Is $0.1 on the cards for Dogecoin holders? Answer might surprise you

[ad_1]

If there is one thing Dogecoin [DOGE] investors may have agreed upon lately, it might be to push the meme token to $0.1.

This is because the Elon Musk-backed cryptocurrency has defied all odds despite the momentum of the entire crypto market.

With Bitcoin [BTC], Ethereum [ETH], and other top cryptocurrencies failing to register substantial price increases, DOGE followed the other route.

Its closest competitor, Shiba Inu [SHIB], which had outperformed the coin lately, was also not able to match up. At press time, DOGE was up 15.93% and trading at $0.088. So what could have driven DOGE to greens in the wake of swinging market sentiment?

Retail investor magic

In the wake of this rally, DOGE retail investors seem to be in strong positions by pumping more volume into the Dogecoin ecosystem.

Crypto investor Lark Davis tweeted about the happenings as low cap coins continued to troop into Dogecoin’s Decentralized Exchanges (DEXes).

Madness happening on #dogechain right now with loads of mega low cap meme coins popping up left right and center

— Lark Davis (@TheCryptoLark) August 16, 2022

According to the DEX screener, both volume and transactions on the DOGE chain have incredibly increased.

At press time, there had been over $13 million in volume and with over 152,000 transactions. In addition, the activities were showing no signs of stopping as a series of $500,000, $200,000, and $430,000 continued pumping into the meme liquidity chain.

Despite the uptick, DOGE’s seven-day run remained at a 22.45% increase compared to SHIB’s 29.85%.

Whether it meets up with SHIB or not, the chances of DOGE hitting a 40% rally in the third quarter (Q3) may have been confirmed.

However, chances are clear that the uptick may not be sustainable once those involved in the meme pump activity are done.

DOGE-ing the trend

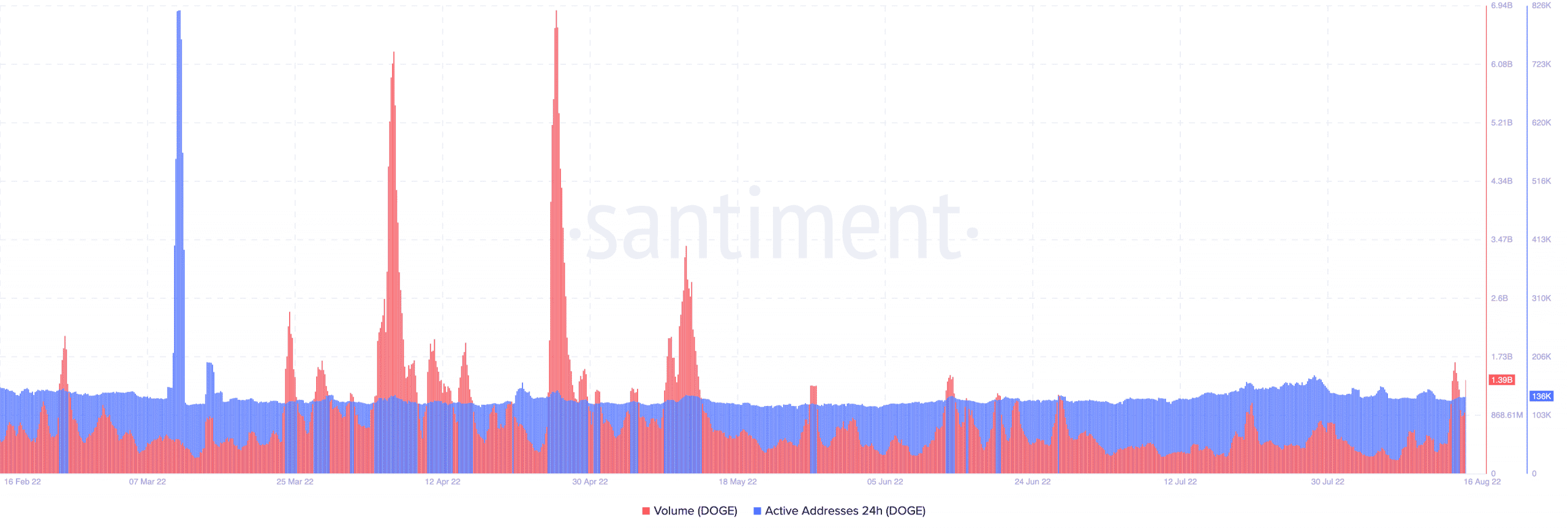

While DOGE soared in price, several of its metrics did not follow. On-chain analysis from Santiment revealed that the volume over the last 24 hours did not pick up as it was a 0.45% decline.

With a $1.39 billion trading volume, the 24-hour active addresses also remained in a neutral position.

Source: Santiment

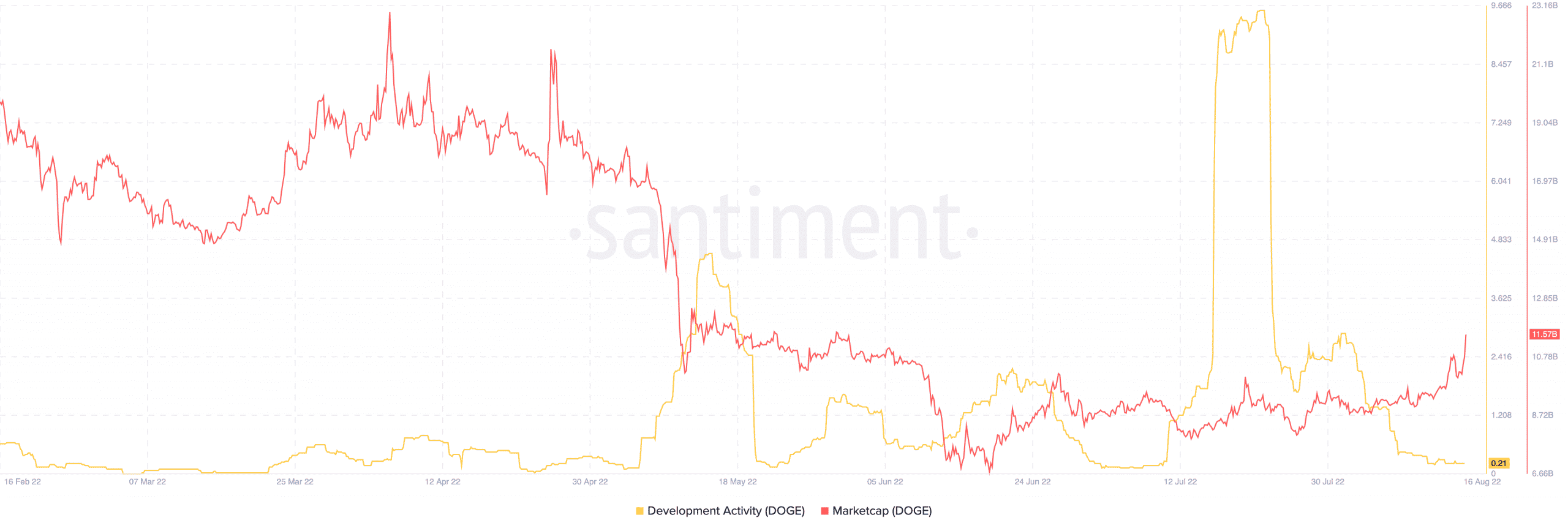

Even though its market cap expectedly followed the price increase, development activity on DOGE was almost at the lowest it was in July.

Source: Santiment

As these metrics did not align with the DOGE uptick, it could be possible that expectations of reaching $0.1 may be in jeopardy.

However, underestimating the DOGE community is not something anyone would want to do. Still, investors may need to stay vigilant as a further uptick and price plunge remains possible.

[ad_2]

Source link

Leave a Reply