Is FTX Crash An End Of Crypto? And How This Debacle Unfolded?

[ad_1]

There have been a number of articles published asking the same question: “Is the FTX Crash The End Of Crypto?”. Well, the short answer is – No.

Did Lehman Brothers’ bankruptcy and subprime mortgage crisis in 2007–08 spell an end for the stock market? No, it didn’t. Was it bad? Of course. Was it a setback for the stock market? Definitely yes!

Is the FTX crash a major setback that has pushed the crypto market into the dead of winter? Unfortunately, yes. The FTX-Alameda crisis has significantly impacted the crypto market, and it will take time to recover from this setback.

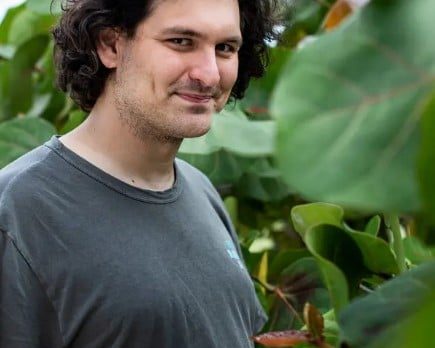

You might want to know how this saga played out—from a buzzing company (FTX) and a towering personality (SBF) to a bankrupt entity and a disgraced figure with so many legal troubles. This debacle has undoubtedly scarred a lot of investors and crypto enthusiasts.

Let’s break down this debacle:

Alameda Balance Sheet Leaks

On November 2, Coindesk published an exclusive report based on a leaked balance sheet of Alameda Research, FTX CEO Sam Bankman-Fried’s trading firm. The report revealed that Alameda’s balance sheet is full of FTT tokens, which are issued by the FTX exchange.

It meant that SBF’s trading firm, Alameda, rested on a foundation largely made up of a token created by his sister company rather than an independent asset like a fiat currency or another cryptocurrency.

FTX uses FTT as a reward currency for trading discounts, and Alameda held considerably more tokens than were traded on the market, implying that its holding would be difficult to liquidate at current prices.

Binance Decides To Pull Out

On November 6, Binance CEO Changpeng “CZ” Zhao announced on Twitter that he was selling his remaining FTT token holdings. Binance was an early investor in FTX and received roughly $2.1 billion’s worth in the form of BUSD and FTT tokens after its exit from the firm. CZ compared FTT to the Luna token, which Binance once supported.

FYI, FTX and Binance have been tussling for supremacy in the crypto exchange market for quite some time.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

The Domino Effect

CZ’s announcement spooked the investors. By November 8, the panicked investors had withdrawn $6 Billion in just 72 hours. The price of FTT tokens plummeted below $22. And FTX was faced with an impending liquidity crisis.

CZ Offers Help But Later Backs Out

On November 8, Binace CEO CZ stepped in to save the FTX. He announced that his company has agreed to buy competitor Sam Bankman-Fried’s FTX for an undisclosed amount. CZ tweeted that they have signed a non-binding Letter of Intent (LOI) to fully acquire the FTX cryptocurrency exchange.

According to CZ, FTX executives contacted Binance due to a serious liquidity crisis. And he has agreed to “help them out.”

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

1) Hey all: I have a few announcements to make.

Things have come full circle, and first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for (pending DD etc.).

— SBF (@SBF_FTX) November 8, 2022

But things didn’t go well. On November 9, they backed out of the deal, citing news regarding the mishandling of customer funds and alleged U.S. agency investigations as the reasons behind this decision. By this point, the FTT token had lost over 90% of its value since the start of the crisis.

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of

— Binance (@binance) November 9, 2022

FTX Exchange Files for Bankruptcy; SBF Steps Down as the CEO

On November 11, FTX announced in a formal press release that it is finally filing for Chapter 11 of the United States Bankruptcy Code in order to begin an orderly process of reviewing and monetizing the firm’s remaining assets for the benefit of all global stakeholders in the company.

Press Release pic.twitter.com/rgxq3QSBqm

— FTX (@FTX_Official) November 11, 2022

1) Hi all:

Today, I filed FTX, FTX US, and Alameda for voluntary Chapter 11 proceedings in the US.

— SBF (@SBF_FTX) November 11, 2022

Sam Bankman-Fried, the company’s founder, also resigned as CEO, stating that he will “assist in the orderly transition.” John J. Ray III was appointed the new CEO.

Reports of Hack in FTX Emerge

On November 12, reports suggest that FTX wallets have been hacked and exploiters have taken insider help to gain root access. Over $600 million in abnormal transfers were reported in just a few hours, with the exploiter swapping all crypto assets to DAI and ETH, which can’t be frozen.

Reuters reports that at least $1 billion in client deposits have gone missing from the bankrupt cryptocurrency exchange, according to sources. Allegations of mismanagement of customers’ funds pile up. Prosecutors say FTX and its founder, SBF, could face criminal charges for using customer funds for his other company, Alameda Research.

Bahamas and SBF

On November 12th, FTX founder Sam Bankman-Fried informed Reuters that he was in the Bahamas, refuting Twitter speculation that he had flown to South America.

While investigating the hack, FTX discovered that Bankman-Fried and FTX co-founder Gary Wang made “unauthorised” transfers at the instruction of the Bahamian government while “essentially in the custody of Bahamas authorities.”

This debacle is far from over. Stay Tuned.

Also Read: Will Trump Be Back on Twitter? Elon Musk Asks Twitter Users To Decide in a Poll

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link

Leave a Reply