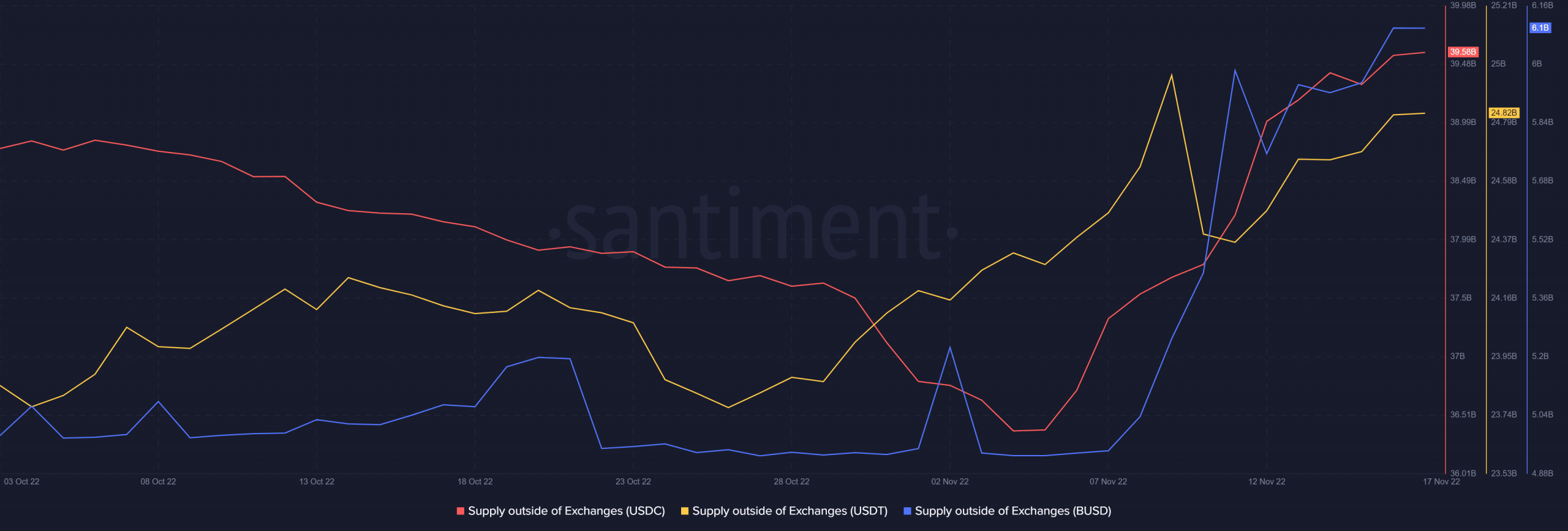

USDC, USDT, BUSD supply outside of exchange spikes, but is this a good sign?

- The outflow of stablecoins from exchanges has been on the rise in the wake of the FTX saga.

- Users appear to be taking custody of their assets, which might have a negative effect on exchanges if it persists.

In recent memory, no calendar year has been harder for the cryptocurrency industry than this one. The Terra catastrophe in 2022 had far-reaching repercussions that are still being felt today.

The FTX crash was another huge event that sent shockwaves through the cryptocurrency industry, and its consequences are still being felt today. According to the most recent data from Santiment, it appears that users of cryptocurrencies are increasingly taking matters into their own hands, as Stablecoin outflow is on the rise.

Self-custody

Leaders in the business shared their perspectives on how to go forward in the wake of the FTX crash. For the time being, exchanges appear to be a weak point, thus Dan Held, Michael Saylor, and Changpeng Zhao (CZ) urged cryptocurrency owners to self-custody.

Users, in their view, are completely at the mercy of the exchange once they deposit their assets there and are vulnerable to any problems that may arise. This rallying cry from these industry heavyweights was apparently heard and acted upon by stablecoin holders.

Stablecoin holders take self-custody hint

Holders of stablecoins appeared to have increased withdrawals from exchanges, according to statistics from Santiment. The Supply Outside of Exchanges metrics indicated that USDC, BUSD, and USDT have experienced significant exchange outflow in recent days. The outflow for USDC was $39.58 billion, for USDT it was $24.82 billion, and for BUSD it was $6.1 billion, at the time of writing.

Source: Santiment

There may be a connection between recent happenings in the cryptocurrency space and the increase in the outflow. Circle recently reported in a filing that the USDC had been impacted as a result of U.S. interest rate hikes.

This according to them had led to increased withdrawals. This change applies not just to USDC but also to other major stablecoins. Some customers have also been prompted to withdraw their stablecoins from exchanges as a result of the recent FTX crash.

Liquidity fear might bring illiquidity

An increase in withdrawals may indicate that exchanges are losing liquidity. This means that there will soon be a severe shortage of tradable assets on the market as more and more consumers pull their funds out of the various exchanges.

This will induce illiquidity because of the panic that follows expectations of it. We may see the cryptocurrency equivalent of a bank run if confidence in these marketplaces continues to erode and users continue to withdraw their funds.

Leave a Reply