Bitcoin (BTC) Crashes With Trading Volumes At 3-Month High

[ad_1]

After a strong push above $20,000 on Tuesday, Bitcoin has failed to hold those levels and crashed once again. the Bitcoin price is down 6.36% at press time and currently trading at $18,774 with a market cap of $358 billion.

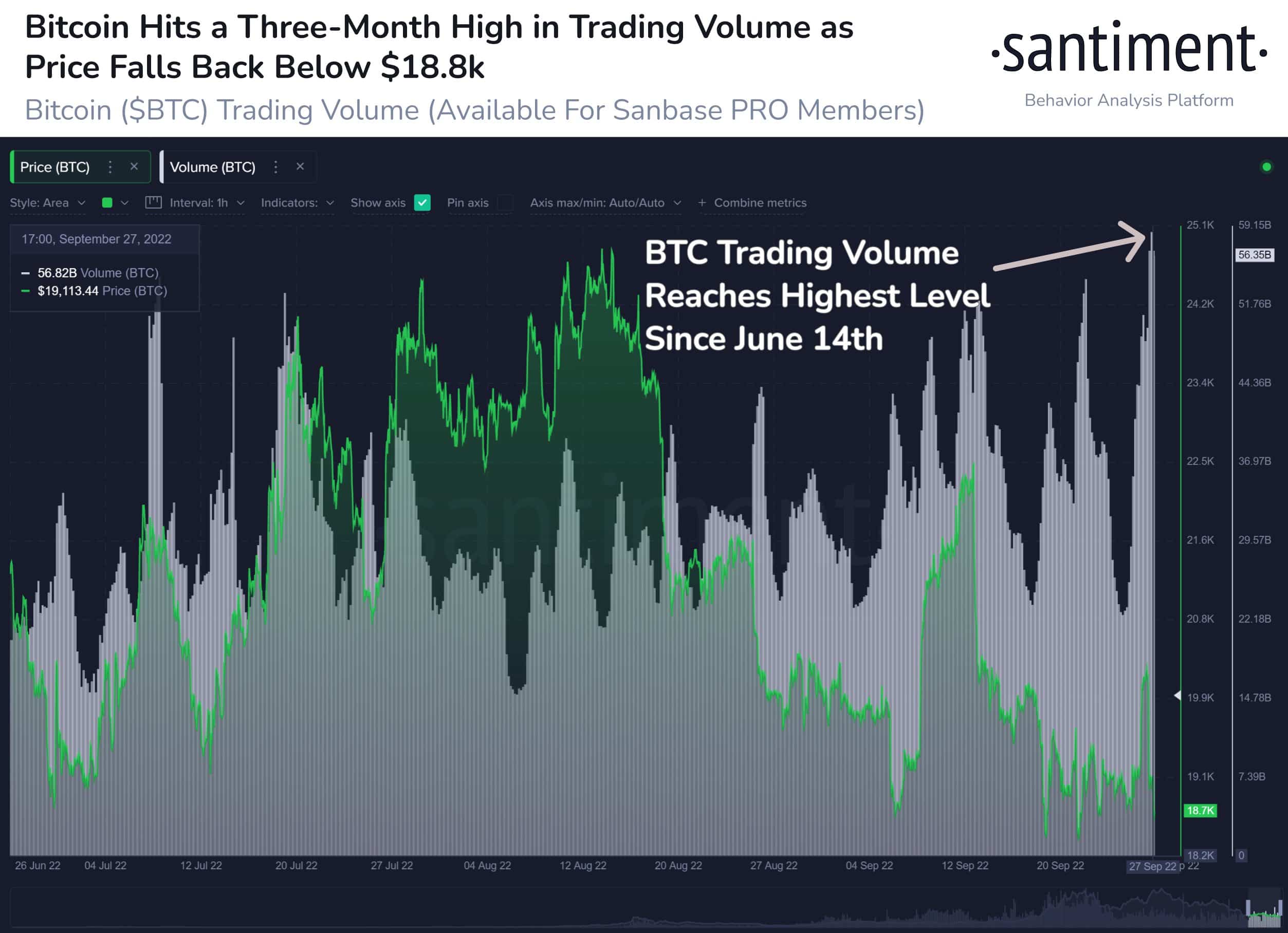

Along with Bitcoin, the broader crypto market is experiencing strong turbulence and volatility with trading volumes shooting up significantly. As on-chain data provider Santiment explains:

Trading volume has heated up for #crypto markets, and especially #Bitcoin. During the big leg down on Tuesday, $BTC peaked at its highest level of trading since June 14th. Volume has gradually risen all year since bottoming out in late January.

Note that back in mid-June, the BTC price had touched its 2022-low of $17,500. As per some analysts, if the selling pressure continues, Bitcoin can retest this level and move even lower. Currently, the bears seem to be in full control of the crypto market.

Along with Bitcoin, the broader crypto market has tanked by 6% eroding more than $50 billion worth of investors’ wealth. Ethereum (ETH) is trading 7% down under $1,300 and other top ten altcoins are down anywhere between 5-10%.

Global Macros Impacting Bitcoin and Crypto

Although Bitcoin and the broader crypto market made an attempt to break through the clutches of U.S. equities, it couldn’t sustain much. The global macros continue to impact Bitcoin price big time as Stocks, bonds and commodities exhibit strong volatility amid high inflation, interest rate hike, and a dim economic outlook.

So far this year, the MVIS CryptoCompare Digital Assets 100 Index has tanked by more than 60%. However, the fact that Bitcoin holds above its June lows makes some analysts believe that it could decouple from the equity markets. Speaking to Bloomberg, Stephane Ouellette, chief executive of FRNT Financial Inc. said:

“Followers of the ecosystem have been excited to see correlations with risk-assets begin to break, meaning the ‘fast-money’ speculative crowd may be losing their influence on the space”.

Bloomberg Intelligence senior commodity strategist Mike McGlone also said that Bitcoin and Gold could outperform other commodities amid tightening monetary conditions. McGlone added: “The most central banks in history hike[d] rates with the world tilting toward recession. Lower commodity and risk-asset prices may be the only way out with deflationary implications, which should buoy the price of gold and its digital version, Bitcoin”.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link

Leave a Reply