Shiba Inu [SHIB]: Why investors should closely watch the latest burn reaction

[ad_1]

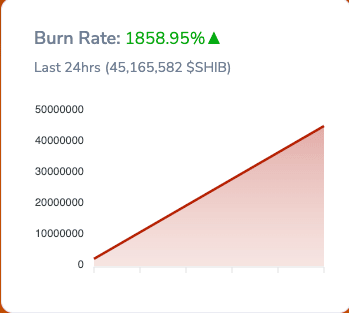

Contrary to its recent trend, Shiba Inu’s [SHIB] burn rate spiked incredibly by 1858% in the last 24 hours. According to Shibburn‘s data, the hike pushed the total SHIB burned within the period to a figure of 45,165,582 SHIB. In doing so, the total SHIB burned since initial supply is now 410.38 trillion.

Here’s AMBCrypto’s Price Prediction for Shiba Inu for 2022- 2023

Source: TradingView

Not the SHIB you used to know

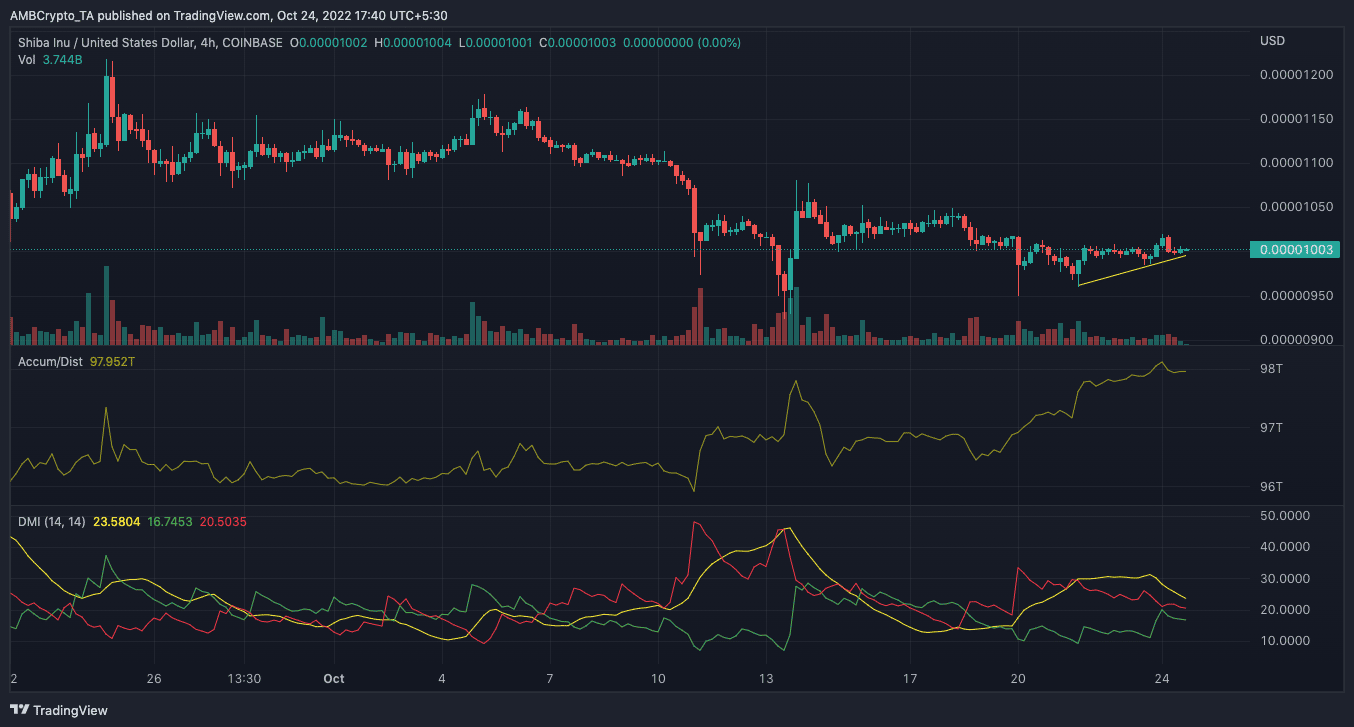

In unusual fashion, SHIB did not follow the trend of an increased burn rate and decreased volume. According to CoinMarketCap, SHIB’s volume rose by 32.86% within the same period the burn rate increased. With the 24-hour trading volume at $123.72 million, SHIB’s price failed to react positively as it preferred an almost neutral position at $0.000010.

While the whole outcome might be surprising, there were other unusual events that took place leading up to the present state. A look at the chart showed that SHIB’s accumulation and distribution had surged incredibly high. With the Accumulation and Distribution Line (ADL) at 97.95trillion, it meant that there was high demand for SHIB. In this case, traders were not only buying to hold, but also using the token to trade.

Despite the neural reaction of the price, it seemed that the ADL had also helped in raising the SHIB support since 21 October. At press time, SHIB was holding its support level at $0.00000994.

However, there were indications that the support might not be solid enough. This state was revealed by the Directional Movement Index (DMI). Based on the DMI indication, SHIB seemed to be at risk of falling to the bears.

This, because of the buyers’ (green) inability to overcome the sellers’ strength (red). Hence, giving the latter an edge over them. In addition, the Average Directional Index (ADX) was close to hitting strong directional movement. With the ADX at 23.58, a move further north might spell doom for investors looking to make short-term profit.

Source: TradingView

What’s with SHIB on-chain?

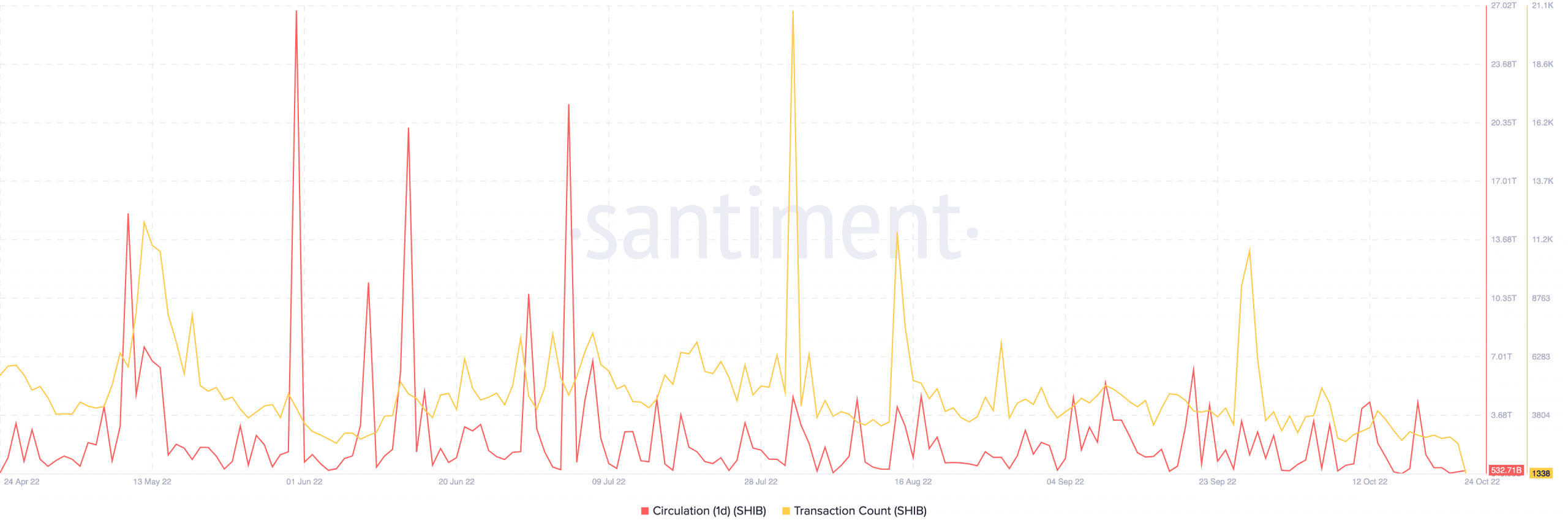

On-chain data from Santiment revealed that SHIB had not done much in terms of its one-day circulation. In fact, the decline from 18 October till the time of this writing was a glaring one. The platform revealed that SHIB’s circulation was 532.71 billion, at the time of writing. The circulating state might prove that investors should not take the DMI’s indications lightly.

It was not also a positive sight, as per the transactions count. Santiment recorded the transaction count to be 133 billion, at press time. As such, SHIB seemed to be losing hold of attracting more investors to its shield. Considering all of this data, SHIB might require an “all-star” increase both on-chain and on-charts to see a significant hike.

Source: Santiment

[ad_2]

Source link

Leave a Reply