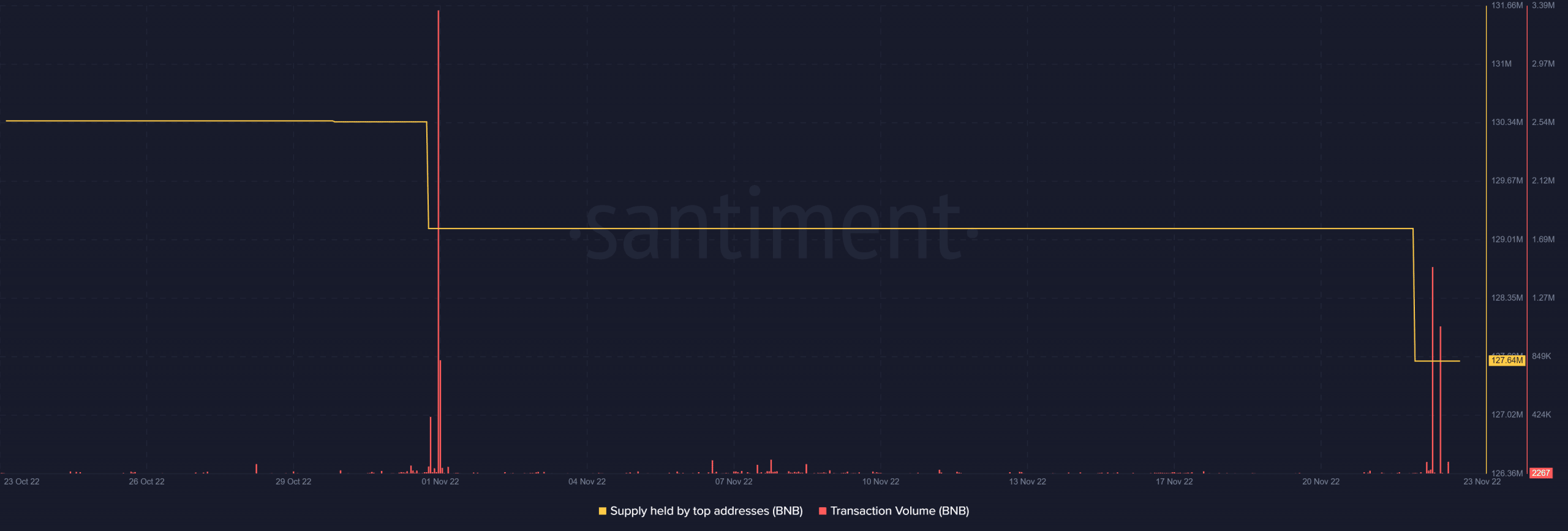

The slight recovery was accompanied by a significant uptick in transaction volume. While this is due to the return of some buying pressure in the market, the supply held by top addresses registered a sizable drop in the last 24 hours.

Source: Santiment

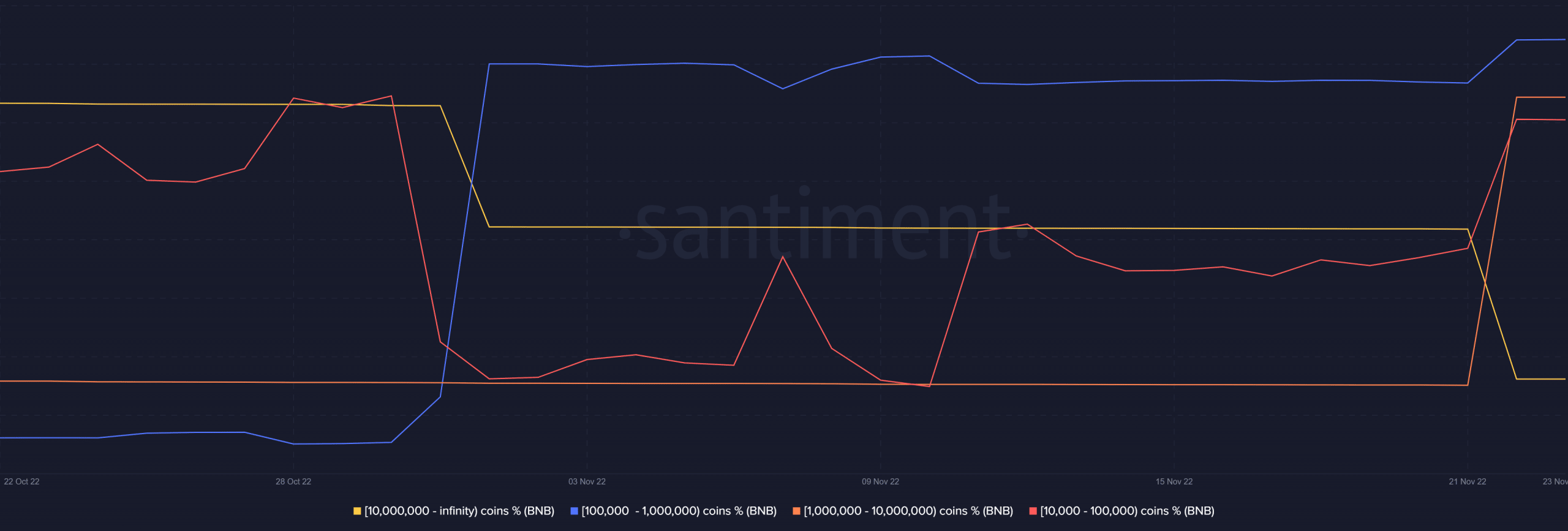

A look at BNB’s supply distribution confirms the observation with the top addresses metric. Addresses holding more than 10 million coins reduced their balances by a substantial margin in the last 24 hours, thus contributing to some selling pressure.

Source: Santiment

The obvious expectation when the largest whales are selling would be more downside. However, the subsequent sell pressure was absorbed by buying pressure from top addresses holding between 10,000 and 10 million BNB coins.

Leave a Reply