Litecoin: Bears may be out for a meal, but LTC could have these tricks up its sleeve

[ad_1]

Litecoin’s [LTC] miners remained profitable despite LTC’s price witnessing a downfall since the last 30 days. Furthermore, regardless of LTC’s declining volume and market cap, there may be potential for LTC to grow. Here’s how…

__________________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for Litecoin [LTC] for 2022-2023

__________________________________________________________________________________________

Let there be “LTC”

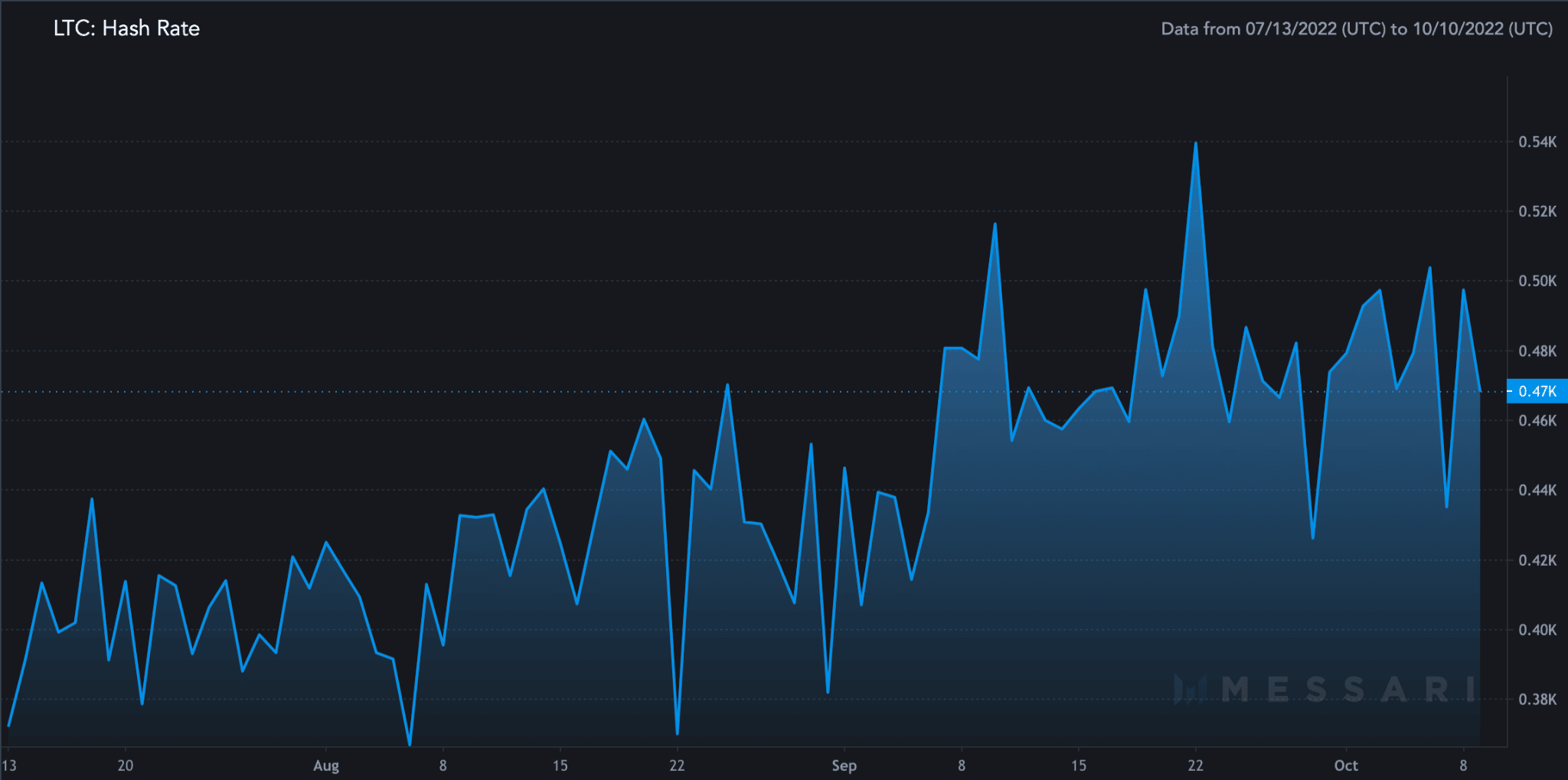

According to CryptoCompare, a website dedicated to analyzing crypto mining data, mining Litecoin, at press time, gave a 34% profit ratio per day. Additionally, LTC’s hashrate was witnessed considerable growth over the last three months as well. This was a good sign for the coin as it indicated a strong and secure network.

Source: Messari

Furthermore, a growth on the social front also acted in favor of LTC. According to LunarCrush, a social media analytics firm, Litecoin’s social engagements grew by 10.68% over the last week and social mentions grew by 11.68%.

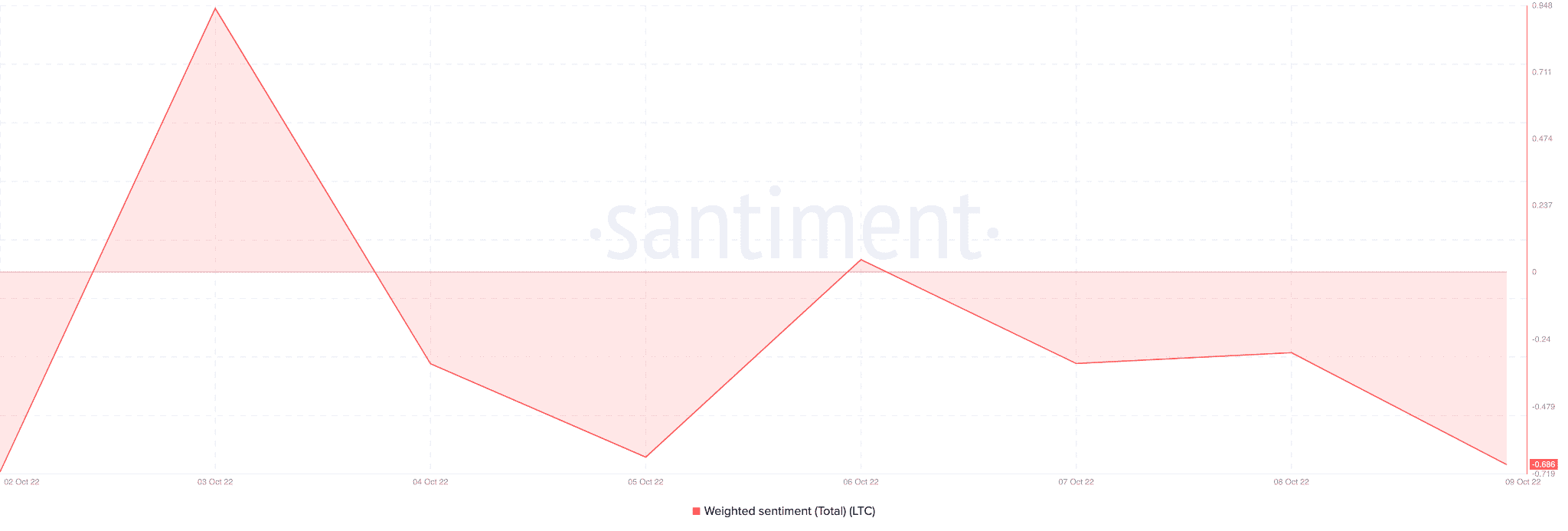

However, the public sentiment was not in Litecoin’s favor. The weighted sentiment for LTC was declining since the past week, indicating that the crypto community had a negative outlook towards the altcoin.

Source: Santiment

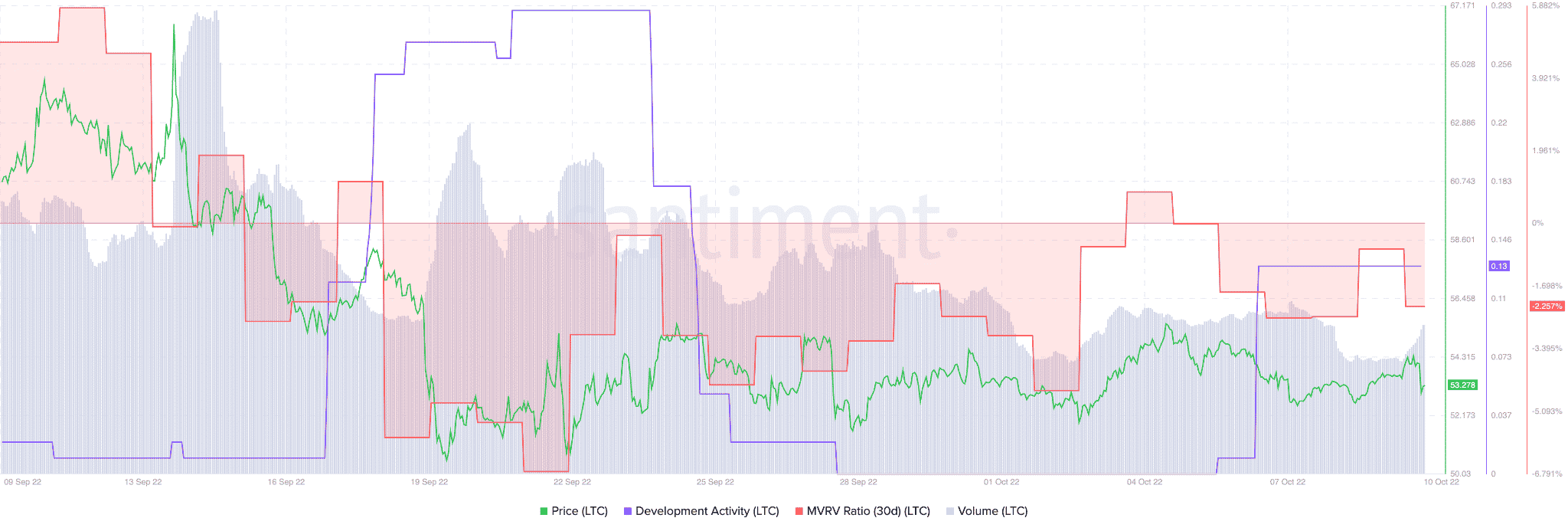

LTC also witnessed a decline in its velocity. Litecoin’s volume, in the last 30 days, depreciated by 69.85% and stood at 329.22 million at press time. Its Market Value to Realized Value (MVRV) ratio was also declining, indicative of a bearish short-term future.

Source: Santiment

Some hope for LTC

However, despite all the bearish activity, a spike in development activity was observed over the past few days. This activity could be attributed to the latest MWEB technology that Litecoin was working on.

The MWEB technology allows users to make transactions on the Litecoin network with confidentiality. Furthermore, as per Litecoin’s latest tweet, Litecoin’s new code was out for review. Furthermore, the LTC team was working with wallet developers and trying to improve on its documentation.

JUST IN: #Litecoin #MWEB Development Update from @DavidBurkett38

🪄 New code out for review

🪄 Working with wallet devs

🪄 Improving documentationRead more:

— Litecoin (@litecoin) October 7, 2022

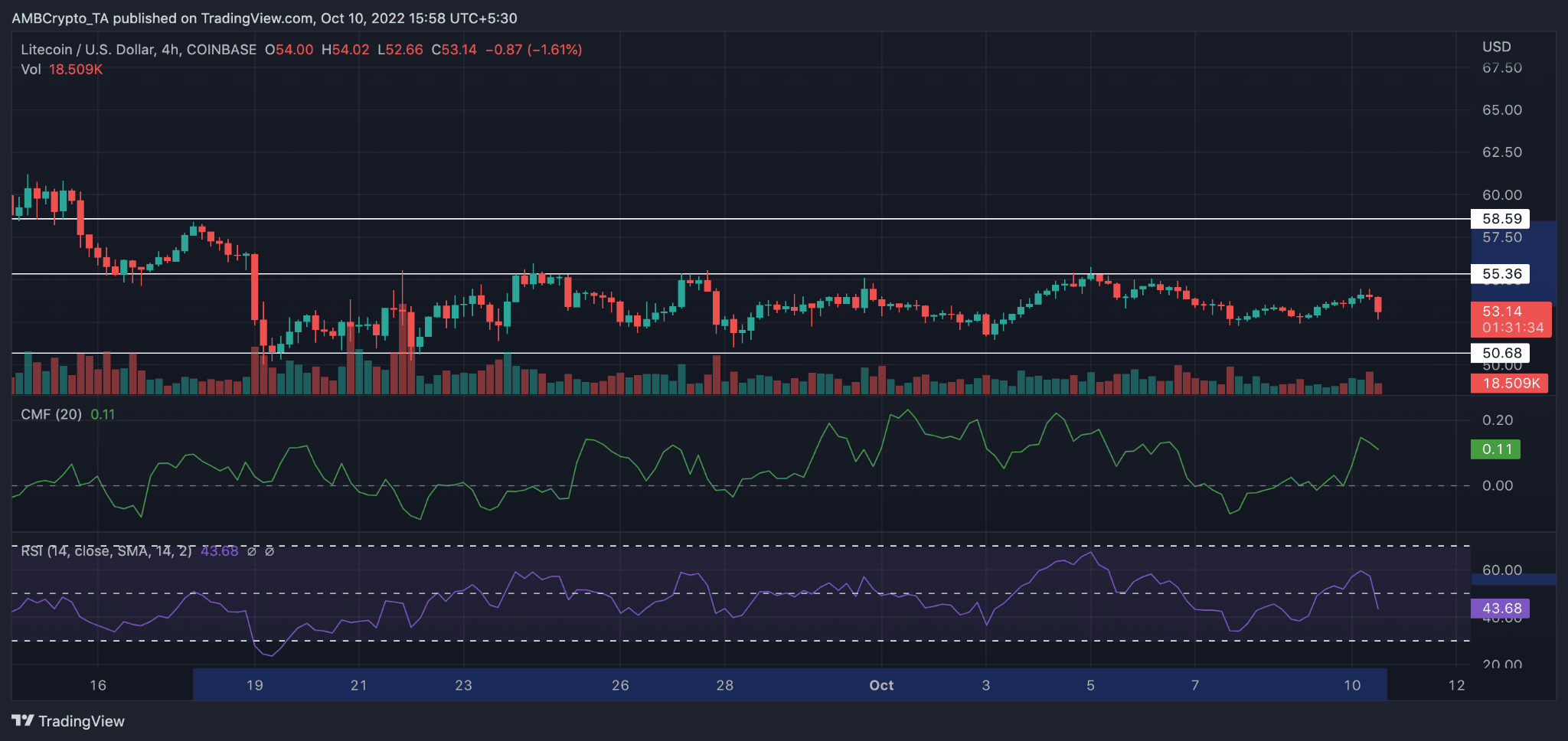

At press time, Litecoin was trading at $53.26. After testing the 58.59 resistance on 17 September, LTC’s price depreciated by 8.62% and was trading between $55.36 and $50.36 since then. The Relative Strength Index (RSI) was in a freefall and stood at 43.68 at the time of writing.

The Chaikin Money Flow (CMF) was at 0.11, which was a bullish indicator. However, it was also observed to be moving downwards, which could imply that the trajectory of Litecoin’s price might change for the worse.

Source: TradingView

Although LTC’s future may look bleak, readers looking to short LTC should also have a look at Litecoin’s daily active address activity so that they can place their bets more effectively.

[ad_2]

Source link

Leave a Reply