Cardano Aims For $0.52 Amid Consolidation; Is Worth Buying?

[ad_1]

Published 6 seconds ago

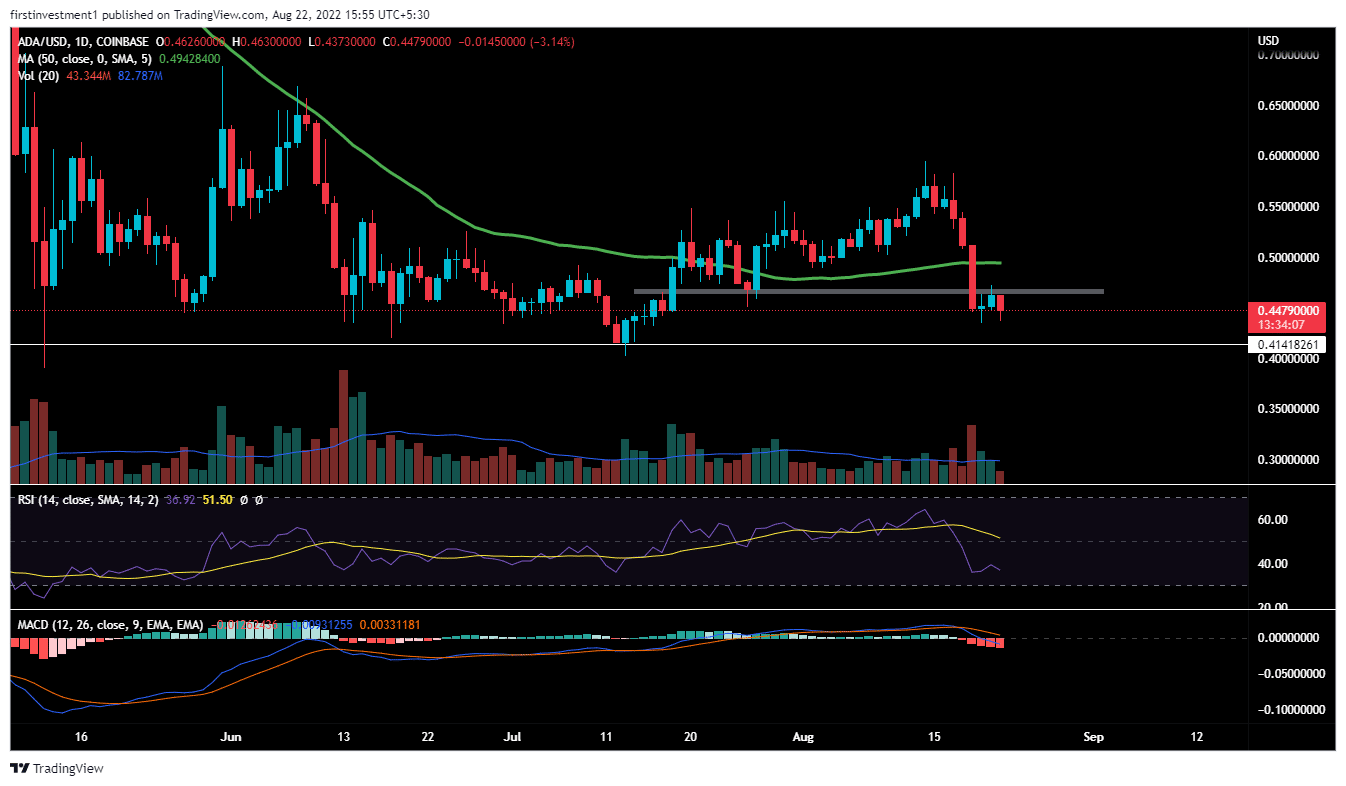

Cardano price analysis indicates a bullish outlook for the day. The altcoin is gaining against most of the major’s mute movement. ADA has undergone a consolidation after it started its fall on August 14. The price depreciated nearly 26% so far.

Curretnly, the buyers attempts to shield $0.4388 zone, and is making a quick recovery toward $0.5065. There is a strong upside barricade place around $0.4926. Additonal buying interest is required to push the price higher.

- Cardano price trades modestly higher on Friday.

- A decisive break above $0.4926 would bring speedy recovery toward $0.5065 and above.

- The momentum oscillators remain mixed wiht no clear direction bias.

Cardano price looks sign for upside extension

ADA is currently trading at $0.4767. The price fell more than 25% in just four trading days, and is now consolidating near the lower levels. On August 19, the price fell sharply by up to 12%, breaking multiple support levels

This, also coincides with the breach of the 50-day exponential moving, but takes the support from its previous swing low.

The Cardano price analysis shows a consolidation near the lower level wiht a positive bias. The formation of multiple doji candelsticks lower level suggets indecision among traders. Howver, for the past 24 hours the trading volume jumped more than 100% at $1,007 billion.

The bulls would like to capitalize on the recent gains and the supportive volume. On moving higher, the first upside target could be found at $0.5000 followed by the high of August 19 at $0.5121.

The nearest support of ADA is at $0.4344, whereas the nearest resistance is at $0.4935. There is a higher probability of price testing its resistance first. So there is an opportunity to take i.e. “Buy on Dips” trading strategy.

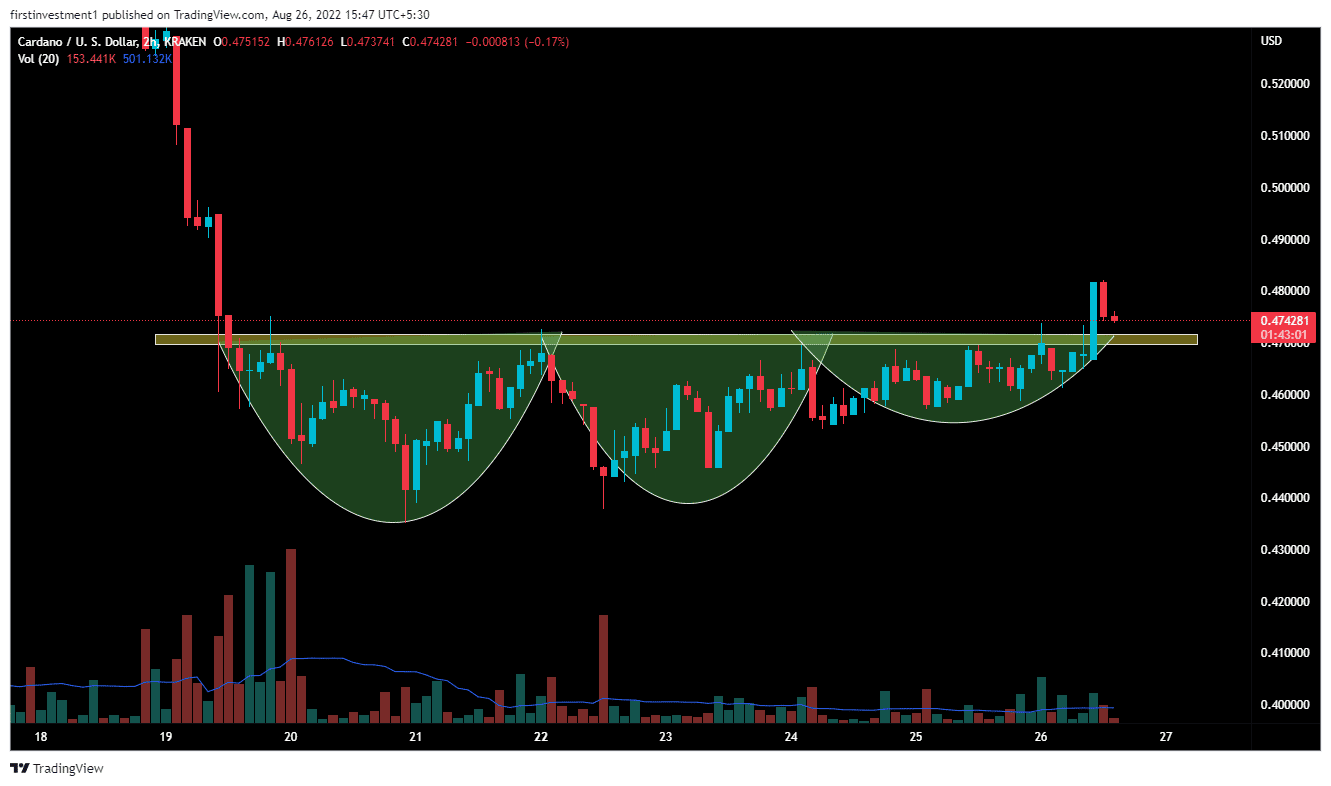

On the two-hour time frame, the price gave a breakout of a “Volume Contraction” pattern.

The key to this pattern is that there needs to be a contraction of volatility as the chart moves from the left to the right. This highlights that the volume available is decreasing and becoming scarce. In addition, the more dramatic in volume, the more likely that the move will be explosive. Above the breakout is accompanied by an increase in the relative volume.

According to the above pattern, The expected upside move in ADA could be above $0.4935 and above.

Also read:

On the other hand, a break below the $0.4565 level could invalidate the bullish outlook. And the price can drop below $0.4344

ADA is slightly bullish on all time frames. Above the session’s high closing on the hourly time frame, we can put a trade on the buy side.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Close Story

[ad_2]

Source link

Leave a Reply