$6.7 Breakout May Trigger A Directional Rally In Uniswap Price

Published 6 seconds ago

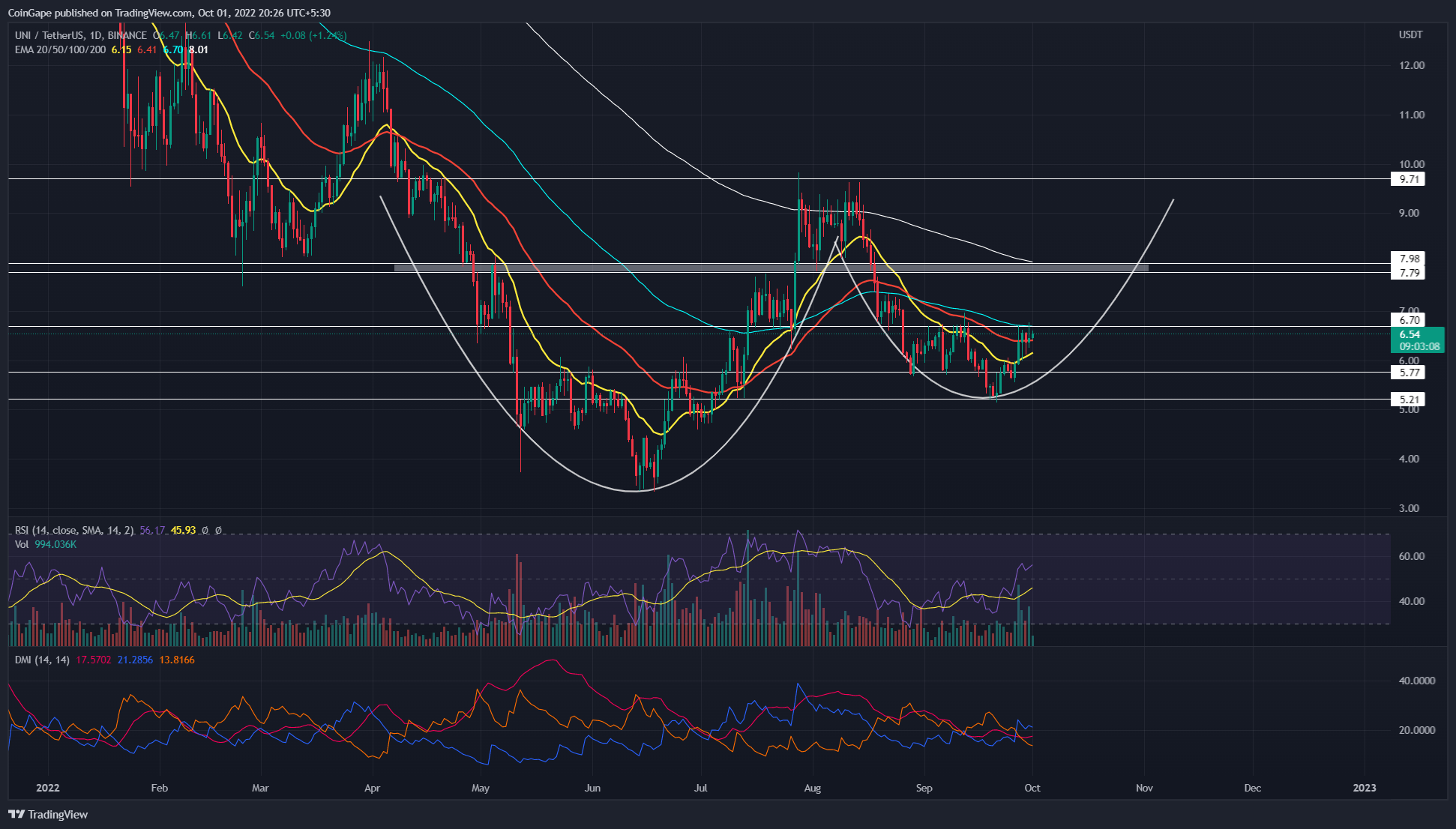

Following the June-July recovery, the Uniswap coin price showcased a steady correction over the past two months. However, this correction assisted buyers in forming a Cup and handle pattern. For the handle portion, the altcoin has obtained significant support of $5.2 and shows recovery signs in the daily chart.

Key points:

- The UNI price is recovering in a V-shaped manner

- The Higher price rejection candles at $6.7 indicate high supply pressure

- The 24-hour trading volume in the Uniswap token is $137 Million, indicating a 7% gain.

Source-Tradingview

Source-Tradingview

The increased supply in August greatly declined the Uniswap market price, as the prevailing recovery rally took a 180-degree shift from the $9.71 mark. Furthermore, the daily chart displays the reversal started from the 200-day EMA, coinciding with the overall trend as bearish.

However, the bear trend nearly loses its momentum at $5.2 support, reflecting a consolidation range with increasing bullish influence. Currently, the price action displays the growth of 6.5% in the past few days with the support of increased trading volume.

Also read: Breaking: Uniswap Labs Eyes Fundraising At $1 Billion Valuation, $UNI Price Jumps

Support. Therefore the Uniswap Price action analysis reflects an increase in buying pressure at lower levels, leading to a double bottom. Additionally, the bullish reversal pattern shows a neckline at $6.7, close to the 100-day EMA.

The increasing demand projects a high likelihood of a price jump to $9.7 to complete the bullish pattern accounting for a price jump of 177%.

On a contrary note, if the selling pressure increases, the Uniswap market price will prolong the correction fall to $8.21.

Technical indicator

EMAs: the downsloping(100 and 200) EMAs reflect an overall downtrend. Moreover, 100-EMA wavering at $6.7 gives an additional barrier against buyers;

RSI indicator: following evident bullish divergence, the daily-RSI jumps above the midline indicates growth in bullish momentum. Hence, technical indicators support the possibility of a bullish breakout from the $4.7

Uniswap intraday price levels

- Spot price: $6.45

- Trend: Sideways

- Volatility: High

- Resistance levels- $6.87, $8

- Support levels- $5.75 and 50

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Close Story

Leave a Reply