ETH Holds Near $1,600; Is More Pain In Offer?

[ad_1]

Published 10 mins ago

Ethereum price analysis shows a bounce back in today’s session following a blood bath in the previous session.

The ETH/USD pair is currently trading below the $1,650 mark as the bulls are licking their wounds following the previous session’s intense sell-off. The price is struggling to make gains above the mentioned level. The more time ETH stays below this level, the more selling pressure will build.

- Ethereum prints modest gains following the last session selling spree.

- The price fell like a pack of free cards from the highs of $1,848.29, the largest single-day fall since June 13.

- A daily candlestick below $1,600 on the weekly basis would strengthen the downside movement.

Ethereum price turns south

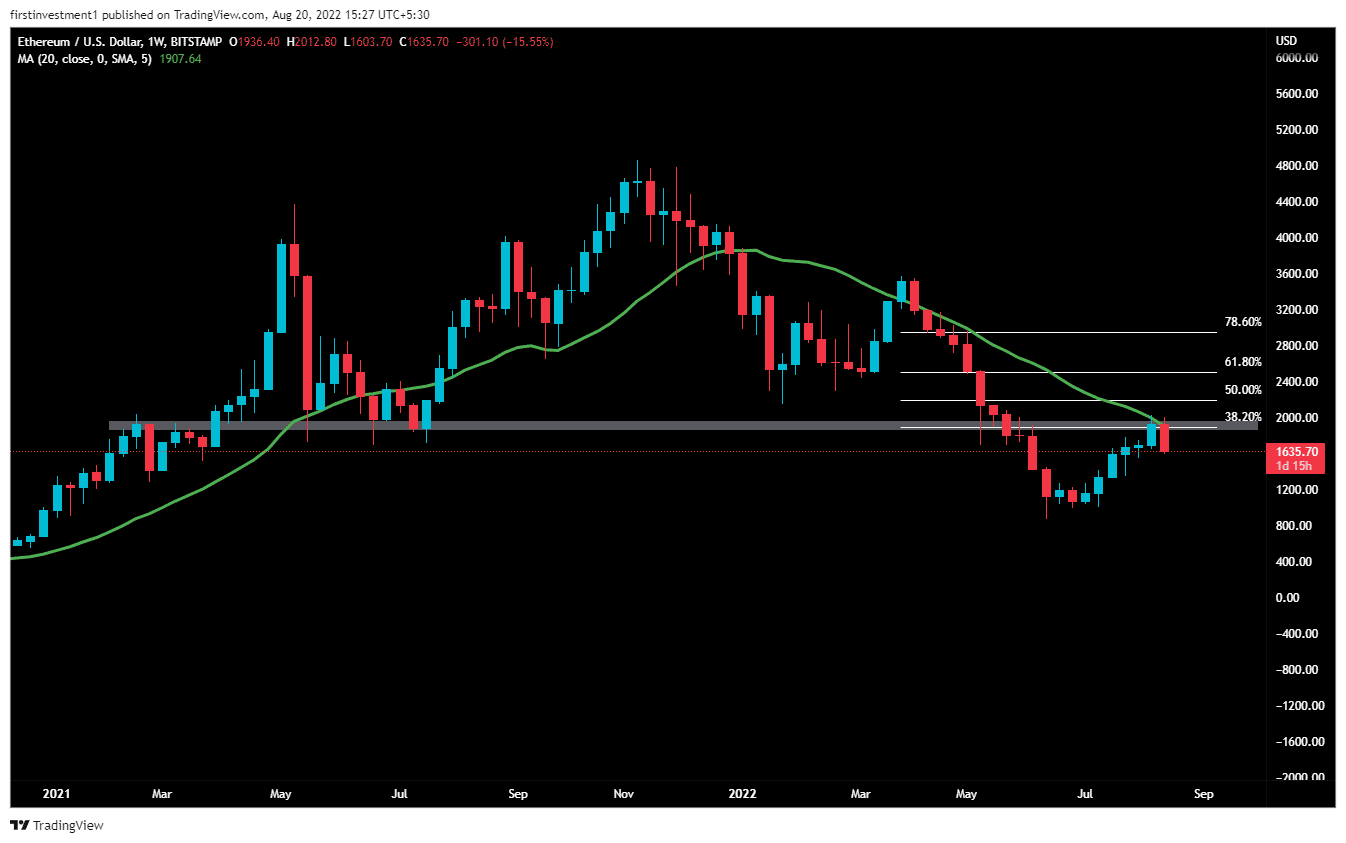

On the weekly chart, the Ethereum price analysis indicates bearish momentum.

ETH’s price closed above $2,100 for the first time in the week ended March 2021, and since then the price had made a high of $4,867.

However, the price broke the support of more than a year of $2000 in May 2022, & started to fall from there to test all time low of $898.

In the previous week, the price finally tested the $2000 level again, but couldn’t sustain above that level. As ETH faces heavy selling pressure near the level.

The price is facing an upside hurdle near the 20-day exponential moving average. Along with a 38.6% Fibonacci retracement, which will act as immediate resistance for this week.

Now, if the price on the weekly chart, closes below the previous bullish candle, and formed a Bearish Engulfing pattern, then there is a high probability of the price falling up to its recent swing low to $1,230.

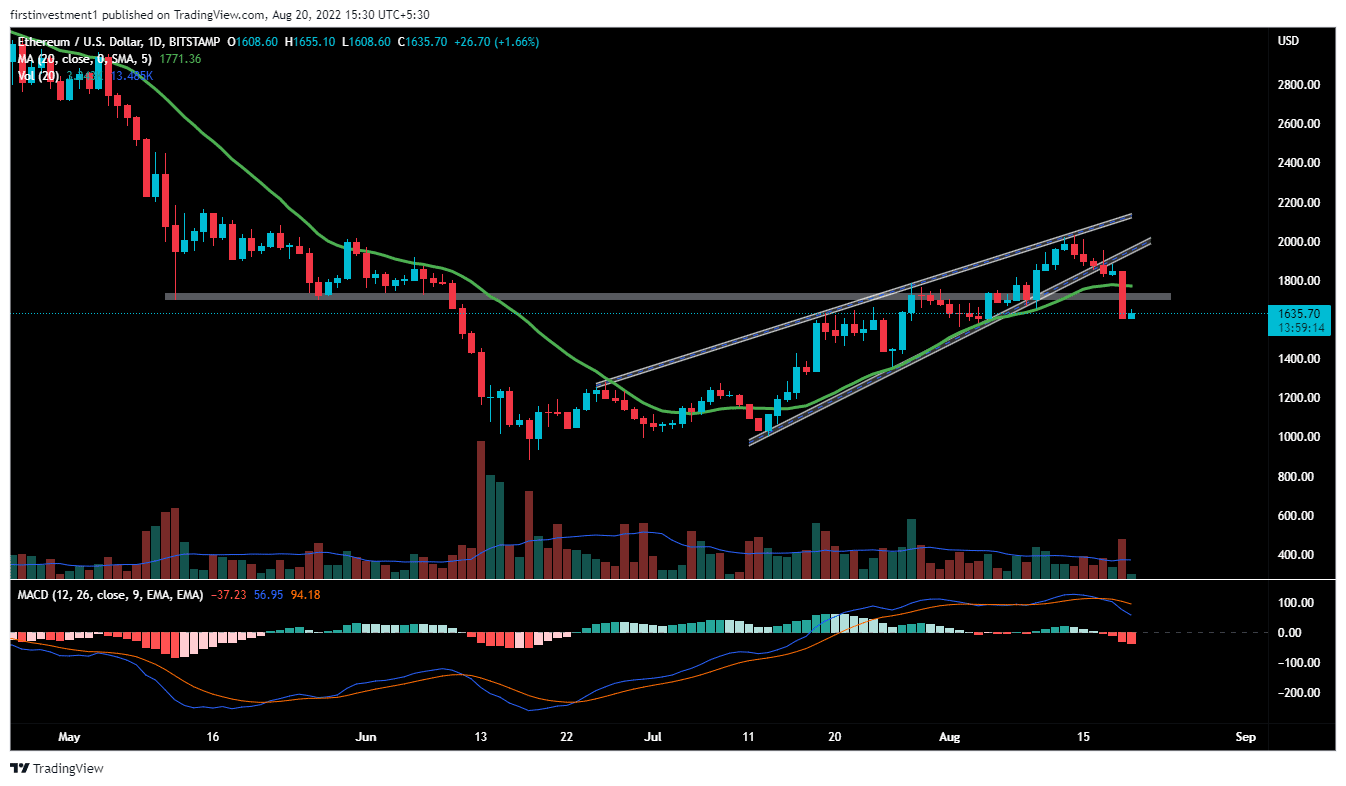

On the daily chart, the ETH gave a breakdown of a “Rising Wedge” Pattern, indicating broader weakness.

On August 8, the Ethereum price gave a breakout of a bullish “Cup & Handle ” pattern and started to move up from $1,730 to $2,030.

Also read: Miners To Freeze Liquidity Pool After Hardfork, Here’s Why

The volumes are below the average line and declining, with the price moving upwards, which implies a worrisome. When the market is rising while volume is declining, big money is not the one buying, more likely slowly exiting positions.

The nearest support is the swing low, which is at $1,570, whereas the nearest resistance is at $1,765. There is a higher probability of the price to breaks a lower level. “Sell on rising” opportunity is the best course of plan we can go with.

On the other hand, a daily candlestick above the $1,760 level could invalidate the bearish outlook. And the price can move higher toward $2.000 once again.

ETH is bearish on all time frames. Below $1,570 closing on the daily time frame, we can put a trade on the sell side.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Close Story

[ad_2]

Source link

Leave a Reply