ApeCoin revealed its stance on the FTX episode, but will it do any good?

- ApeCoin’s treasury is held in segregated custody accounts via Coinbase Custody.

- Several influencers sold their APE holdings before the price plummeted.

In the latest tweet, ApeCoin [APE] revealed its status regarding the FTX episode. Reportedly, the Ape Foundation does not hold any assets on FTX. The treasury has been held in segregated custody accounts via Coinbase Custody.

Ape Fam, we want to reassure the community with some information in light of the recent events in the blockchain ecosystem. The Ape Foundation did not, and does not currently, hold any assets on FTX. The treasury is held in segregated custody accounts via Coinbase Custody. (1/5)

— ApeCoin (@apecoin) November 14, 2022

Furthermore, ApeCoin highlighted the importance of segregated custody. According to the ApeCoin team, when functioning at an institutional level, segregated custody is not only customary procedure, but it also significantly lowers key risks, especially when a sizable treasury is involved.

Read ApeCoin’s [APE] Price Prediction 2023-24

This may have caused the fall

The FTX episode affected the entire crypto market, and APE was no exception. The altcoin registered a 32% decline in its price over the last week. The price touched a crucial mark at $2.65, thus giving chills to the investors.

Interestingly, it was found out that several influencers sold their APE holdings before the price crash.

ApeCoin ( $APE) dropped 49% from $5.2 to $2.65 under the influence of #FTX/#Alameda.

We found that influencers sold $APE before the price crashed.

1.🧵

I will share them with you.👇 pic.twitter.com/nXGzGJ497V— Lookonchain (@lookonchain) November 14, 2022

For instance, j1mmy.eth, the founder of Avastars NFT, received an airdrop of 809,500 APE ($6.9 million at the time) and hosted all the APE to address “0x39b5.” Later, on 7 and 9 November, he sold 638,000 APE ($2.3 million) at $3.61.

Surprisingly, at the time of writing, APE showed a few signs of recovery as its price went up by over 4% in the last 24 hours and was trading at $2.91 with a market capitalization of more than $2.91 million.

Can this help?

Not only did APE’s price go up, but the whales also showed interest in the token. APE was one of the top 10 purchased tokens among the top 500 ETH whales. This was a piece of good news as it showed the confidence of whales in the alt.

JUST IN: $BIT @BitDAO_Official now on top 10 purchased tokens among 500 biggest #ETH whales in the last 24hrs 🐳

We’ve also got $APE, $UNI & #FTX Token on the list 👀

Whale leaderboard: https://t.co/tgYTpODGo0#BIT #whalestats #babywhale #BBW pic.twitter.com/fjhki8tRsL

— WhaleStats (tracking crypto whales) (@WhaleStats) November 14, 2022

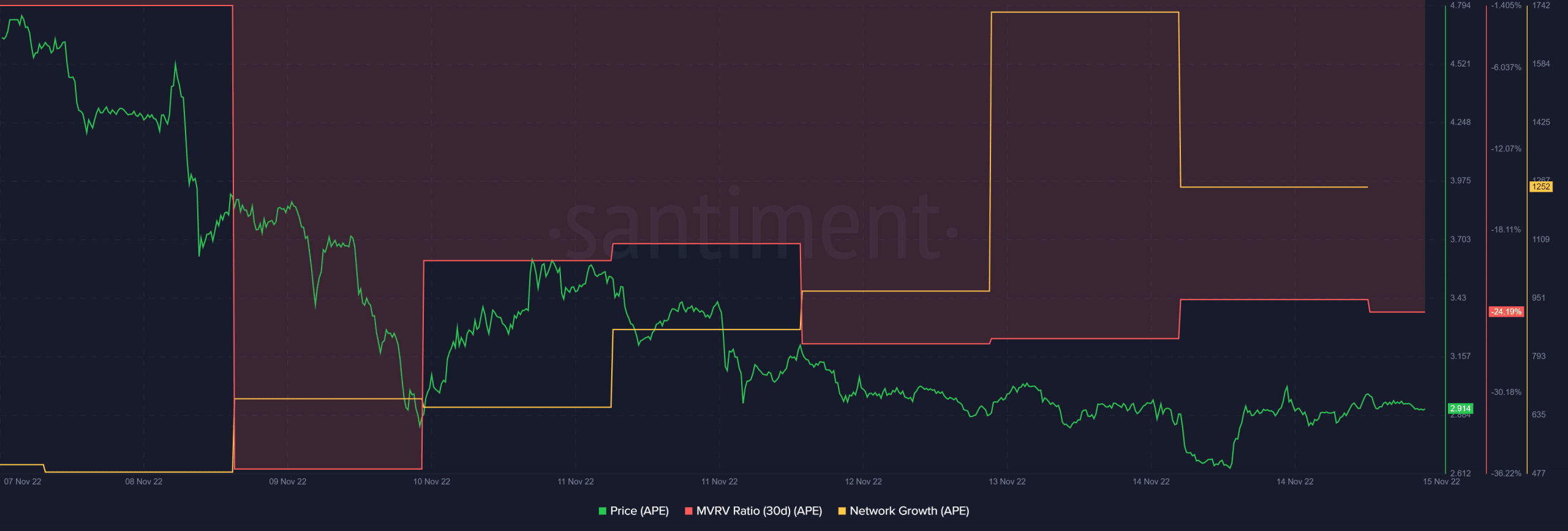

Let’s have a look at ApeCoin’s on-chain metrics to better understand what might be in store for APE in the days to follow.

According to Santiment’s data, APE’s MVRV Ratio registered an uptick, giving further hope to investors for a continued price hike. APE’s network growth also increased when compared to the last week, which is yet another positive signal.

Source: Santiment

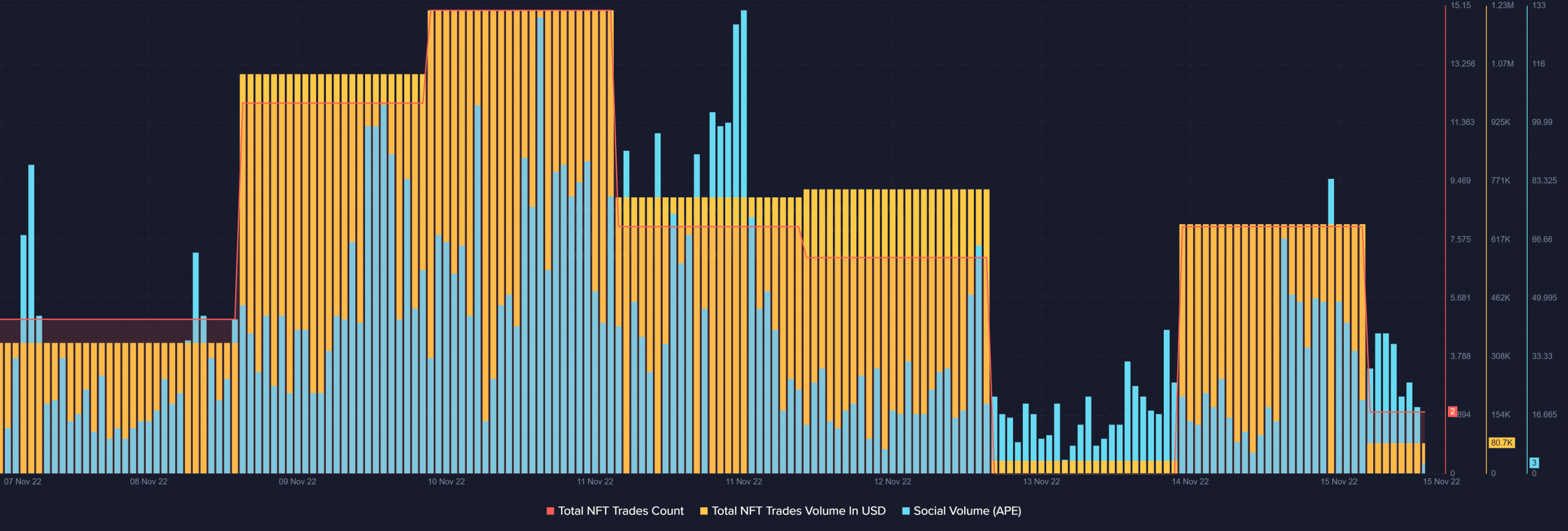

Moreover, ApeCoin’s NFT space witnessed growth over the last week as its total NFT trade count and NFT trade volume in USD went up.

Nonetheless, both metrics declined over the last two days. APE’s social volume also followed a similar route. Considering all the positives and negatives, it is quite difficult to find out what may be ahead, therefore caution is advised.

Source: Santiment

Leave a Reply