NFT lending platform BendDAO initiates vote to alter protocol

[ad_1]

Ripples of the credit crisis that affected several crypto-exchanges are now being felt in the NFT space. Popular NFT-based lending platform BendDAO has now initiated a vote to approve emergency changes. This, in a bid to avert what experts are describing as a “death spiral” for the NFT market.

Writing a proposal to improve the protocol, including some parameters change, will post in the forum today and will effect 24hours after voting, hope that WAGMI.

— CodeInCoffee.eth (@CodeInCoffee) August 22, 2022

In fact, an alarming statistic recently obtained from Etherscan is that the BendDAO contract has run out of Wrapped Ether, leaving 0 ETH for payment to lenders.

BendDAO’s proposed changes

In the proposal, BendDAO’s Co-founder who goes by the pseudonym CodeInCoffee said,

“We are sorry that we underestimated how illiquid NFTs could be in a bear market when setting the initial parameters. In the past several days, we got tons of feedback and suggestions from the community. After a comprehensive review and discussion, it’s time to make a proposal to help ETH depositors to build confidence.”

Here are the short-term changes proposed for the protocol 0

- Systemically adjust Liquidation threshold to 70%, 5% weekly reduction beginning from 30 August, 2022

- Change the auction period from 48 hours to 4 hours in order to improve liquidity for auctions

- Eliminate first bid limitation of 95% of floor price to cap auction competitors

- Adjust Interest Base Rate to 20% to encourage repayment by NFT holders and help ETH depositors earn more interest

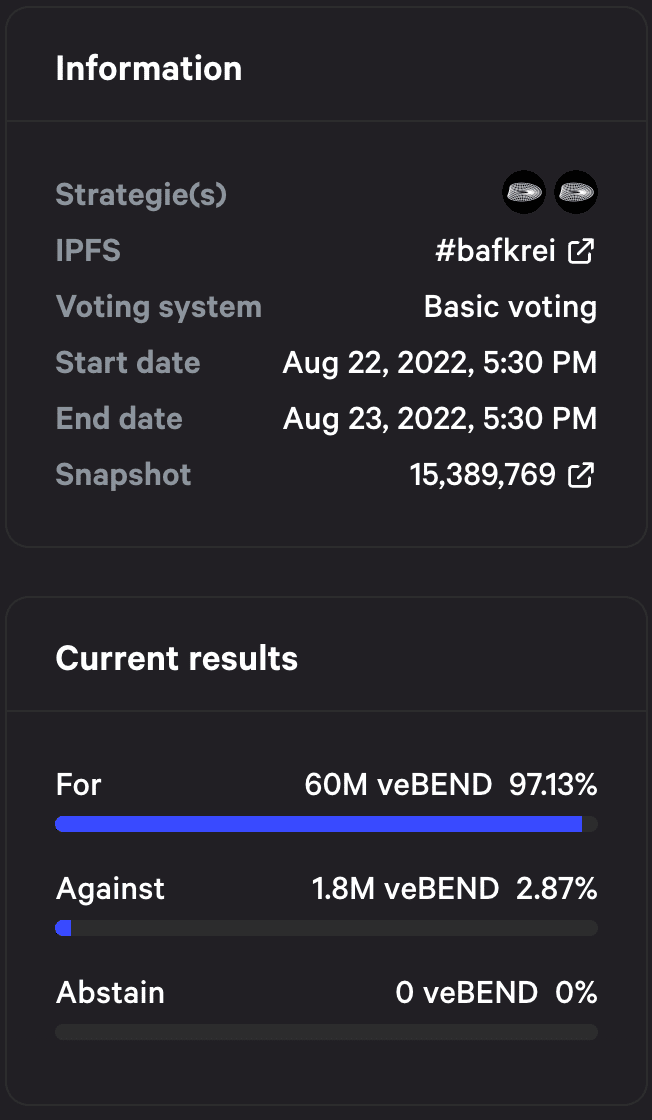

The BendDAO protocol is using Snapshot, an off-chain voting system, to arrive at a consensus. As per the rules on the Snapshot, 47 million veBEND i.e 20% of the total supply would constitute a quorum. A 75% approval would make the proposed changes possible.

In addition to changes to the protocol, BendDAO developers revealed user interface (UI) improvements. These include a section on the BendDAO auction page, one where the number of floating bad debts in ETH would be displayed. This, along with information about interest total generated for veBend holders and ETH depositors.

BendDAO Co-founder also outlined protocol improvements for the future. These include supporting offers for collateral on the platform, supporting down payment for auctions, and securing partnerships with other exchanges in order to list collateral.

When the first ape fell

Panic struck on 18 August when the first Bored Ape Yacht Club (BAYC) NFT entered a liquidation auction after its floor price fell to 72, down 52% from its all-time high in May 2022. What followed was a bank-run on BendDAO, depleting its wallet by over 99.9%.

As a result, hundreds of NFTs have defaulted and entered into the liquidation auction window, with no bids. Investors are hesitant to bid on the defaulted NFTs because the prospect of submitting a bid higher than the debt and locking up ETH for 48 hours seems risky.

It is important to note that a number of NFTs are nearing the liquidation window, even though their debts have not defaulted. This, because of the declining health factor assigned by BendDAO, with the same depending on the liquidation threshold of the collateral.

Voting figures

At the time of writing, polling results showed that 60 million veBEND (97.13%) had voted in favor of the proposal, meaning that the platform will go ahead with the changes.

[ad_2]

Source link

Leave a Reply